Via Political Calculations blog

One month after setting a record low level for affordability, the unaffordability of new homes in the U.S. has skyrocketed.

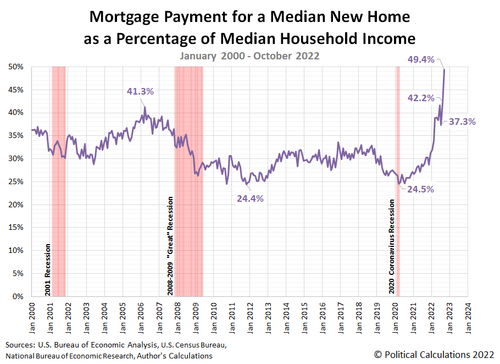

The mortgage payment for the median new home sold in the U.S. during October 2022 would now consume nearly half the monthly income of an American household earning the median income. The following chart illustrates that development.

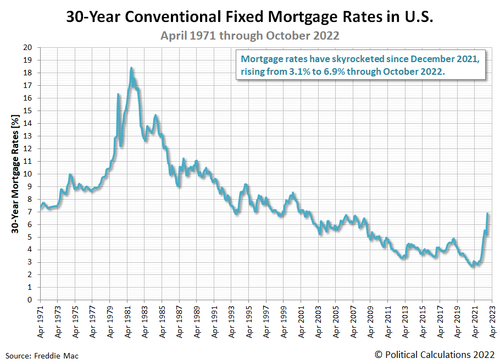

This negative change is primarily the consequence of rising mortgage rates, which have been pushed upward as the U.S. Federal Reserve has sought to make borrowing more expensive in its attempt to stall and reverse President Biden’s inflation in the U.S. economy. The next chart shows how mortgage rates have exploded during 2022 in response.

As mortgage rates have exploded, median new home prices have remained elevated, holding down their raw level of affordability with respect to median household income itself. The third chart confirms the raw affordability of new homes has hit a new low in that measure.

October 2022’s estimated median household income of $78,595 would only cover 17.06% of the sale price of the median new home sold during the month. New homes have never been less affordable for the typical American household.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!