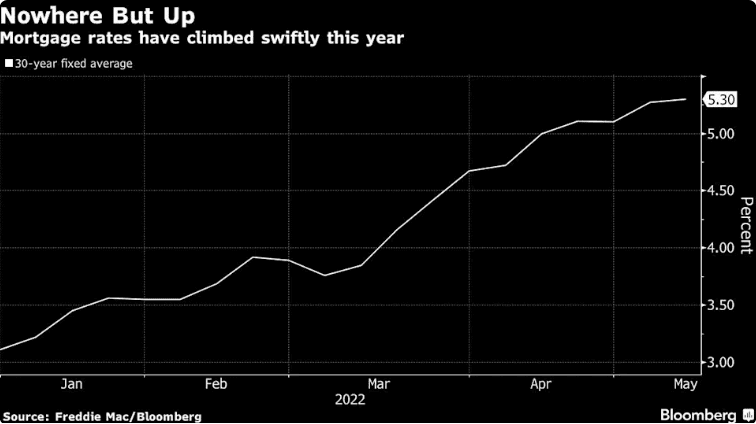

(Bloomberg) — US mortgage rates jumped again this week, extending a steep climb that is shutting some would-be homebuyers out of the market.

The average for a 30-year loan was 5.3%, up from 5.27% last week and the highest since July 2009, Freddie Mac said in a statement Thursday.

Rates tracked yields for 10-year Treasuries, which last week reached 3% for the first time since 2018. US consumer prices rose more than forecast in April, signaling the Federal Reserve will need to be aggressive in its efforts to contain inflation. As the Fed raises benchmark interest rates, mortgage costs are expected to follow.

In what’s traditionally the housing market’s busiest and most competitive season, higher rates will put more pressure on buyers to seal deals before loans get even more expensive. Others are delaying home searches after calculating that they can’t afford bigger mortgage bills.

At the current 30-year average, a borrower with a $300,000 mortgage would pay $1,666 a month, $384 more than at the end of last year.

The many cash buyers in the market, including downsizers and property investors, aren’t rate sensitive, so they’ll continue to make purchases even as first-time buyers pull back, said Greg McBride, chief financial analyst at Bankrate.com.

“The run up of mortgage rates since beginning of the year has the same impact on affordability as an increase in home prices of more than 20%,” McBride said. “It will certainly temper demand as many would-be homebuyers are priced out. But rising rates won’t turn this into a buyer’s market as long as inventory remains as low as it is.”

Adjustable-rate mortgages are becoming more popular as a cheaper option. Last week, ARMs — with variable interest rates that reset based on the market at predetermined times — accounted for the biggest share of home-loan applications since 2008, data from the Mortgage Bankers Association show.

The current average for five-year ARMs is 3.98%, Freddie Mac said, up from 3.96% last week.

(Updates with comments from analyst starting in sixth paragraph.)

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!