We’re still just a little more than a week removed from a mind-blowing 9-day mind-meld with brilliant thought leaders, niche experts, and seasoned investors and entrepreneurs …

… so we’ve been busy catching up on the news and looking at the world through our freshly expanded paradigms.

There are two things bouncing around our brains we think are important, but few real estate investors are paying attention to …

Gold and oil.

Sure, both these “commodities” fit well with real estate in a strategic real asset portfolio. And if you’re not sure how all that works, you can start with these past podcasts about gold and oil.

But bigger picture, both gold and oil probably drive more of geo-politics than most casual observers realize … and both are quasi-proxies for the dollar.

In other words, when you understand what’s happening with gold and oil, you have insights into the future of the dollar … and some of the things governments are doing to either defend dollar dominance … or break free from it.

Of course, if you earn, invest, borrow, or denominate wealth in dollars, the future of the dollar should be of great interest to you … even if you think of the dollar as being as permanent and reliable as air (it’s not).

As real estate investors, our primary interests (besides occupancy and cash flow) are demographics, migration trends, local economic strength, interest rates, taxes, and the supply and demand dynamics in our local market.

But all of that sits on the foundation of a functional financial system with two primary components … credit and currency. Gold and oil provide insight into both.

Oil is important at both the macro and the micro level.

In the macro, it takes energy to drive economic activity. When energy’s expensive, it drives up the costs of everything and is a drag on economic activity.

At the micro level, high dollar-denominated oil prices drive up the cost of living for your dollar-denominated tenants.

But for metros where oil is big business, oil also means local jobs. Remember, Texas and its robust energy sector were the primary driving force for U.S. job creation coming out of the 2008 recession.

Investors who realized this (like our pal Kenny McElroy) strategically invested in those markets while most people were hiding under the sheets.

So whether or not you’re interested in oil as a direct investment, paying attention to the oil business can be a great way to pick markets likely to hold up well if oil prices rise.

Oil also has a potential impact on credit markets and interest rates. Billions of dollars of debt has been created to fund shale oil production.

If oil prices drop, it both undermines the ability of regional oil economies to grow … but also for those employers to service their debt.

In the macro, if a big chunk of the debt goes rotten, credit markets could tighten. Think about what happened in 2008 when sub-prime mortgage debt went bad.

So again, whether you’re an oil investor or not, the oil industry has a direct impact on your real estate investing.

Watching oil helps you see what’s coming sooner … so you have time to position yourself to capture opportunity and mitigate risk.

Of course, the good news and bad news about real estate is it moves slowly.

So while you have plenty of time to be proactive IF you’re paying attention, it’s really hard to act fast if you’re not. That’s why we pay attention.

What about gold?

On the macro level, gold is a good gauge of how the world feels about U.S. Treasuries and the dollar.

When things get choppy in stocks, paper investors worldwide tend to flee into Treasuries for safety. After all, Treasuries are backed up by the Fed’s printing press.

Of course, what does the Fed print? U.S. dollars.

But to quote Watto from Star Wars – The Phantom Menace …

“Republic credits are no good here. I need something more … real.”

That is, when investors worldwide are looking for safety … and they don’t trust the paper … they go into gold.

So what does that mean to real estate investors?

Remember, mortgage rates and availability derive from healthy bond markets … most notably, U.S. Treasuries.

The 2008 Great Financial Crisis had its genesis in a broken bond market … mortgage-backed-securities. When those went bad, frightened investors worldwide piled into Treasuries … and rates fell.

But what happens if investors worldwide don’t trust Treasuries?

You don’t have to wonder. China came out in 2009 and scolded Uncle Sam about the size of the deficit and all the dollar printing doing on.

Why did it bother them? Because they own TRILLIONS in U.S. bonds. They don’t want to get paid back in diluted dollars.

But Uncle Sam’s debt, deficits, and printing have BALLOONED since then.

So it’s no surprise that China … along with Russia and several other countries … have been diligently accumulating and repatriating gold.

They’re getting out of dollars and Treasuries to do it. And who can blame them?

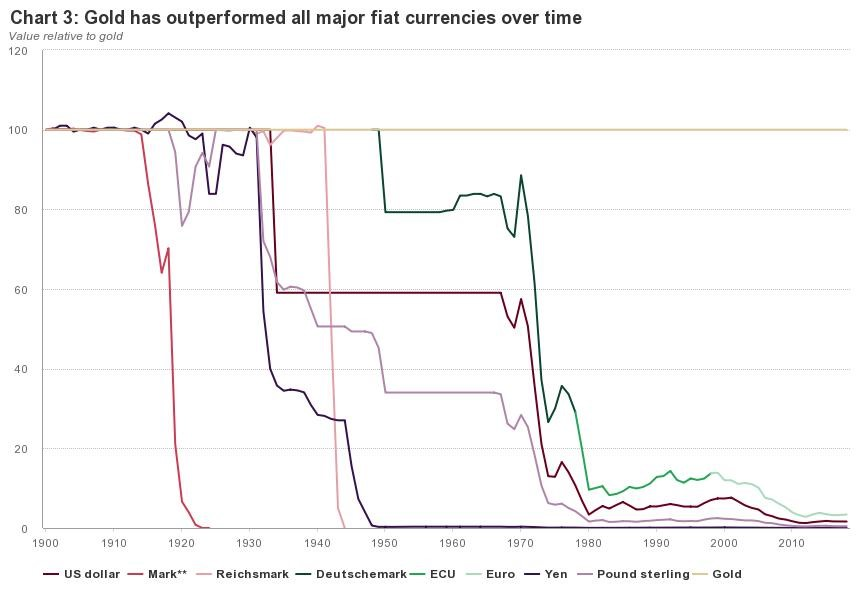

Paper money has an atrocious long-term record as a store of wealth …

Source: World Gold Council

Consider this when you think about where you’re storing YOUR long-term liquid wealth.

Meanwhile, there’s just a little more to the developing story of gold … and the story behind the story. It’s a little complicated, but interesting and noteworthy.

After the 2008 crisis, the world’s bankers got together in Basel, Switzerland to come up with voluntary rules to prevent another financial crisis. The agreement is called the Basel Accord.

A provision in the agreement, known as Basel III (the agreement’s rolled out in phases) allows financial institutions to consider gold “Tier 1” capital. So adding gold is supposed to make banks more liquid and stable.

This is a bit of a promotion for gold. Some observers think this means demand for gold will increase, but we’re not smart enough to have an opinion on that.

But there are a couple of things we are thinking about …

Perhaps most obviously, international bankers apparently consider gold more valuable than simply a “barbarous relic” with no place in a modern monetary system.

Keep that in mind when you hear people criticize the placement of gold in a portfolio. If gold can make a bank more stable and liquid, can’t it do the same for you?

To be clear, we’re not fans of gold as an investment. It’s just an alternative to cash … a way to store long-term liquidity while hedging against a declining dollar and bank counter-party risk.

But the more interesting aspect of gold’s now elevated role in bolstering the banking system is why it’s necessary in the first place.

Is it because the banking system is still fragile and in need of support? Is it because the world needs more leverage to expand … and so more collateral to lever? Why not just use Treasuries?

We don’t know yet. But we’ll be checking in with our big-brained gold experts to see what they think.

Meanwhile, we encourage you to think outside both the real estate and mainstream financial media boxes. It seems like oil and gold might be trying to tell us something.

Are you listening?

Until next time … good investing!

More From The Real Estate Guys™…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.