Just when you thought it couldn’t possibly get any worse for the bond market, we got a dire 2Y auction.

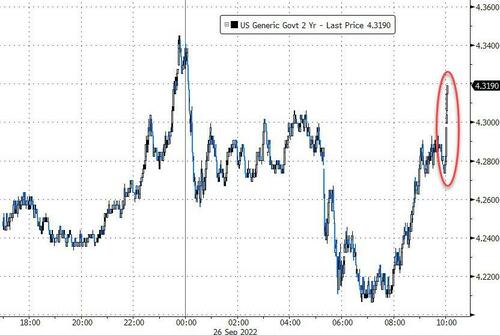

One minute after 1pm, the Treasury announced results from today’s sale of $43 billion in 2Y paper, which were nothing short of disastrous. The high yield – already the highest in 15 years – was almost a full percent, or 98bps, above August’s 3.307%, and stopping at a high yield of 4.290%, the auction tailed the When Issued 4.274% by 1.6bps, the biggest tail going back to feb 2020 when the bond market was similarly paralyzed, but back then it was due to covid.

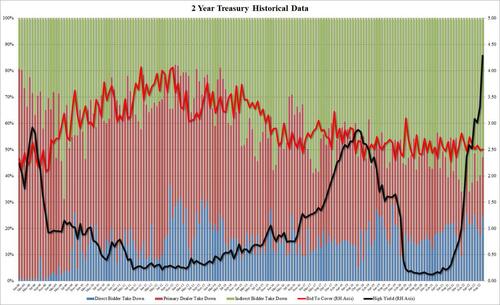

The bid to cover of 2.510 was a modest improvement to last month’s 2.488, but below the six-auction average of 2.56. As shown in the chart below, the BTC oln the 2Y auction has been largely stuck around 2.50 since 2018.

The internals were also ugly, with Indirects taking down just 52.95%, the lowest since June and far below the recent average of 59.5%. And with Directs awarded an impressive 24.84%, Dealers were left holding 22.20%, in line with last month’s 22.95%, if above the recent average of 18.6%.

Overall, a very ugly auction but that was to be expected a time when pretty much everything is blowing up. And sure enough, the 10Y yield spiked to session highs after the results from today’s dismal auction were announced, pushing the 10Y as high as 3.90%, the highest level since June 2010, and sparking the biggest VaR shock of a generation.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!