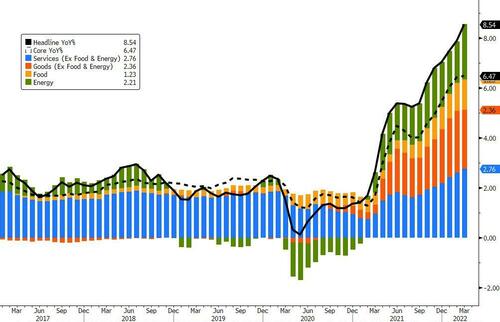

Having warned the world to expect “extraordinarily elevated” levels of inflation due to “Putin’s Price Hike”, The White House is likely in shock this morning as headline CPI rose 1.2% in March (vs +1.2% MoM) which sent the headline CPI up a shocking 8.5% YoY (vs +8.4% YoY exp and +7.9% prior) – the highest since 1981.

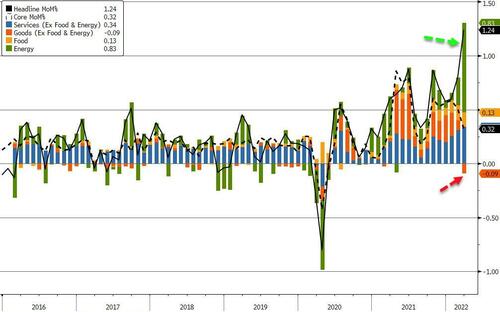

The 1.2% MoM rise is the biggest since Sept 2005 and CPI has risen for 22 straight months, but we note that goods inflation actually fell on a MoM basis (while energy soared)…

However, Core CPI (ex food and energy) rose just 0.3% MoM (below the +0.5% expected) and was up 6.5% YoY (above Feb’s 6.4% but below the +6.6% exp).

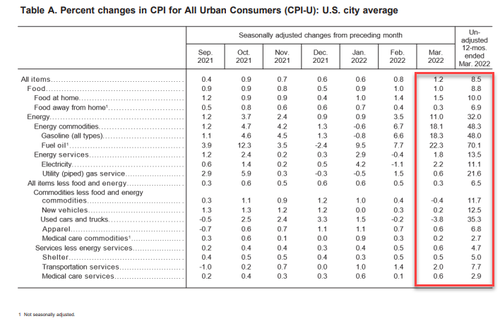

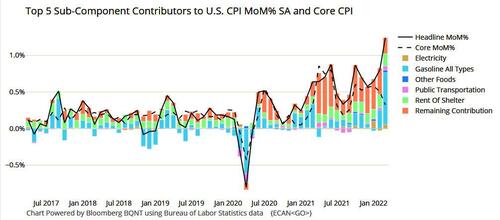

The shelter index was by far the biggest factor in the increase, with a broad set of other indexes also contributing, including those for airline fares, household furnishings and operations, medical care, and motor vehicle insurance.

In contrast, the index for used cars and trucks fell 3.8 percent over the month.

A full breakdown of the top 5 subcomponents in the monthly increase is shown below.

On a year-over-year basis, the rise in prices was dominated by Energy and goods.

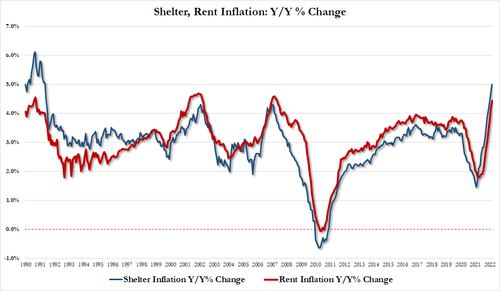

The cost of putting a roof over your head (unless you’re homeless in LA) continues to soar…

- March Shelter inflation 5.0% Y/Y, up from 4.7% in Feb, and the highest since May 1991

- March Rent inflation 4.44% Y/Y, up from 4.17% in Feb, and the highest since May 2007

A full heatmap of March inflation (more to follow in a subsequent post).

Bear in mind that after this March report, inflation expectations start to step down, with second-quarter CPI seen at 7.6% and 5.7% by year-end, according to a Bloomberg survey. According to at least 6 Wall Street banks, this was the peak of the inflation wave.

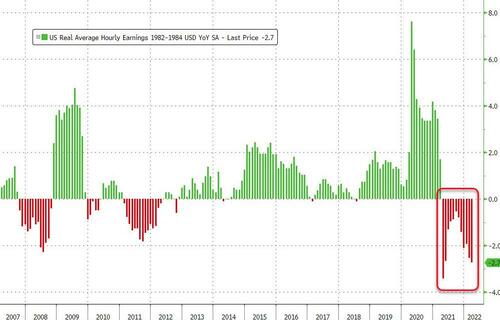

And finally, and perhaps most importantly for the average American who actually has to pay for ‘stuff’ every day with his (or her or zher) own money, real average hourly earnings fell for the 12th straight month…

This confirms NBC News recent poll that showed 62% of Americans saying their incomes cannot keep up with the rising cost of living.

Still, the good news is, we all know who to blame for this right?

The bottom line: No inter-meeting or 75bps rate hike as the CPI data isn’t as bad as it could have been.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!