High mortgage rates, persistent inflation and economic woes are making expensive parts of the country less attractive and relatively affordable places more popular. Migration out of Los Angeles, New York, Washington, D.C. and Boston has picked up from last year.

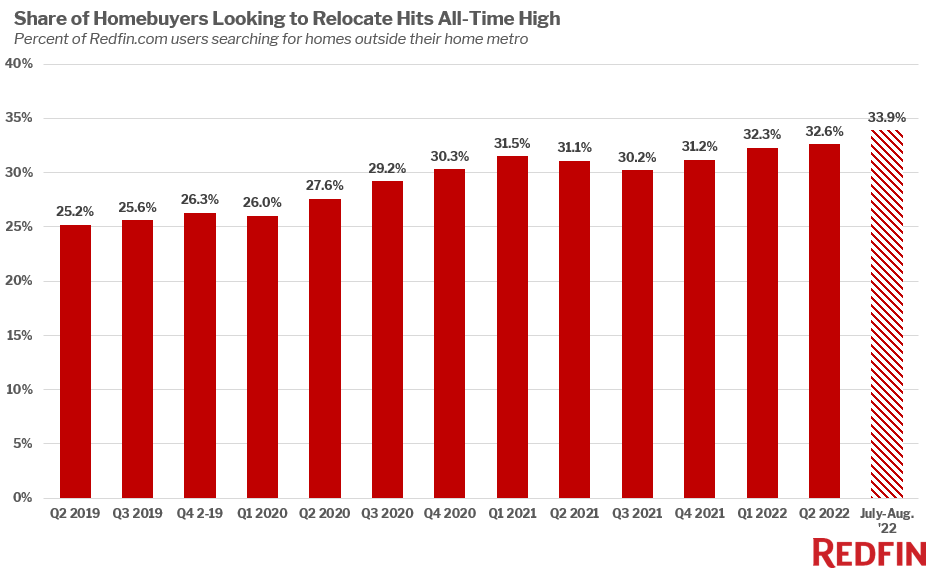

A record 33.9% of Redfin.com users nationwide looked to move from one metro to another in July and August, up from 32.6% in the second quarter and about 26% before the pandemic.

The U.S. housing market has slowed considerably from the height of the pandemic homebuying frenzy and home sales are down 20% from a year ago. But the share of relocating buyers out of all buyers is at its highest level since at least 2017, when Redfin started tracking migration data.

“The overall slowdown and the popularity of relocating are both due to high home prices and mortgage rates that have doubled since last year,” said Redfin Deputy Chief Economist Taylor Marr. “Six percent mortgage rates are exacerbating already-high home prices and motivating homebuyers–especially remote workers–to leave expensive areas for more affordable ones. Persistent inflation and slumping stocks are also cutting into buyers’ budgets, making relatively affordable areas even more attractive.”

Homebuyers are leaving expensive coastal areas at higher rates than a year ago

More homebuyers left the Bay Area than any other metro in July and August. That’s determined by net outflow, a measure of how many more Redfin.com users looked to leave a metro than move in.

Next come Los Angeles, New York, Washington, D.C. and Boston, all expensive job centers highly populated by remote workers with the flexibility to relocate.

Migration out of four of those five places–Los Angeles, New York, Washington, D.C. and Boston–increased from a year earlier. That’s partly because of high mortgage rates and economic woes, including inflation, making it more difficult to afford homes in those places.

The number of homebuyers looking to move out of the Bay Area declined, likely because it’s one of the only parts of the U.S. where home prices are dropping year over year, giving buyers in the perennially expensive area a bit of relief. Prices fell 8% year over year in San Francisco, 1.6% in Oakland and 0.2% in San Jose.

Top 10 Metros by Net Outflow of Users and Their Top Destinations

| Rank | Metro* | Net Outflow, July and August 2022† | Net Outflow, July and August 2021 | Portion of Local Users Searching Elsewhere, July and August 2022 | Portion of Local Users Searching Elsewhere, July and August 2021 | Top Destination | Top Out-of-State Destination |

|---|---|---|---|---|---|---|---|

| 1 | San Francisco, CA | 40,432 | 52,854 | 24.1% | 25.2% | Sacramento, CA | Seattle, WA |

| 2 | Los Angeles, CA | 34,832 | 30,754 | 20.0% | 18.1% | San Diego, CA | Las Vegas, NV |

| 3 | New York, NY | 26,786 | 25,725 | 28.7% | 27.3% | Philadelphia, PA | Philadelphia, PA |

| 4 | Washington, D.C. | 20,542 | 16,405 | 17.7% | 15.1% | Salisbury, MD | Salisbury, MD |

