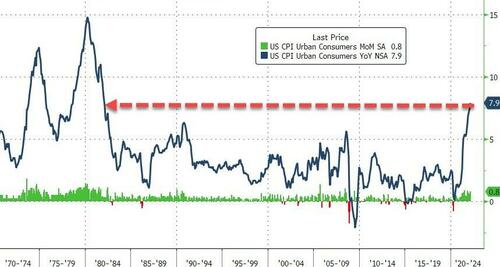

With the Biden administration already setting the narrative yesterday that today’s inflation print could be ‘high’, and expectations for a headline print of +7.9% YoY (from +7.5% YoY in January), the bar was high for any surprises and the headline print came in right in the dot at +7.9% YoY – the highest since Jan 1982.

Source: Bloomberg

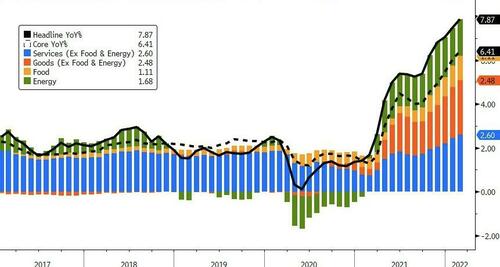

That is the 21st straight month of MoM (non-transitory) increases in consumer prices, with Energy (and Services) dominating the recent surge…

Source: Bloomberg

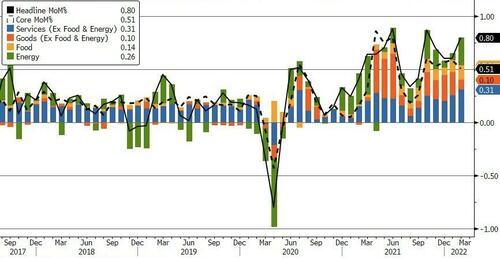

On a MoM basis, Energy and Services costs also dominated the increases…

Source: Bloomberg

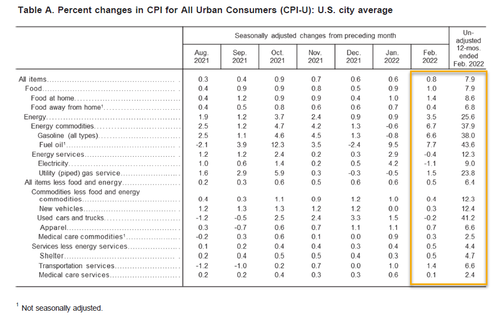

One thing of note… one tiny sliver of hope… Used Car prices fell very modestly in February…

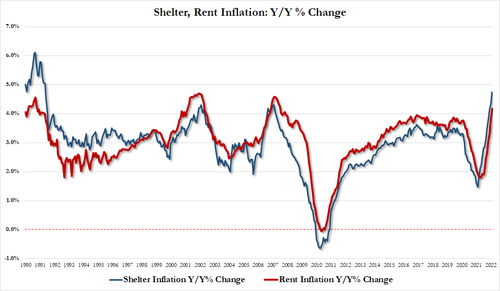

But, in the interest of balance, the costs of a roof over your head are exploding higher…

- March shelter inflation 4.74%, up from 4.36% in Jan and the highest since May 1991

-

March rent inflation 4.17%, up from 3.76% and the highest since July 2007

Source: Bloomberg

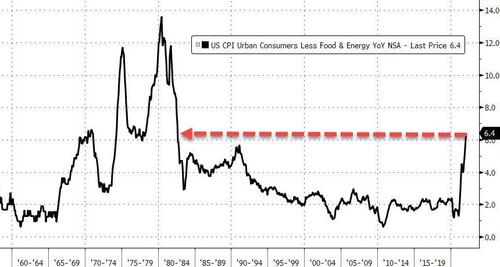

Core CPI rose 6.4% YoY in February (in line with +6.4% expectations and well above +6.0% in January)

Source: Bloomberg

Finally, and to many, most importantly, real wages (average hourly earnings) dropped on a YoY basis for the 11th straight month…

Source: Bloomberg

So the next time the Biden admin tries to tell you to be grateful that your wages are rising, show them that chart!

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!