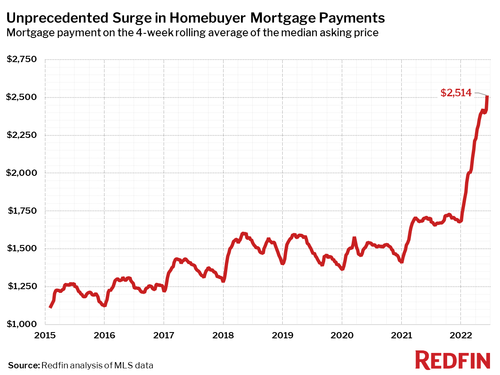

Fast forward to this week when things have gone from worse to catastrophic, because with 30Y mortgage rates soaring at the fastest pace on record to above 6%, or levels last seen just before the housing bubble burst…

…. sending the average mortgage payment on a median mortgage up by almost $800 in just the past 6 months…

making housing the most unaffordable in history…

… sending new home sales plunging at the fastest pace since the peak of the covid crisis after the longest negative streak since 2010…

… and homebuyer sentiment imploding to the lowest level in generations…

Which brings us to the latest housing market summaries from real-estate brokerage RedFin, which are not pretty.

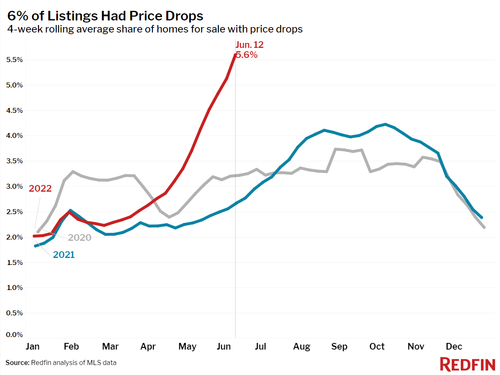

The first shows that after the period of unprecedented gains for home prices and a uniformlly sellers market, has flipped, and according to Redfin, the highest share of sellers on record dropped their list price during the four weeks ending June 12 as mortgage rates shot up to levels not seen since 2008, collapsing the pool of potential home shoppers.

In the Austin, Texas, and Nashville, Tennessee, metro areas, the share of new-construction offerings with price cuts has quadrupled from a year earlier, according to Redfin. They tripled in Phoenix and doubled in the Tampa, Florida, region.

“We are in a different place — the builder can no longer name a price and say, ‘pay it or move along,” said Nicole Freer, a Houston agent who has slashed prices by $2,000 to $20,000 on homes she lists for builders. “They’re telling us: ‘Our managers have allowed us to negotiate again.’”

Still, despite the clear cracks in housing, homebuying has never been more expensive. Due to delays in pricing, the typical buyer with a 30-year fixed-rate mortgage is looking at a monthly payment of $2,514, up from $1,692 a year ago!

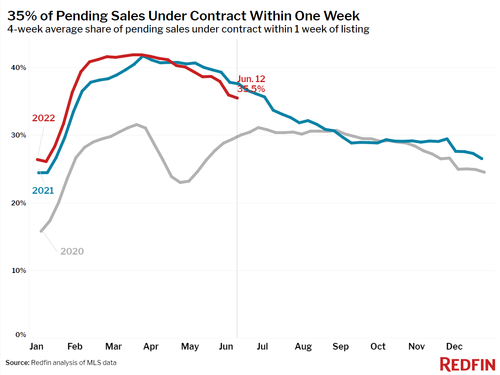

But those who remain in the market may notice they face less competition from other buyers.

Homes are more likely to sit on the market for a few weeks, compared to last year when they would go under contract within a week…

… and home prices are being bid up less often than they were earlier in the spring.

“The housing market isn’t crashing, but it is experiencing a hangover as it comes down from an unsustainable high,” said Redfin deputy chief economist Taylor Marr. “Housing demand has already cooled significantly to the point that the industry has begun facing layoffs. This week’s rate hikes will further stretch homebuyers’ budgets to the point that many more may be priced out. While a lot of home sellers are already dropping their prices, more homeowners will likely decide to stay put now that the mortgage rate on a new home is significantly higher than their current one.“

“If it weren’t for the surge in mortgage rates, the housing market would still be in a boom right now,” said Redfin Bay Area real estate agent James Cappello. “Demand from homebuyers was still extremely high as recently as February, but rates are making it really tough. Going from 3% to nearly 6% almost instantly has scared a lot of people out of the market.”

