Newsfeed: U.S. Energy Bills See Largest Rise In Decades—More Pain To Come

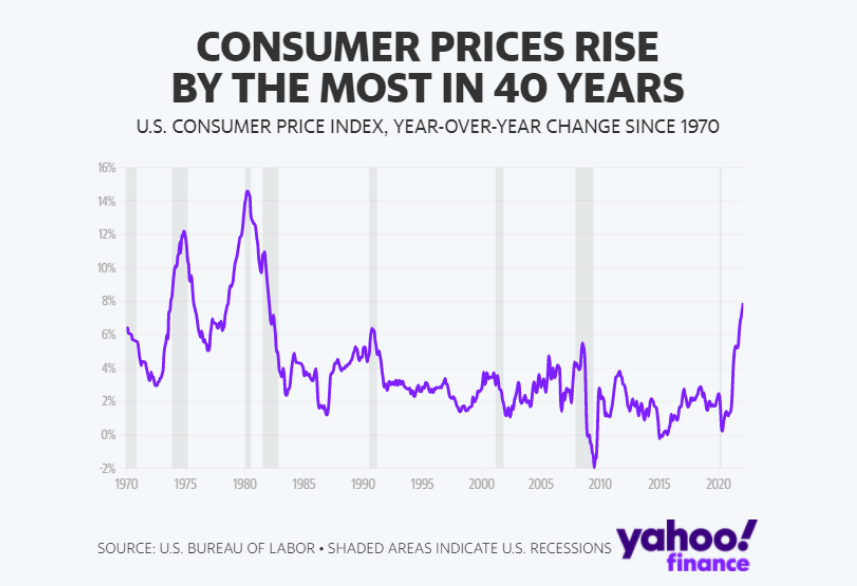

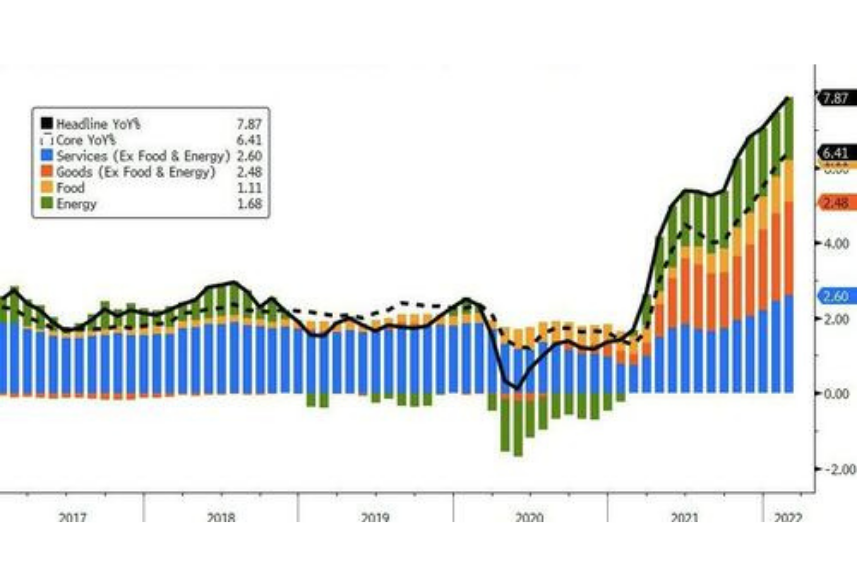

If it seems like your energy bills have fell victim to price creep, you’re right. Data from the U.S. Bureau of Labor Statistics and the Energy Information Administration suggest that U.S. consumers have seen the largest increase in natural gas and electricity bills in decades.

Newsfeed: U.S. Energy Bills See Largest Rise In Decades—More Pain To Come Read More »