A lot of folks have been asking lately … where are we at in “the cycle”?

Of course, the question presumes cycles exist (they do).

But with so many new people getting into real estate investing … including many who’ve never invested through a “correction” (geek speak for a downturn) …

… it’s amazing there’s anyone who isn’t wondering when the next one’s coming … and HOW to know.

It’s not really that complicated, unless you’re trying to get the timing down to the precise day and time.

Then again, if it were truly easy, everyone would know it and be on the right side of it.

This is where it gets tricky …

That’s because for there to be a right side, there’s got to be a wrong side.

This means if everyone knows it’s coming and acts accordingly, not only will it not not happen …

(We know … that’s a notty sentence. Our English teachers are rolling over in their graves. They never liked it when we were too notty.)

… but it’s actually more likely to happen because everyone knows it’s coming.

Our point is cycles are as much psychological as fundamental.

So when everyone sees it and moves in anticipation … it’s their very movement that makes it happen. It’s a self-fulfilling prophecy.

You see it play out all the time in the paper markets.

Like a high-speed tailgater … even a flash of brake lights causes the lemmings of Wall Street to rush from one position to another …

… all trying to outrun each other to the exit of the entrance of a trade. The rush pushed prices up or down depending on which way the crowd’s running.

Of course, as we often point out … real estate investing is boring by comparison … in a good way. Real estate is slow, steady, and relatively stable.

That’s because real estate is not a commodity. Real estate can’t be traded in large lots at lightning speed … because every deal is different.

And with real estate, the logistics of the transaction …

… verifying title, arranging financing and insurance, getting inspections and appraisals, and simply vacating the property …

… are all glacierly slow when measured in Wall Street nano-seconds.

Nonetheless, real estate is not immune to a rush for the exits … especially now that Wall Street players own huge blocks (pun semi-intended) of homes.

But even though real estate cycles like everything else, it’s still very slow. It’s easy to fall asleep at the wheel.

Of course, even if you’re alert (and we all know the world needs more alerts) … you need to know what to pay attention to.

And THIS is where newbie investors get confused. They don’t know which gauges to watch.

Is it the stock market? Interest rates? Jobs? Wages? Taxes? Cap rates? Days on market? Year-over-year price changes? Price trends? Occupancies?

Yikes. It’s information overload.

No wonder people just want to ask someone they perceive as smart to flip to the back of the book and point at the answer.

Sorry to burst your bubble (calm down … it’s just a figure of speech), but the truth is no one knows for sure.

That’s partly because real estate is highly local. And there are many niches … each with their own unique dynamics.

Still … there are some basic principles to apply to whatever product niche and market you’re investing in.

It comes down to the willingness and capacity

Just because you want something, doesn’t mean you can afford it.

So effective upward pressure on prices comes when the supply in the market is being overwhelmed by demand from buyers fueled with the capacity to pay more.

So, the key ingredients to understanding what drives pricing are …

- Supply, and the capacity for supply to expand

- Demand, in terms of number of people chasing the supply …

- Capacity to pay, which is generally a factor of incomes, interest rates, and loan availability.

(For rental properties, incomes are rents and net operating incomes. For single-family consumer housing, income means wages.)

Of course, to be precise with timing, you’ll need to dig into each of these factors for your specific geography, demographic, and product niche.

But when addressing “where we are in the cycle” (bet your thought we’d never get there) …

… you’re looking for a divergence between growth and the underlying driver.

Since housing is a hot topic for everyone … and usually the first thing that pops to mind when asking about real estate cycles …

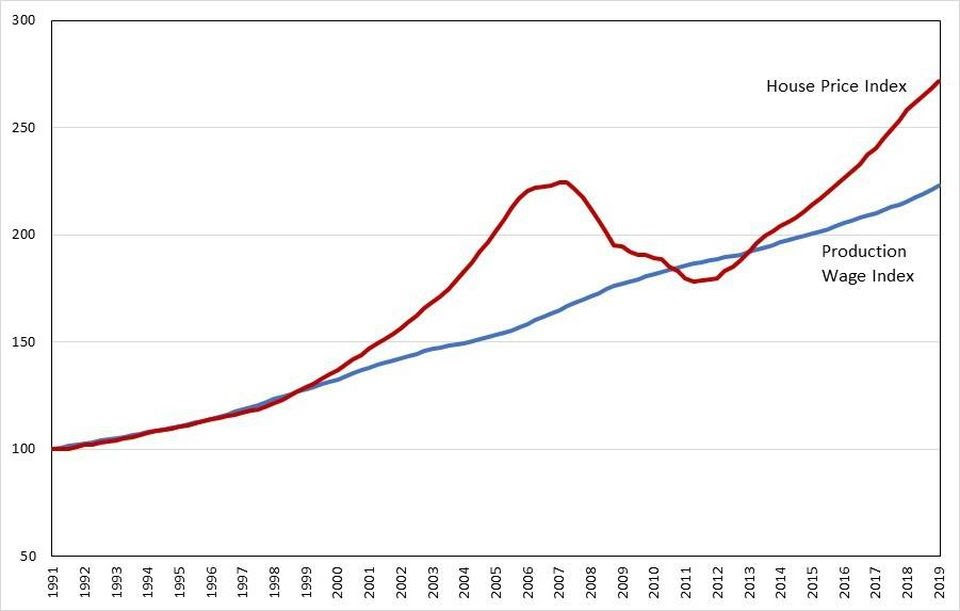

… take a look at this chart:

Housing Price Index to Production Wage Index

(The data came from the Fed, but the chart was put together by The Heritage Foundation here )

Notice that wages and home prices are tightly correlated from 1991 to 1999.Then something apparently happened to create a divergence in 1999. Of course, from 2000 to 2007 a “bubble” blew up and peaked.

We’ve all heard or experienced how that ended. Not pretty for those who weren’t prepared for the possibility.

Severe deflation (the housing crash) ensued.

And as the chart shows, prices relative to incomes over-corrected … falling below the wage trend line … so by 2011 housing was actually very affordable.

But it didn’t last long. And you can see where we’re at in the “cycle” now.

Kind of makes you stop and go hmmmm….

Of course, there’s a lot of insight hidden in the history of events from 1999 to 2019.

And because real estate is about buying and holding for the production of income over the long haul …

… it’s probably worth a trip down memory lane to see what can be gleaned from the last 20 years and applied to the next 20 years.

We’ll take that up in our next edition.

Until next time … good investing!

More From The Real Estate Guys™…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.