By Ted Dabrowski and John Klingnerk

Every year, states across the country compete with each other for people and their wealth as millions of Americans move between states. The stakes are large. A growing population for the winners means an increasing tax base, economic growth and investment. For the biggest losers, it means more difficulties in paying down debts, higher taxes and fewer investments for the future.

The nation’s most-recent winners of migration from other states are Florida and Idaho according to the latest migration data released by the IRS. Florida, the nation’s perennial winner, gained the most people and income overall in 2020, while Idaho gained the most of both on a percentage basis.

On the other end of the competition are states that have become perennial losers. States like California, New York, Illinois and New Jersey once again experienced some of the nation’s biggest losses of both residents and their money.

Those findings are based on a Wirepoints’ analysis of the latest 2020 domestic migration data provided by the Internal Revenue Service. The IRS reviews tax returns annually to track when and where people move. It also aggregates the ages, income brackets and adjusted gross incomes of filers.

Winners and losers

The Sunshine State attracted over $41.1 billion in Adjusted Gross Income (AGI) from 624,000 new residents (tax filers and their dependents) that moved into Florida in 2020. On the flip side, Florida lost $17.4 billion in AGI from 457,000 people who left. Overall, Florida came out ahead with 167,000 net new people and $23.7 billion in net new taxable income.

That’s a total gain of about 3.3 percent of the state’s total 2019 AGI ($711 billion).

Texas was the runner up with a net income gain of $6.3 billion, followed by Arizona with $4.8 billion. North and South Carolina rounded out the top five with net gains of $3.8 billion and $3.6 billion, respectively.

On the losing side, New York suffered the worst outflow of money of any state in 2020. The Empire State lost a net $19.5 billion in income, or 2.5 percent of its 2019 AGI, while a net of nearly 250,000 residents moved out.

California was next, losing a net $17.8 billion and 263,000 people. Illinois was third with a net loss of $8.5 billion and 101,000 people. Massachusetts and New Jersey were in 4th and 5th place, with $2.6 and $2.3 billion in income losses, respectively.

Tables with each state’s ranking in migration gains/losses are provided below.

Tables with each state’s ranking in migration gains/losses are provided below.

The cumulative impact of income losses and gains

The problem with chronic outflows, like in the case of New York, is that one year’s losses don’t only affect the tax base the year they leave, but they also hurt all subsequent years. The losses pile up on top of each other, year after year. And when a state loses income to other states for 21 straight years, the numbers add up.

In 2020 alone, New York would have had nearly $123 billion more in AGI to tax had it not been for the state’s string of yearly migration losses. And when the state’s AGI losses are accumulated from 2000 to 2020, it totals $1.0 trillion in cumulative lost income that could have been taxed over the entire period.

