SPECIAL PRESENTATION …

Exploring the Tax Advantages

of Oil & Gas

Keep money in your pockets! Reap major tax

benefits by investing in oil and gas.

At the end of every year, you have a choice to make. Will you hand over your money to the IRS, or will you invest in your future?

Oil and gas investing can generate more wealth than any other single investment class … and the tax benefits are HUGE.

In fact, if you live in the United States, you may deduct 85 percent (or more!) of your domestic oil investment in the FIRST YEAR … against ordinary income.

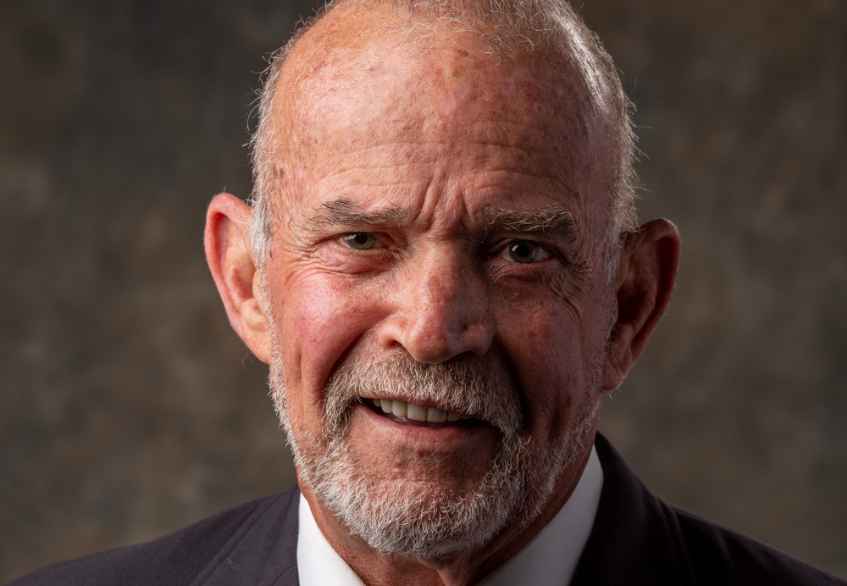

With more than four decades of experience in the oil and gas industry, Bob Burr knows the ins and the outs of this investment class.

While Bob and his team at Panther Exploration are not CPA’s or tax experts … they’ve personally experienced the tax advantages of investing in domestic oil partnerships

So tune in to this video training to learn how the tax benefits mean BIG RETURNS on your investment.

Keep more money in your pocket and diversify your investment portfolio. Simply fill out the form below to access this informative video training.

Discover More Content You'll Enjoy ...

Panther Exploration – Bob Burr

Panther Exploration – Bob Burr Shore up your portfolio by investing in domestic oil production. Demand for oil survives every crisis … and recent technology

Oil and Gas Investing 101

Oil and gas investments offer some of the best tax incentives! Make tax benefits and rising oil and gas demand work for you with a skilled partner to guide you through the process. Learn from oil expert Bob Burr and his team at Panther Exploration about how YOU can shore up your portfolio in this exclusive report.

Boots-on-the-Ground Market Insights: Understanding Today’s Opportunities in Oil

SPECIAL PRESENTATION… Boots-on-the-Ground Market Insights: Understanding Today’s Opportunities in Oil In this special edition of Boots-on-the-Ground, The Real Estate Guys™ Co-Host Russell Gray and Bob