WSJ reports that millions of Americans with subpar low credit scores are falling behind on paying their credit cards and automobile and personal loans. This is an ominous sign the ‘strong consumer’ narrative is cracking.

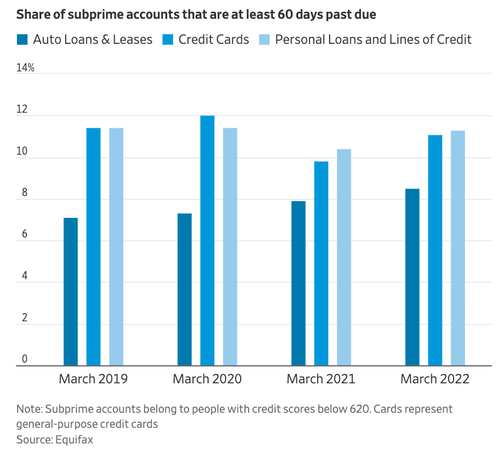

Data from credit-reporting firm Equifax Inc shows a rise in the share of 60-day delinquencies for subprime credit cards and personal loans. Those delinquencies hit an eight-month high in March, nearing levels not seen since before the virus pandemic.

Equifax’s data also showed subprime car loans and leases soared to a record-high in February. The data goes back to 2007.

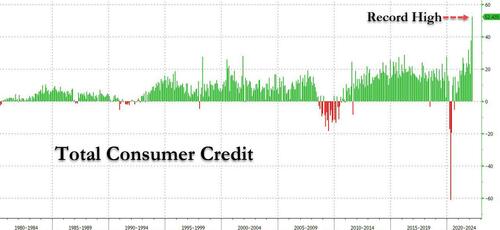

There’s new concern about the consumer’s health. A little over a week ago, the latest data from the Federal Reserve showed credit card debt in March had the largest increase on record at $52.4 billion.

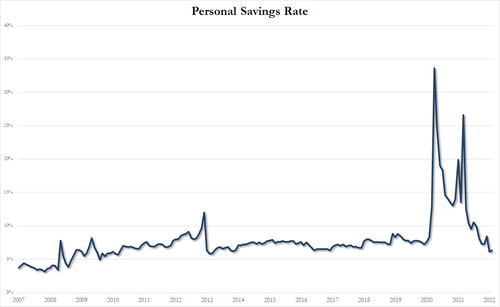

The historic credit-fueled purchases come as any “excess savings” consumers had during the pandemic have been entirely wiped out. Or viewed in another way: consumers are tapped out.

The basic narrative is straightforward: The Federal Reserve has been hell-bent on taming inflation and is embarking on the most aggressive monetary policy in decades, if not ever. In a tightening cycle, as interest rates soar, the first causalities are usually consumers with the weakest balance sheets, such as ones in the subprime complex. Compound monetary tightening with the highest inflation in four decades, and it’s not hard to see why consumers have been on a debt borrowing binge as they struggle to survive this bearish macro environment.

Self, a fintech startup, recently told Yahoo Finance Live about 108 million consumers have a low or no credit score. When credit conditions tighten, it becomes challenging for millions of Americans to obtain lifelines as lenders pull back.

In 2021, Equifax data showed that subprime lending hit record highs in total dollar amounts for personal loans. The easy money times of the pandemic have long been gone, and the credit crunch is just beginning.

About 11% of general-purpose credit cards with credit scores below 620 were at least 60 days behind one payment in March, up from 9.8% a year prior. Personal loans and lines of credit delinquencies were 11.3%, up from 10.4% a year prior. Car loan and lease delinquencies hit a record in February, with 8.8% of subprime accounts behind on payment by at least 60 days. It was down to 8.5% in March, though still the second-highest.

Lenders are saying the rising delinquencies in the subprime complex are part of the normalization of two years of artificially low levels.

“It would be an unnatural thing for credit to stay where it is,” Capital One Chief Executive Richard Fairbank said on the bank’s last earnings call. “We would expect this is an across-the-board kind of return toward normal over time.”

Capital One and lender Bread Financial Holdings reported higher credit card delinquency rates in the first quarter versus the prior year.

What’s happening is the consumers’ reliance on leverage over the last two years has come to an abrupt halt. The Fed is tightening financial conditions right into a consumer-driven recession that could start in the next five months or as late as the second half of 2023.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!