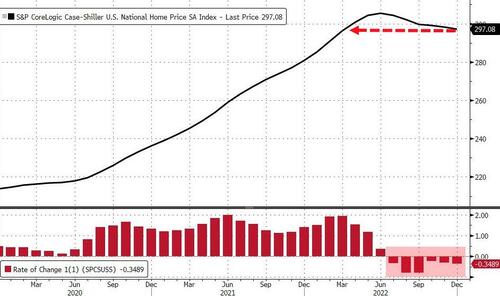

National home prices fell for 6 straight months up to December (the latest data from S&P Global’s Case-Shiller index), dropping more than expected (-0.51% MoM vs -0.40% MoM exp). This slowed the annual growth of prices to the weakest since July 2020…

The headline national home price index is at it lowest since March 2022…

“The prospect of stable, or higher, interest rates means that mortgage financing remains a headwind for home prices, while economic weakness, including the possibility of a recession, may also constrain potential buyers,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“Given these prospects for a challenging macroeconomic environment, home prices may well continue to weaken.”

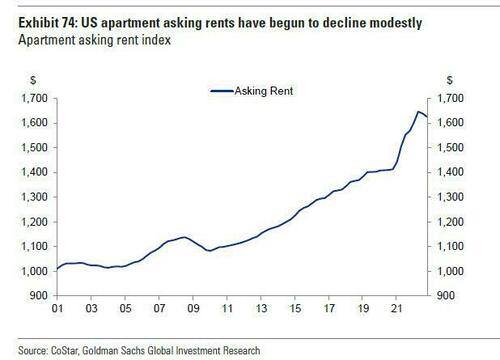

Asking rents are now tracking home prices lower…

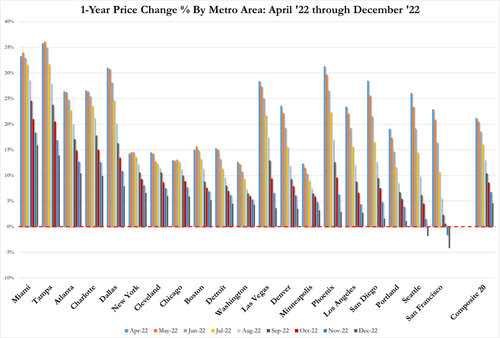

Miami, Tampa, and Atlanta reported the highest year-over-year gains among the 20 cities surveyed (although every city is seeing price growth slow)…

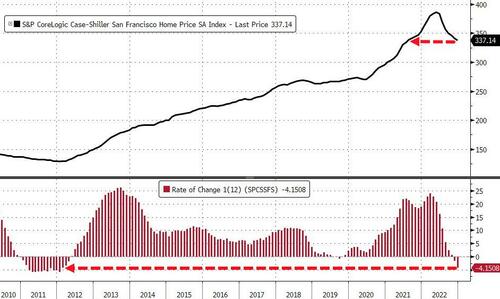

…but San Francisco prices are plummeting the fastest with prices down -4.2% YoY, the biggest annual drop since March 2012 to the lowest since July 2021…

Bear in mind that these prices are extremely lagged (December) which is where mortgage rates began to flatten before turning up dramatically in February…

Do not expect any pause in home prices yet… and besides, that is not what The Fed wants.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!