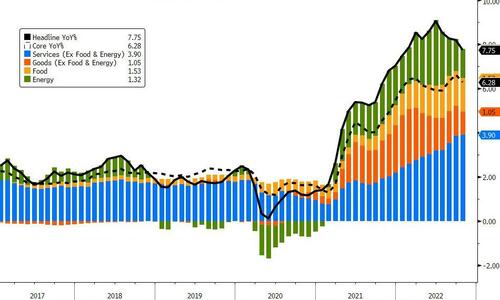

It’s that time of the month again. The ‘most important’ CPI print in history, since the last ‘most important’ CPI print, is expected to show some moderation in October data (but remains at extremely high historical levels in both headline and core), and it did just that and then some:

The headline CPI printed far cooler than expected at +7.7% YoY (vs 7.9% exp) and down from the +8.2% in Sept. That is the lowest since January…

Core CPI rose for the 29th straight month (on a MoM basis) but inched back off 40 year highs on a YoY basis, rising just +6.3% vs +6.5% exp…

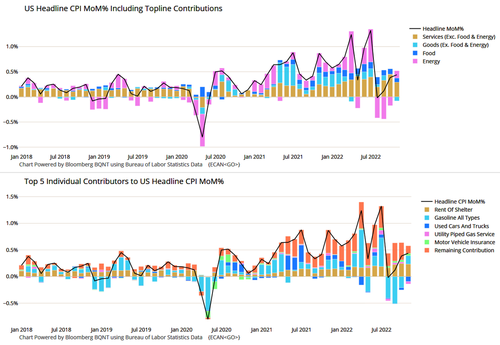

Looking below the surface, Services CPI is now at its highest since 1982, rising faster than Goods CPI…

On a MoM basis, Goods costs fell, Services rose along with Food costs…

On a YoY basis, Services inflation is countering any improvement in Goods costs…

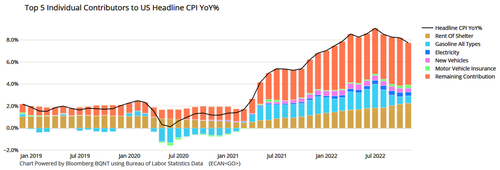

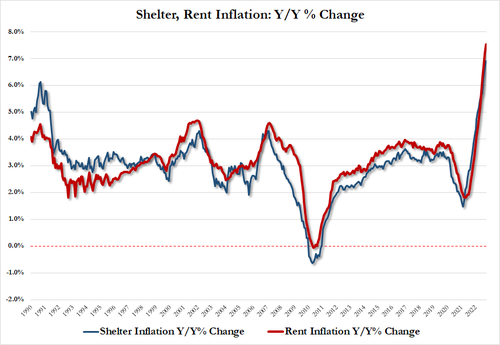

But the rise in shelter CPI continues…

The index for all items less food and energy rose 0.3 percent in October, following a 0.6-percent increase in September. The shelter index continued to increase, rising 0.8 percent in October, the largest monthly increase in that index since August 1990. The rent index rose 0.7 percent over the month, and the owners’ equivalent rent index rose 0.6 percent. The index for lodging away from home increased 4.9 percent in October, after declining 1.0 percent in September.

The shelter index was the dominant factor in the monthly increase in the index for all items less food and energy; other components were a mix of increases and declines. Among the indexes that rose in October was the index for motor vehicle insurance which rose 1.7 percent in October after rising 1.6 percent in September. The index for recreation rose 0.7 percent over the month, following a smaller 0.1percent increase in the previous month. The new vehicles index increased 0.4 percent in October, and the personal care index rose 0.5 percent.

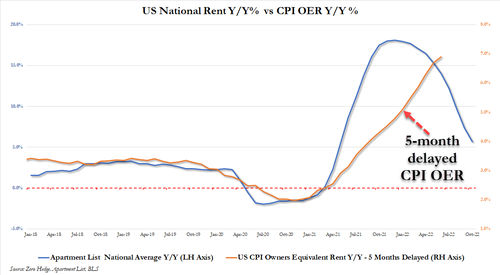

Indeed, even as real-time rents are now sliding, Rent/Shelter inflation continues to soar…

- Rent Inflation 6.92%, highest on record, up from 6.59%

- Shelter inflation 7.52%, highest on record, up from 7.21%

The shelter index accounted for over 40 percent of the total increase in all items less food and energy.

… but as a reminder, the very much delayed CPI OER number is set to to fall dramatically in coming months as it catches down to reality.

In contrast, and just as we previewed last night, the medical care index fell 0.5 percent in October after rising 0.8 percent in September. The index for hospital and related services decreased 0.2 percent over the month, and the index for prescription drugs declined 0.1 percent. The index for physicians’ services was unchanged in October. Last night we warned that health insurance CPI would tumble and boy did it – in fact it was the biggest driver behind today’s soft print.

Other indexes which declined over the month include the index for used cars and trucks, which fell 2.4 percent in October after decreasing 1.1 percent in September. The apparel index fell 0.7 percent over the month, after declining 0.3 percent the previous month. The index for airline fares fell 1.1 percent in October, following a 0.8-percent increase in September. The index for household furnishings and operations was unchanged over the month.

Core CPI (ex-shelter) fell 0.1% MoM -0 the first MoM decline since the COVID lockdown crisis….

Before the CPI print, the market was pricing a 30% chance of 75bps hike in Dec… and that has been crushed on this print…

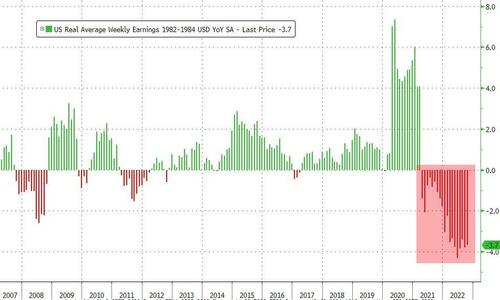

Finally, for the 19th straight month Americans cost of living increased as real wages tumbled…

Which is odd because President Biden proclaimed earlier in the week that real wages in America are rising?

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!