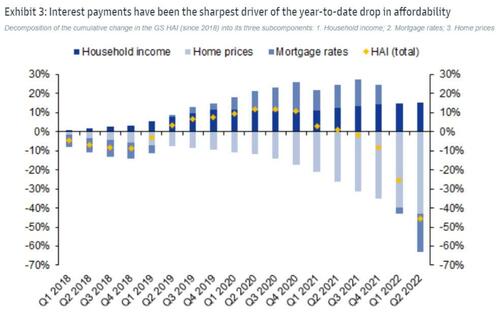

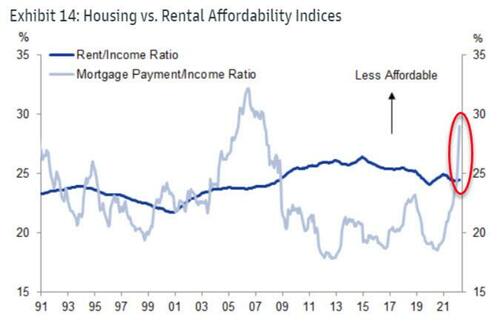

As mortgage rates (and home prices) have soared, rental affordability has held up better than mortgage affordability…

The housing market has cooled significantly in recent weeks as buyers have stepped back from the market. Sales of previously owned homes slid in May for the fourth straight month.

“I don’t know that we’ll ever see affordability again like we saw in the last year or two,” said Mark Fleming, chief economist at First American Financial Corp.

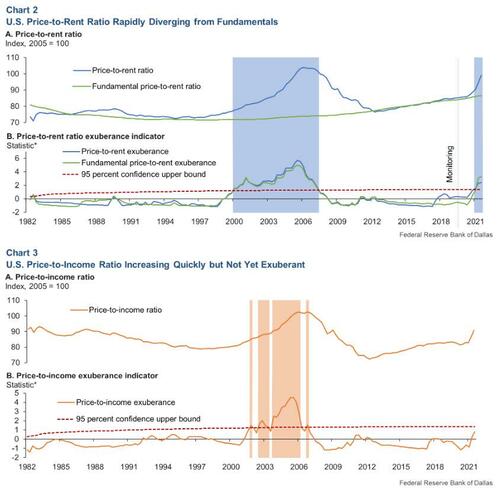

Even The Dallas Fed recently admitted that the US housing market is suffering “abnormal market behavior” for the first time since the boom of the early 2000s. They add to what Goldman says, citing clear reasons for concern in certain economic indicators – the price-to-rent ratio, in particular, and the price-to-income ratio – which show signs that house prices appear increasingly out of step with fundamentals.

While The Dallas Fed notes that historically low interest rates are a factor, they point out that rates do not fully explain housing market developments.

Other drivers have played a role, including pandemic-related U.S. fiscal stimulus programs and COVID-19-related supply-chain disruptions and associated policy responses.

The resulting fundamental-driven higher house prices may have fueled a fear-of-missing-out wave of exuberance involving new investors and more aggressive speculation among existing investors.

Last week saw mortgage rates fall significantly but “rates are still significantly higher than they were a year ago, which is why applications for home purchases and refinances remain depressed,” said Joel Kan, MBA’s associate vice president of Economic and Industry Forecasting.

“Purchase activity is hamstrung by ongoing affordability challenges and low inventory, and homeowners still have reduced incentive to apply for a refinance.”

Speaking to Fox Business, Redfin chief economist Daryl Fairweather pointed out that higher interest rates are pushing buyers away from the housing market, and sellers are unwilling to drop prices at present. But things could change once the economy begins to weaken.

“Rate movement depends on Federal Reserve policy and how the market anticipates that, so it makes forecasting incredibly difficult,” said Lien Kiefer, an economist at Freddie Mac.

“Given all the volatility in the market, it’s hard to say how rates will behave week to week. But the risks are kind of balanced – I don’t think they’ll move dramatically higher or lower.”

That means borrowers could see mortgage rates hover around 5% well into 2023.

Finally, Goldman expects affordability will linger at historically challenging levels through year-end.