Last year, I pointed out that the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, would NOT lead to a surge in foreclosures and impact house prices (as happened following the housing bubble). In September 2021, I wrote:

With house prices up sharply year-over-year – up 16.6% nationally in May according to Case-Shiller – very few borrowers will have negative equity, and most seriously delinquent borrowers will be able to sell their house, as a last resort, and avoid foreclosure.

So, although foreclosures will increase from the record low levels, it will take some time (probably in 2022), and there will not be a huge wave of foreclosures like following the housing bubble.

Some simple definitions (for housing):

Forbearance is the act of refraining from enforcing mortgage debt.

Delinquency is the failure to make mortgage payments on a timely basis.

Foreclosure is when the mortgage lender takes possession of the property after the mortgagor failed to make their payments. “In foreclosure” is the process of foreclosure.

REO (Real Estate Owned) is the amount of real estate owned by lenders.

Here is some data on REOs through Q1 2022 …

We will probably see an increase in REOs throughout 2022.

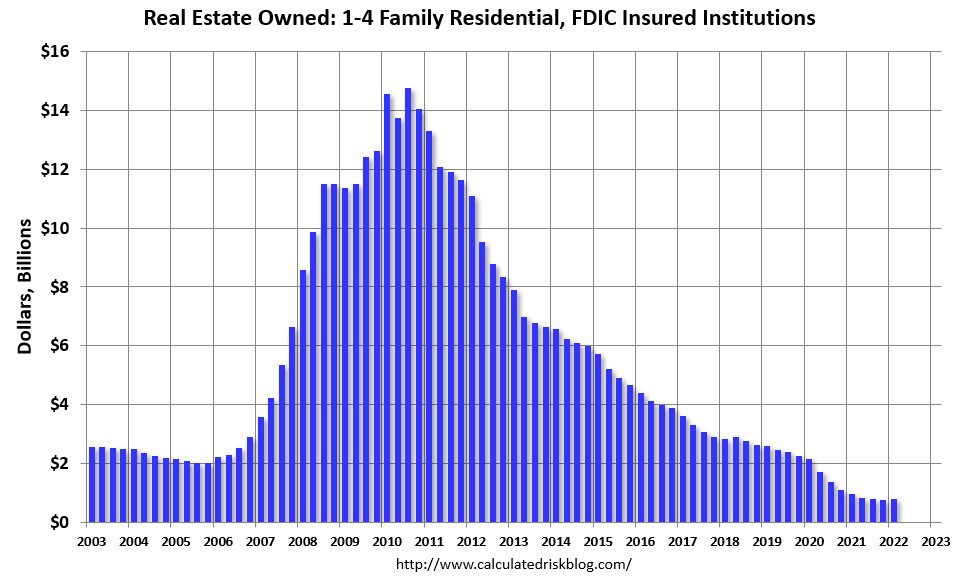

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased slightly from $779 million in Q4 2021 to $788 million in Q1 2022. (Probably declined in 2020 and 2021 due to foreclosure moratoriums, forbearance programs and house price increases).

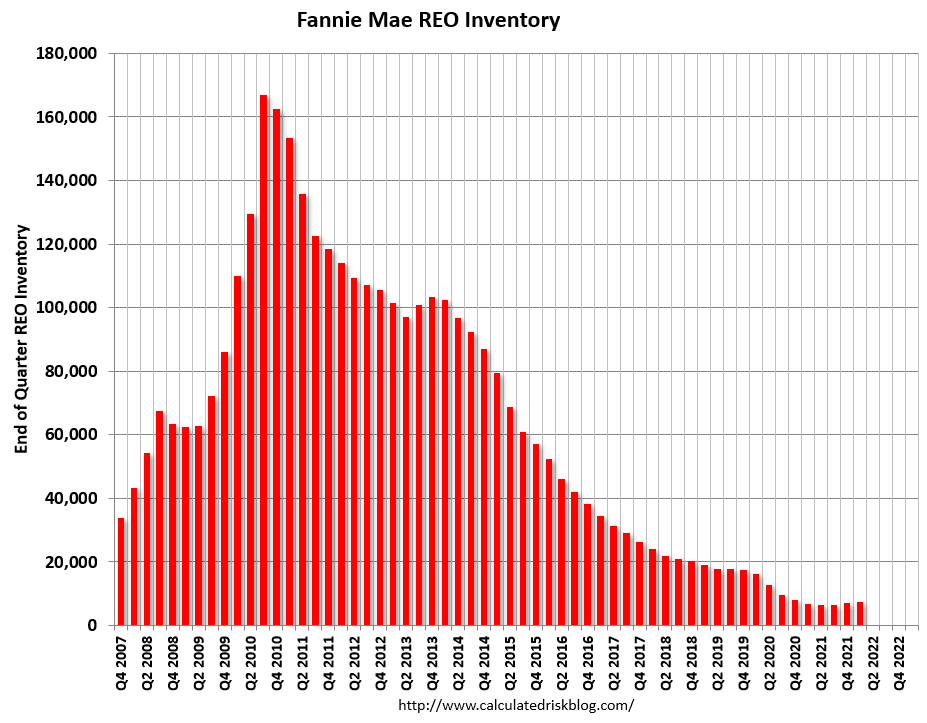

Fannie Mae reported the number of REO increased to 7,430 at the end of Q1 2022 compared to 6,918 at the end of Q1 2021.

Here is a graph of Fannie Real Estate Owned (REO). REO inventory increased in Q1 2022, and inventory is up 7% year-over-year.

Here is some data on delinquencies …

It is important to note that loans in forbearance are counted as delinquent in the various surveys, but not reported to the credit agencies.

