Tl;dr: Headline and Core CPI printed ‘as expected’ (which is likely disappointing for the whisper numbers and remember the last CPI printed ‘cooler than expected’). Goods inflation continues to slow but Services inflation continues to soar (highest in over 40 years). Shelter costs continue to soar.

* * *

Expectations for this morning’s headline CPI ranges from +6.3% to +6.8% YoY, with consensus seeing a 0.1% decline MoM – something the world and his pet rabbit has bid stocks up into anticipating this as the signal for an about face by The Fed on their higher for longer narrative as it ‘proves’ inflation has peaked.

The headline print came in right as expected with a 0.1% decline MoM (leaving the YoY print at +6.5% as expected)…

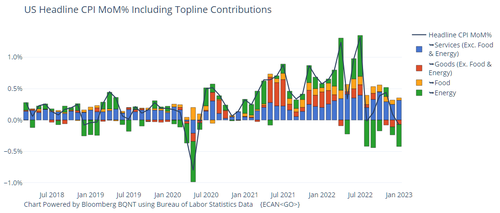

While Goods inflation tumbled to its lowest since Feb 2021, Services inflation soared to its highest since Sept 1982…

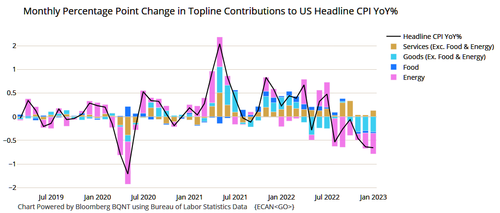

Energy was the biggest driver of the decline in the YoY print along wioth Goods costs (while Services continues to rise)…

Services and Food costs rose on a MoM basis…

With shelter still rising on a MoM basis…

Core CPI rose 0.3% MoM as expected, leaving the YoY rise at +5.7% – lowest since Dec 2021…

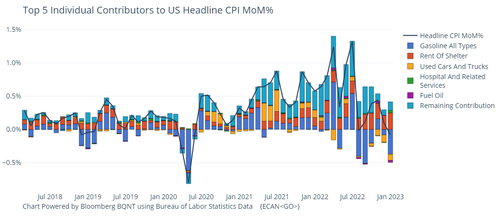

Shelter was biggest contributor to Core CPI 0.3% gain: the increase in the shelter index in December at 0.8% is biggest since 1990s.

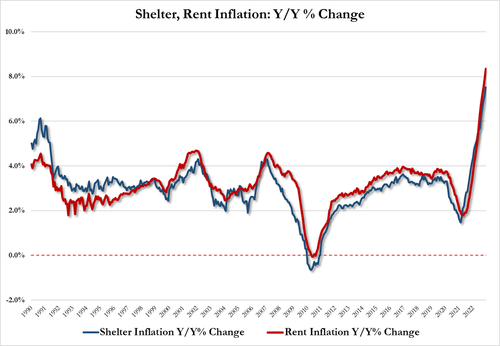

- Dec rent inflation 8.35%, Y/Y up from 7.91% in Nov

- Dec shelter inflation 7.51% up from 7.12% in Nov

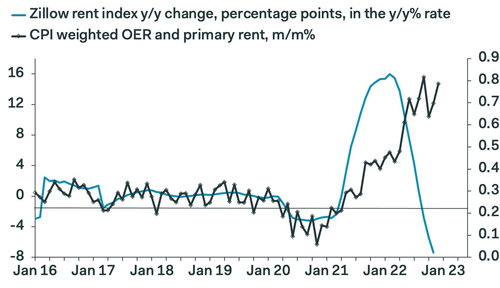

It is also about 12 months behind market reality, as Pantheon Macro notes:

“biggest contribution to the core was rents they account for the entire increase in the core owners equivalent rents up 0.79% biggest increase in the three months but it won’t last, given the steep drop in rents for new tenants recorded by Zillow and others“

Real average weekly earnings continue to decline – this is the 21st month in a row that Americans’

Finally, it appears CPI is tracking the decline in M2 velocity (with a lag) rather well…

It seems the ‘not cooler than expected’ CPI print is disappointing the pre-emptive market.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!