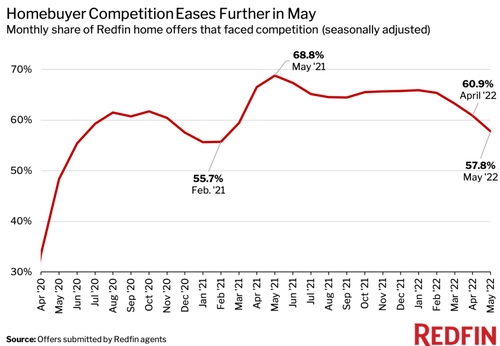

There’s more. In a subsequent report, Redfin reports that competition for existing inventory is collapsing with 57.8% of home offers written by Redfin agents facing competition on a seasonally adjusted basis in May, the lowest level since February 2021. That’s down sharply from a revised rate of 60.9% one month earlier and a pandemic peak of 68.8% one year earlier, and marks the fourth-consecutive monthly decline. On an unadjusted basis, May’s bidding-war rate was 60.8%, down from 67.8% in April and 71.8% in May 2021.

As a result of declining competition, the typical home in a bidding-war received 5.3 offers in May, down from 6.8 in April and 7.4 in May 2021.

“Homes are now getting one to three offers, compared with five to 10 two months ago and as many as 25 to 30 six months ago,” said Jennifer Bowers, a Redfin real estate agent in Nashville.

“Offers also aren’t coming in as high above the list price as before. I recently listed a three-bedroom, three-bathroom home in a super cute neighborhood for $399,900. It ended up going under contract for $12,000 above the list price with an inspection, whereas three months ago, the buyer probably would have paid $60,000 over asking and waived the inspection.”

In light of the above, it’s not surprising that today Bloomberg reports that “the fastest-rising mortgage rates in decades have cooled demand so abruptly in many hotspots that it took the industry by surprise. Builders that were artificially limiting sales and auctioning houses to the highest bidder now have inventory to move.”

It’s part of a rapid shift in the US housing market as the Federal Reserve sharply raises interest rates to tame inflation, sending home-loan costs to the highest level since 2008 and straining buyers whose affordability limits were already being tested. Just this week, brokerages Compass and Redfin said they would slash jobs, as economic data showed housing starts dropped to the lowest level in more than a year and homebuilder sentiment is at a two-year low while homebuyer sentiment is the lowest on record.

The market has certainly noticed the collapse in housing, and share prices for builders have collapse, with the Supercomposite Homebuilding Index tumbling 42% this year through yesterday, almost double the 23% drop in the S&P 500.

Builders, who last year had so much power that people would wait in line overnight for homes they would meter out, are now contending with both falling demand and high material and labor costs. And with the Fed signaling more big rate hikes in coming months, they’re eager to get contracts signed before house hunters pull back even more.

In Sarasota, Florida, would-be buyers are hesitating because homes are taking so long to build, and it’s impossible to know where borrowing costs will land by the time they’re completed, said Donnette Herring, a Realtor with Keller Williams.

“Inflation makes them nervous,” Herring said.

The signs of a shift are still early. Conditions vary from region to region and even between subdivisions, including many where demand still far outpaces supply. And rather than cutting prices, many builders are offering incentives such as free upgrades, money toward closing costs and subsidized mortgage rates. But the market is changing fast, said Ali Wolf, chief economist at Zonda. Her company, which tracks new construction, began hearing of price cuts toward the end of May and into June.

“The builders that are cutting prices are also those that raised prices the most over the past six to 12 months,” she said.

Many of those are in areas that were favored destinations for pandemic migrants who have been moving from pricey regions in search of cheaper homes and more space. In the Phoenix metropolitan area, 22% of new-home listings had price cuts from May 9 through June 5, up from 7% a year earlier, according to data from Redfin. In Tampa, the share jumped to 21% from 9% a year earlier, and in Austin, it climbed to 13% from just 3%.

The cuts have come from both small private builders and big public ones, including D.R. Horton, Meritage Homes and Lennar according to listings in Florida, Texas and Arizona publicly available on sites such as Redfin and Realtor.com. A PulteGroup website shows 146 finished homes in Arizona, mostly with price reductions. Jim Zeumer, vice president of investor relations, said those appeared to be typical incentives used to sell spec houses – those built without a buyer in place – that are complete or will be finished soon.

“We will typically have one or two finished specs in a community but use incentives to manage inventory levels over the life of a community,” Zeumer said.

During the recent boom, many builders were waiting until homes were nearing completion before allowing buyers to purchase them because of uncertainty around materials and labor costs. As a result, they have a flood of new homes that need to be matched up with buyers.

In the Houston region, it’s the fast-growing areas further from the city, such as Conroe to the north and Alvin to the south, that are cooling the most, said Freer, the local agent. Builders who were only selling homes that were almost done now are telling her that they’ll take orders for “dirt.”

Of her roughly 120 listings for builders, about 70% now have cuts, she said. Soon it will be 100%.

A key metric to watch is the contract cancellation rate, said Rick Palacios, research director at John Burns Real Estate Consulting in Irvine, California. It topped 9% nationally in May, according to his company’s survey of builders, up from 6.6% in April. That’s still short of the 16% pace after the pandemic lockdowns first took hold two years ago.

“The writing is on the wall that more supply is coming, no matter how you slice and dice the data,” Palacios said. “Builders are trying to get in front of that wave. We could have the double-whammy of the economy cooling and a lot of supply coming on. That’s not the best recipe to sell homes.”