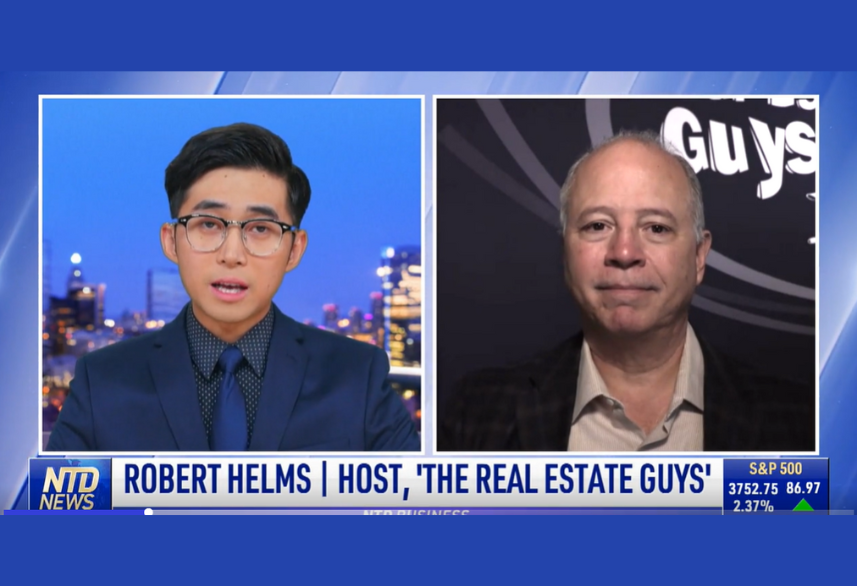

Podcast: The Elephant in the Room – What Rising Interest Rates Mean for Real Estate

Interest rates are soaring higher and faster than we’ve seen in recent history … With affordability plummeting and investors’ bottom lines and cash flow eroding, it’s no surprise that many are becoming more than a little hesitant …

Podcast: The Elephant in the Room – What Rising Interest Rates Mean for Real Estate Read More »