| 5 | Boston, MA | 11,543 | 9,253 | 19.8% | 16.8% | Portland, ME | Portland, ME |

| 6 | Chicago, IL | 6,883 | 5,504 | 16.6% | 12.3% | Los Angeles, CA | Los Angeles, CA |

| 7 | Detroit, MI | 5,330 | 3,300 | 34.4% | 28.2% | Cleveland, OH | Cleveland, OH |

| 8 | Seattle, WA | 4,143 | 3,766 | 17.1% | 14.5% | Los Angeles, CA | Los Angeles, CA |

| 9 | Minneapolis, MN | 3,740 | 1,777 | 31.0% | 21.8% | Chicago, IL | Chicago, IL |

| 10 | Denver, CO | 3,739 | 4,662 | 24% | 20.1% | Chicago, IL | Chicago, IL |

*Combined statistical areas with at least 500 users in July and August 2022

†Among the two million users sampled for this analysis only

Warm Sun Belt metros are most popular for relocating homebuyers

Relatively affordable, warm-weather locales are typically the most attractive for relocating homebuyers, and July and August were no exception.

Miami was the most popular migration destination, continuing a year-plus streak of the South Florida metro taking the number-one spot. Popularity is measured by net inflow, or how many more Redfin.com users looked to move into an area than leave.

Next come two California metros: Sacramento, perennially popular for homebuyers moving from one metro to another, and San Diego, which only recently jumped onto the list of most popular destinations. Las Vegas and Tampa, FL round out the top five. They’re followed by Phoenix, Cape Coral, FL, North Port, FL, Portland, ME and San Antonio, TX.

Nine of the 10 most popular destinations are warm-weather metros located in the Sun Belt (Portland is the exception). Eight of the 10 have median sale prices below $500,000; Sacramento ($570,000) and San Diego ($800,000) are the exceptions. And six of them are located in places with no state income tax, which lowers the overall cost of living. Although home prices in many of the popular destinations have increased significantly throughout the pandemic, they’re still more affordable than the places homebuyers are coming from. The typical home in Las Vegas, for instance, sold for $416,000 in August, half of the $845,000 median in Los Angeles, the number-one origin for people moving in.

Top 10 Metros by Net Inflow of Users and Their Top Origins

|

Rank

|

Metro*

|

Net Inflow, July and August 2022†

|

Net Inflow, July and August 2021

|

Portion of Searches from Users Outside the Metro, July and August 2022

|

Portion of Searches from Users Outside the Metro, July and August 2021

|

Top Origin

|

Top Out-of-State Origin

|

|---|---|---|---|---|---|---|---|

| 1 | Miami, FL | 8,845 | 10,435 | 33.2% | 33.1% | New York, NY | New York, NY |

| 2 | Sacramento, CA | 8,504 | 8,327 | 43.9% | 42.1% | San Francisco, CA | Reno, NV |

| 3 | San Diego, CA | 7,811 | 3,598 | 33.6% | 28.4% | Los Angeles, CA | Seattle, WA |

| 4 | Las Vegas, NV | 7,323 | 6,739 | 47.2% | 41.8% | Los Angeles, CA | Los Angeles, CA |

| 5 | Tampa, FL | 7,145 | 6,240 | 48.1% | 46.9% | Orlando, FL | New York, NY |

| 6 | Phoenix, AZ | 6,447 | 8,411 | 36.0% | 35.4% | Los Angeles, CA | Los Angeles, CA |

| 7 | Cape Coral, FL | 4,951 | 4,234 | 68.5% | 69.4% | Chicago, IL | Chicago, IL |

| 8 | North Port, FL | 4,700 | 3,983 | 67.3% | 67.8% | Chicago, IL | Chicago, IL |

| 9 | Portland, ME | 3,876 | 3,692 | 64.9% | 65.2% | Boston, MA | Boston, MA |

| 10 | San Antonio, TX | 3,235 | 4,396 | 38.9% | 42.0% | Austin, TX | Los Angeles, CA |

*Combined statistical areas with at least 500 users in July and August 2022

†Negative values indicate a net outflow; among the two million users sampled for this analysis only

Methodology

The latest migration analysis is based on a sample of about two million Redfin.com users who searched for homes across more than 100 metro areas in July and August, excluding searches unlikely to precede an actual relocation or home purchase. To be included in this dataset, a Redfin.com user must have viewed at least 10 homes in a particular metro area, and homes in that area must have made up at least 80% of the user’s searches. Redfin’s migration data goes back to 2017. We published July homebuyer migration data last month; the data in this report covers both July and August.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!