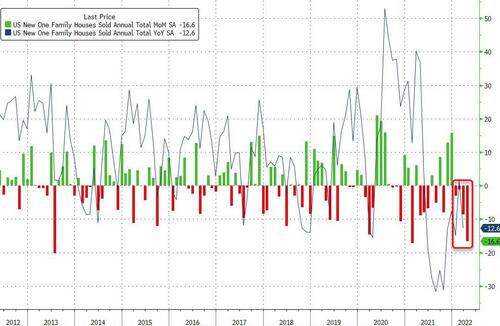

Following the unexpectedly large decline in existing home sales (directionally not unexpected given the surge in mortgage rates, plunge in mortgage apps, slump in homebuilder sentiment, drop in building permits, and weakening in labor market signals that are emerging), analysts expected new home sales to slide 1.8% MoM in April. They were right in direction but drastiucally wrong in magnitude – New Home Sales in April collapsed a stunning 16.6% MoM – that is the worst drop since the peak of the COVID crisis (and before that the taper tantrum in 2013)

This is the 4th straight month of new home sales declines – the longest streak since October 2010.

The new home sales SAAR dropped to 591k, the lowest since April 2020…

Source: Bloomberg

New home prices exploded higher, with the massive surge in the mean price relative to the median prices suggesting the mix shift is increasingly skewed to the higher end homes selling.

Home ownership is becoming increasingly out of reach for many Americans, as a rapid run-up in mortgage rates compounds the effects of limited inventory and record prices. The average rate on a 30-year mortgage was 5.25% last week, up from around 3% at the end of 2021, Freddie Mac data show.

But the silver lining for some is the fact that the number of houses for sale in April rose 8.3% m/m to 444,000, leaving the months’ supply at 9.0 in April compared to 6.9 prior month.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!