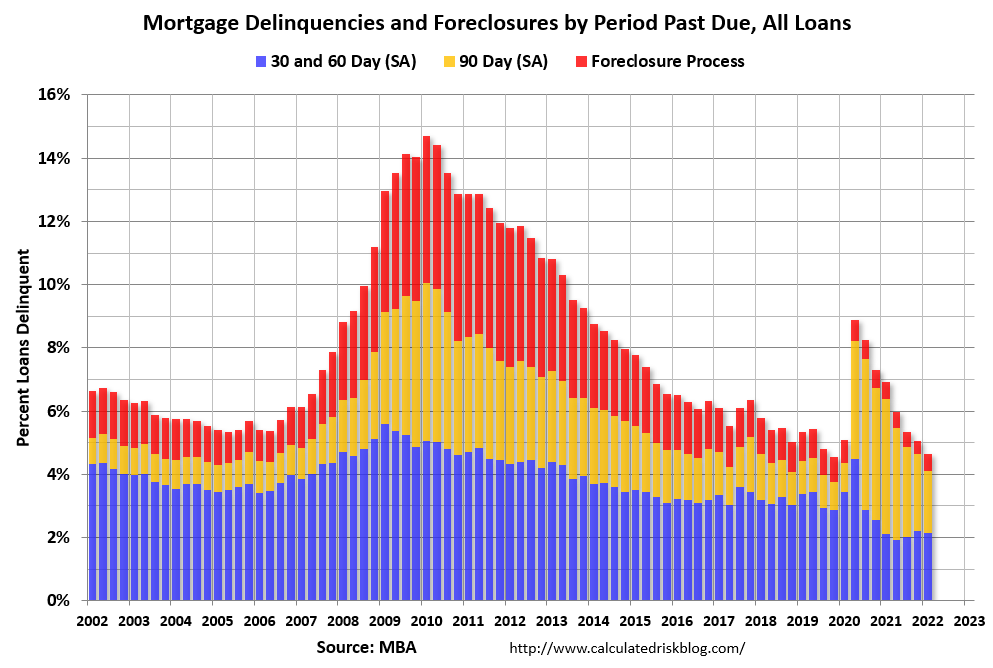

Here is a graph from the MBA’s National Delinquency Survey through Q1 2022.

Note The percent of loans in the foreclosure process increased in Q1 with the end of the foreclosure moratoriums. Loans in forbearance are mostly in the 90-day bucket at this point, and that is declining.

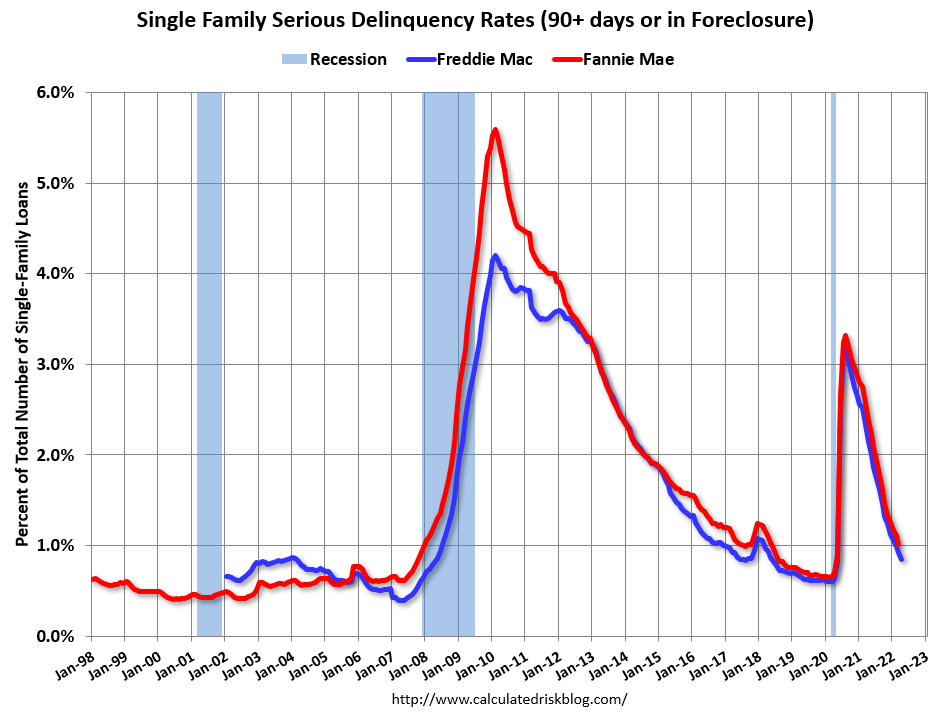

Both Fannie and Freddie release serious delinquency (90+ days) data monthly. Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.01% in March from 1.11% in February, and down from 2.58% a year ago.

Freddie Mac reported that the Single-Family serious delinquency rate in April was 0.85%, down from 0.92% March, and down from 2.15% in April 2021.

This graph shows the recent decline in serious delinquencies:

The pandemic related increase in serious delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes – and they will be able to restructure their loans once they are employed.

And on foreclosures …

Black Knight reported that active foreclosures have increased slightly, but foreclosure started declined in March. From Black Knight: Black Knight: As Home Affordability Nears All-Time Low Amid Spiking Interest Rates and Still-Rising Prices, Borrower Behavior and Preferred Products Changing

Despite still-elevated serious delinquency levels, foreclosure starts dropped nearly 12% from March and are holding well below pre-pandemic levels – though active foreclosures edged slightly higher

The bottom line is there will be an increase in foreclosures this year (from record low levels), but it will not be a huge wave of foreclosures as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!