While the market’s volatility this week has been focused on UK pension funds and budgets and systemic risk, this morning’s US CPI print will likely determine the next leg from here with expectations for an acceleration in core inflation and small slowdown in headline growth of consumer prices.

Disappointingly, for the hopeful bulls, Headline and Core CPI printed hotter than expected.

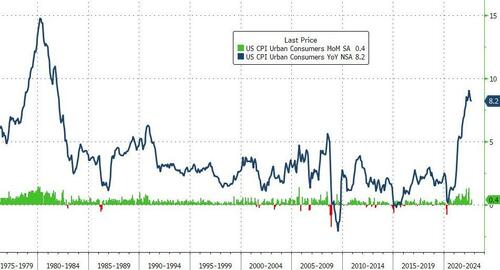

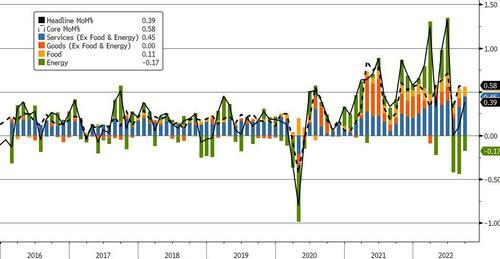

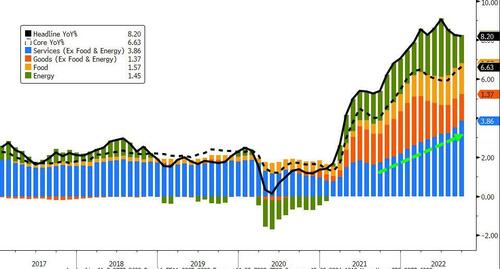

Headline CPI rose 0.4% MoM (double expectations) and up 8.2% YoY (hottere than the +8.1% exp)…

Core CPI is up 28 straight months, soaring to +6.6% YoY – the highest since August 1982…

Notably, the range of forecasts for core CPI was extremely narrow between +0.3% and +0.5% MoM.

Two words… “Not Transitory…”

INFLATION: President Biden says fears of persistent inflation are unwarranted, and that price increases will be temporary. pic.twitter.com/rGDwxWnJLf

— Forbes (@Forbes) July 19, 2021

Services inflation continues to rise as goods inflation slows…

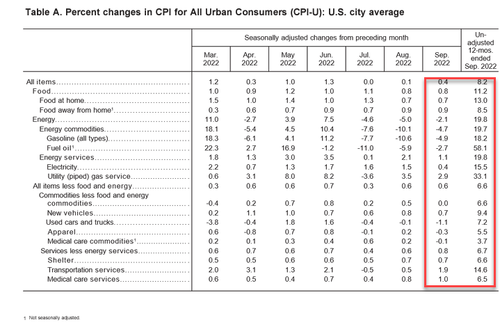

Under the hood food and shelter jumped notably (despite energy drops). A few indexes declined over the month, including the index for used cars and trucks, which fell 1.1 percent in September after decreasing 0.1 percent in August. The apparel index fell 0.3 percent over the month, and the communication index decreased 0.1 percent in September.

Food inflation remains extremely high…

The owners’ equivalent rent index also increased 0.8 percent over the month, the largest monthly increase in that index since June 1990.

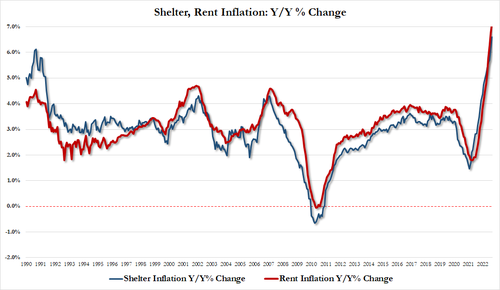

- Shelter inflation 6.59%, up from 6.24% last month and the highest on record.

- Rent inflation 7.21%, up from 6.74% last month, and the highest on record.

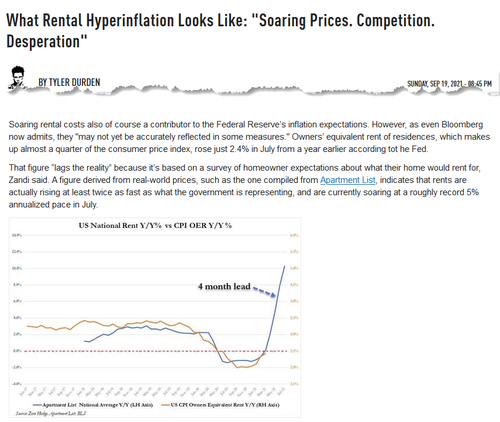

CPI says “shelter index also rose 6.6% Y/Y, accounting for over 40 percent of the total increase in all items ex food and energy.” This is because rent data flow through into CPI is 6-9 months delayed from the market, meanwhile real-time rent data now negative MoM.

As a reminder, the time to panic about soaring rent and its implications for CPI was a year ago…

Services dominated the rise MoM…

…and Services and Food really driving the YoY shift…

Sadly, real wages are lower for Americans for the 18th straight month…

Margin pressure continues…

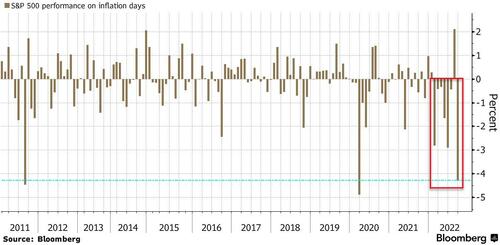

The market has been down 7 of the last 9 CPI days…

Finally, here’s JPMorgan’s guide to trading this print:

- CPI prints above 8.3% -> this will be another -5% day. The Sep 13 CPI print, when the whisper number was a miss but got a beat instead (8.3% vs. 8.1% consensus; 8.5% prior) triggered a 4.3% decline in the SPX as Credit outperformed.

- CPI prints 8.1% – 8.3% -> also a negative outcome, with SPX -1.5% – 2%, potentially characterized by a buyers strike. The bigger concern here, according to JPM, is the bond market repricing to increase the probability of a 75bps hike in December.

- CPI prints 7.9% – 8.0% -> this is likely enough to stage a rally, perhaps +75bps – 100bps. Currently, Bloomberg’s mash up of economic forecasts show 2022 Q4 averaging 7.2%, meaning that if we see an 8.0% print this week, then the next two prints need to average 6.9%.

- CPI prints below 7.9% -> should this come to fruition, JPM thinks a +2-3% day is most likely, though if we see CPI gap down more than 60bps (largest is the move from 9.1% to 8.5%) the move could be larger; then calls for a Fed pause/pivot may become deafening.

So, you know what to do…

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!