Another month, another plunge in housing.

Hot on the heels of the latest catastrophic homebuilder sentiment print and plunging single-family starts and permits, analysts expected existing home sales to accelerate their recent decline with a 4.9% MoM drop in July. They were right in direction but severely wrong in magnitude as existing home sales tumbled tumbled 5.9% MoM in June.

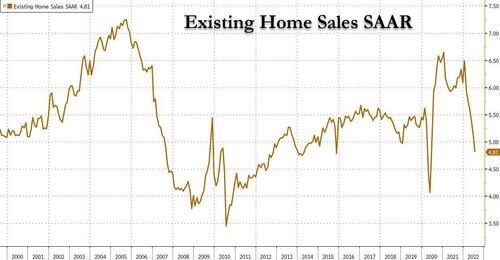

That is the 6th straight month of existing home sales declines – the longest stretch since 2013 – pulling home sales down a stunning 20.2% YoY. From the NAR

“The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun.

“Home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers.”

The collapsing housing market means the SAAR is now below the full year pace of 2012 – one decade ago.

Interestingly, despite the broad collapse in the market, properties typically remained on the market for 14 days in July, the same as June and down from 16 days in May and 17 days in July 2021. The 14 days on market are the fewest since NAR began tracking it in May 2011. Eighty-two percent of homes sold in July 2022 were on the market for less than a month.

In other words, the market is frozen, but inventory remains at record lows!

“We’re witnessing a housing recession in terms of declining home sales and home building,” Yun said. “However, it’s not a recession in home prices. Inventory remains tight and prices continue to rise nationally with nearly 40% of homes still commanding the full list price.”

Finally, there is some good news – the number of homes for sale rose for the first time in three years on an annual basis to 1.31 million, up from 1.26 in June and the highest since September. At the current sales pace it would take 3.3 months to sell all the homes on the market, marking the fifth straight rise in months’ supply.

Despite hopes that prices would start to roll over – helping with affordability – the median selling price rose 10.8% from a year earlier to a near-record $403,800. First-time buyers accounted for 29% of US sales last month, up from 30% in May.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!