Authored by Naveen Anthrapully via The Epoch Times,

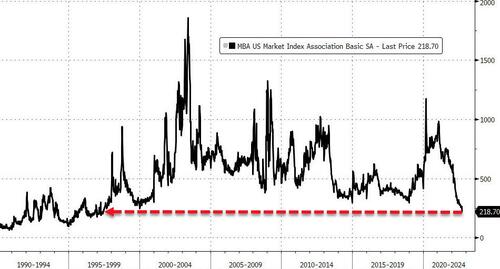

The pace of mortgage applications has fallen to a multi-decade low amid high housing interest rates, according to the latest data from the Mortgage Bankers Association (MBA).

The Market Composite Index, a measure of mortgage loan application volume, declined by 14.2 percent on a seasonally adjusted basis for the week ended Sept. 30, 2022, compared to a year earlier. The Refinance Index fell 18 percent from the previous week, while the Purchase Index registered a decrease of 13 percent.

Joel Kan, MBA’s associate vice president of economic and industry forecasting, pointed out that overall mortgage application activity dropped to its “slowest pace” since 1997, according to a press release on Oct. 5.

For the week ended Sept. 28, 2022, a 30-year fixed-rate mortgage was 6.70 percent, which is more than double what it was a year ago, at 3.01 percent.

“The current [mortgage] rate has more than doubled over the past year and has increased 130 basis points in the past seven weeks alone,” Kan said.

“The steep increase in rates continued to halt refinance activity, and is also impacting purchase applications, which have fallen 37 percent behind last year’s pace.”

Mortgage numbers were also affected by Hurricane Ian hitting Florida last week, as it triggered widespread evacuations and closures, he noted. Mortgage applications in Florida alone fell by 31 percent.

Construction spending in the country, an indicator of total spending on all types of construction, had fallen for the second consecutive month in August, according to a U.S. Census Bureau report, signaling that the housing market is slipping further into a recession.

In July, the National Association of Realtors (NAR) had warned that the United States was in a “housing recession,” as existing home sales fell by 5.9 percent.

Federal Rates

On Sept. 21, the Federal Reserve raised its benchmark federal funds rate by 0.75 percentage points, to a range of 3.0–3.25 percent. In February, the fed funds rate was only at 0.08 percent.

This increase in federal rates has inevitably caused a rise in mortgage rates as well, contributing to the dampening of housing demand.

Between February and September, the average interest rate on a 30-year fixed-rate mortgage rose from 3.55 percent to 6.70 percent, according to mortgage lender Freddie Mac.

“As the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day,” Craig J. Lazzara, S&P’s Dow Jones managing director, said in a July note.

“Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

Elevated mortgage rates have worsened home affordability. According to an analysis by Bankrate, owning a home now takes up around 27 percent of a typical family’s monthly income, compared to only 19 percent a year ago.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!