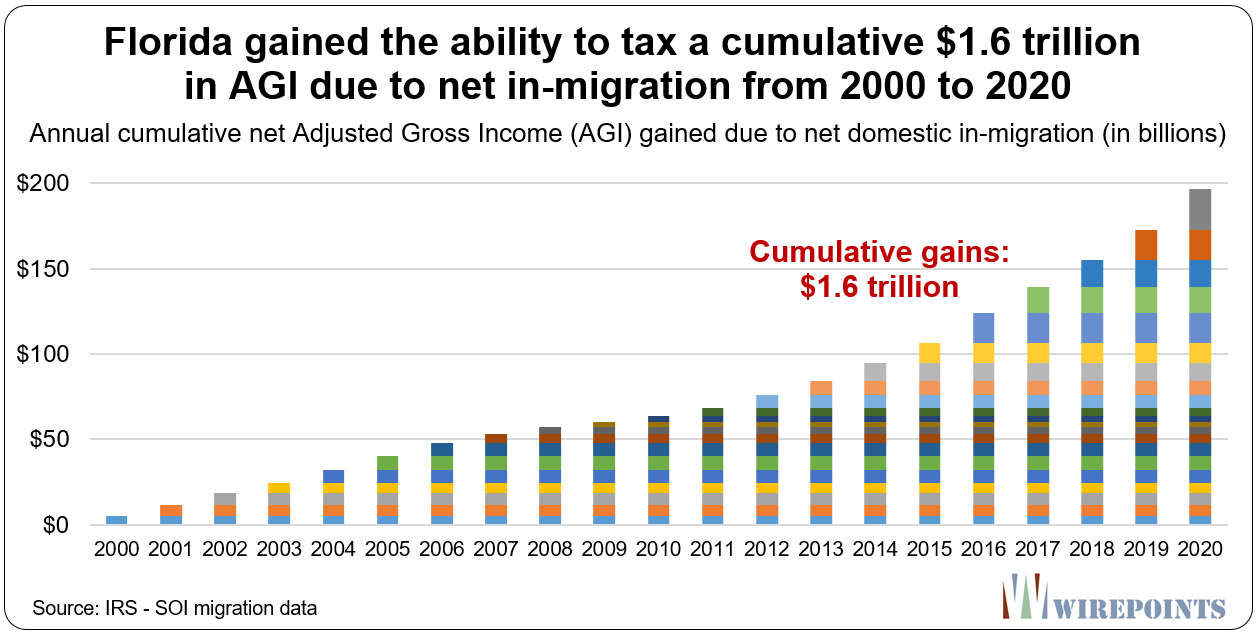

The opposite is true for migration winners like Florida. Gains in people and income pile on top of each other each year, building an ever-growing tax base. In 2020 alone, the state’s tax base was some $197 billion higher due to the 20-year string of positive income gains from net in-migration.

Even though Florida doesn’t tax incomes, Wirepoints also added up Florida’s cumulative AGI to make an apples-to-apples comparison with New York. When the Sunshine State’s AGI gains are accumulated from 2000 to 2020, it totals $1.6 trillion in income that could have been taxed over the entire period.

The competition for people matters

Illinois, one of the nation’s other big losers, shows just how damaging being an “exit” state can be – especially when a state starts to lose its wealthier residents and and they are only partially replaced by people who make less. The Illinoisans who fled in 2020 earned, on average, $30,600 more than the residents Illinois gained from other states. That’s the biggest gap since at least 2000, based on Wirepoints’ analysis of the IRS data.

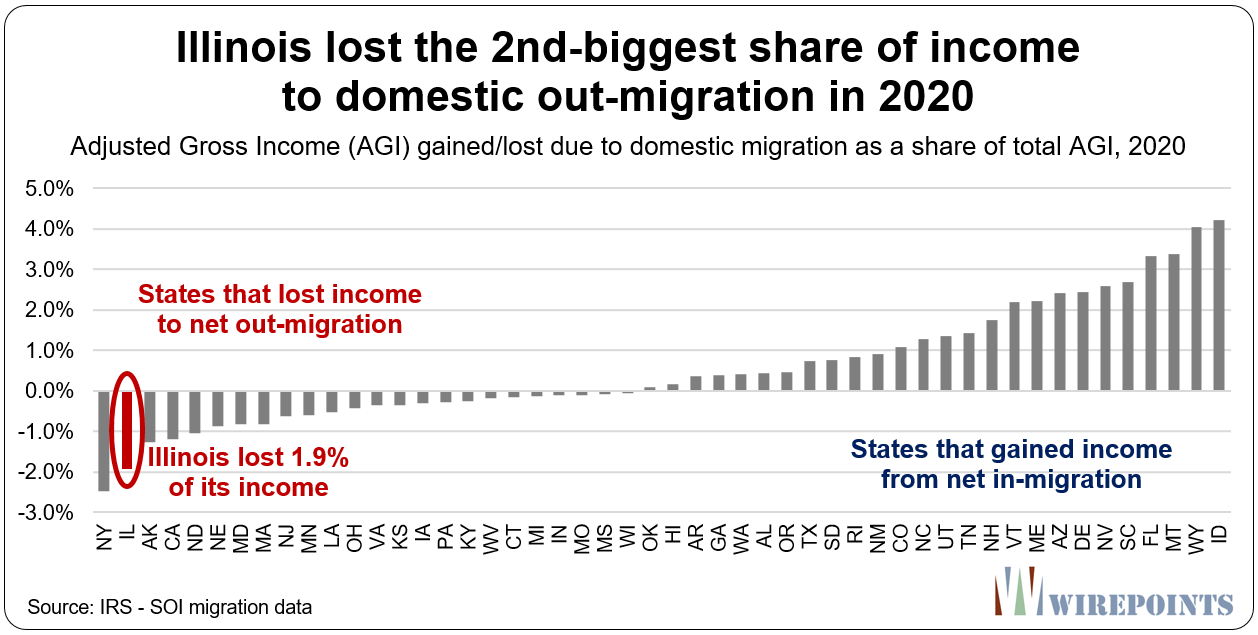

Based on a percentage of total income, Illinois ranked 2nd-worst nationally for income losses in 2020. Illinois lost 1.9 percent of its 2019 AGI. New York and Alaska ranked 1st and 3rd, with losses of 2.5 percent and 1.3 percent of their 2019 total incomes, respectively.

In contrast, Idaho was the nation’s big winner on a percentage basis in 2020, gaining 4.2 percent of its 2019 AGI base. The nation’s top five were rounded out by Wyoming, Montana, Florida and South Carolina.

Florida’s gains and Illinois’ losses are a clear reminder that states are constantly competing for people, businesses and a growing tax base.

The prize for winning is big, but the price for losing may be even bigger.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!