The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 591 thousand.

The previous three months were revised down.

Sales of new single‐family houses in April 2022 were at a seasonally adjusted annual rate of 591,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 16.6 percent below the revised March rate of 709,000 and is 26.9 percent below the April 2021 estimate of 809,000.

emphasis added

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now below pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 9.0 months from 6.9 months in March.

The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

The seasonally‐adjusted estimate of new houses for sale at the end of April was 444,000. This represents a supply of 9.0 months at the current sales rate.

On inventory, according to the Census Bureau:

“A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted.”

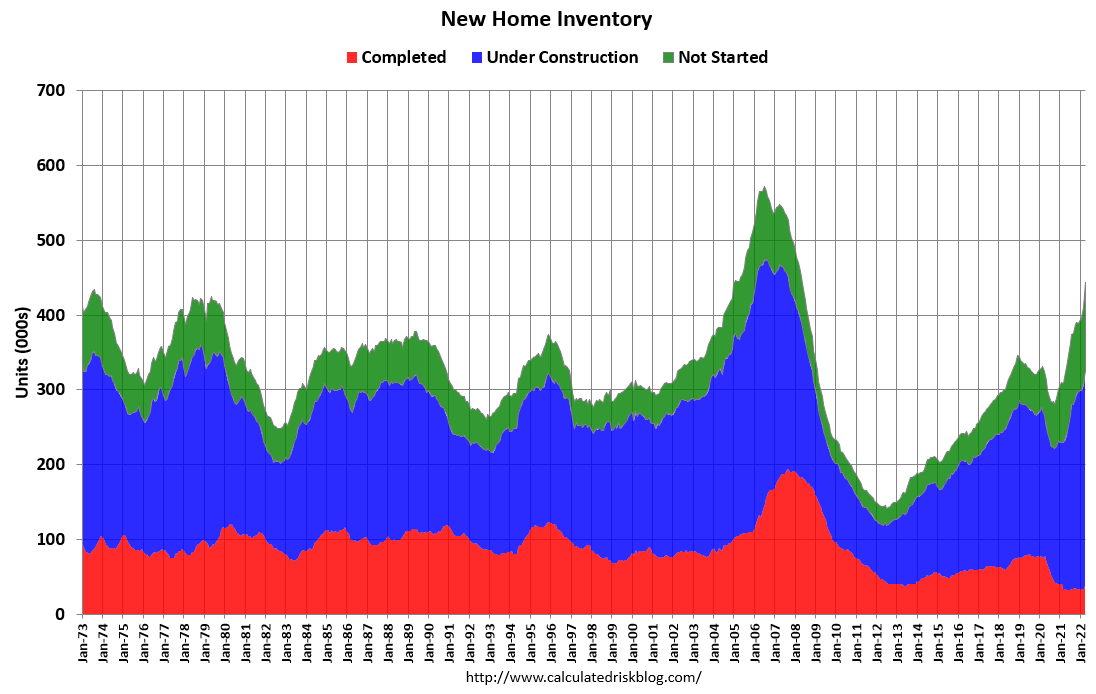

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale – at 38 thousand – is up from the record low of 32 thousand in 2021 and early 2022. This is about half the normal level of completed homes for sale.

The inventory of homes under construction at 288 thousand is the highest since 2006. The inventory of homes not started is at a record 118 thousand.

The fourth graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In April 2022 (red column), 53 thousand new homes were sold (NSA). Last year, 74 thousand homes were sold in April.

The all-time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

The next graph shows new home sales for 2021 and 2022 by month (Seasonally Adjusted Annual Rate). Sales in April 2022 were down 26.9% from April 2021.

Almost 6 Months of Inventory Under Construction

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.

The inventory of completed homes for sale was at 38 thousand in April, up from the record low of 32 thousand in several months in 2021 and early 2022. That is just over 0.8 months of completed supply (red line). This is lower than the normal level.

The inventory of new homes under construction is at 5.9 months (blue line) – well above the normal level. This elevated level of homes under construction is due to supply chain constraints. This is close to the record set in 1980.

And 118 thousand homes have not been started – about 2.4 months of supply (grey line) – almost double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

New Home Prices in January

And on prices, from the Census Bureau:

The median sales price of new houses sold in April 2022 was $450,600. The average sales price was $570,300.

The following graph shows the median and average new home prices. Overall home prices are up sharply year-over-year.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery – with limited finished lots in recovering areas – builders moved to higher price points to maximize profits.

Then the average and median house prices mostly moved sideways since 2017 due to home builders offering more lower priced homes. Prices really picked up during the pandemic.

The average price in April 2022 was $570,300 up 31% year-over-year. The median price was $450,600, up 20% year-over-year.

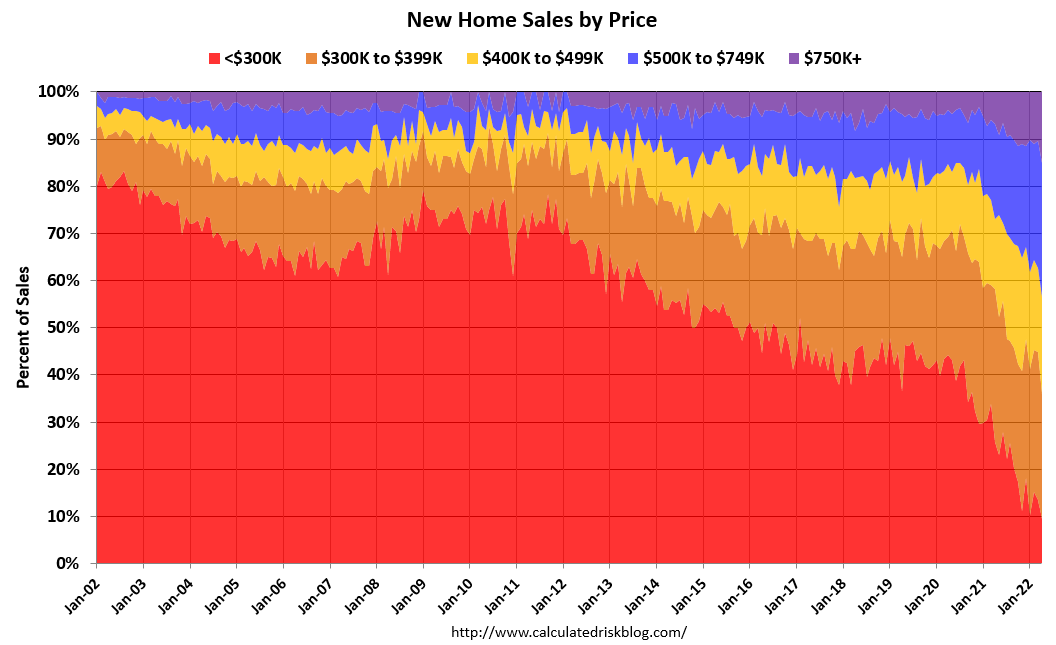

The last graph shows the percent of new homes sold by price.

Only 9% of new homes sold were under $300K in April 2022. This is down from around 80% in 2002. In general, the under $300K bracket is going away (inflation has pushed prices higher).

There has been a sharp increase in the percent of homes over $500K since the beginning of the pandemic. In early 2020, about 17% of new homes sold were over $500K; in April 2022, 43% were over $500K.

Conclusion

It appears sales are being impacted significantly by higher mortgage rates (as expected). The good news – for the home builders – is there are very few completed homes for sale (unlike during the bubble). However, there are a large number of homes under construction (almost 6 months of inventory under construction at the April sales rate).

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!