Housing Start(ing) to Recover

Privately owned housing starts in February came in at a seasonally adjusted annual rate of 1,450,000. This is 9.8 percent above the revised January estimate of 1,321,000, a much bigger jump than the expected 0.1 percent increase.

This suggests an increase in confidence among home builders. Yesterday, the monthly survey of homebuilder sentiment from the National Association of Home Buildings showed improved sentiment for the third month in a row. But the upside surprise in starts indicates that sentiment is even stronger than the survey suggests.

To put this in perspective, starts are still down tremendously from a year ago. February was the last full month before the Fed began hiking rates and starts are down 18.4 percent in the 12 months since. A year ago, of course, mortgage rates were much lower. In mid-February, the average 30-year fixed rate was 3.92 percent. Today, it is 6.6 percent, down a bit from recent highs thanks to banking sector turmoil leading to lower expectations for the fed funds rate.

The big driver in the increase was in multifamily starts, which rose 24 percent to 620,000. The multifamily sector tends to be less interest rate sensitive than the single-family sector. Still, single-family starts showed a better-than-expected improvement, rising 1.1 percent to an 830,000 annual rate.

If the Fed were not so distracted by the ongoing run on regional banks, this nascent recovery in housing might be a cause for concern. It suggests that the Federal Reserve’s interest rate hikes are not as much of a drag as they were last year, which in turn suggests that the Fed has a lot more work to do if it wants to keep monetary policy restrictive for a prolonged period to bring down inflation.

Permissive Outlook

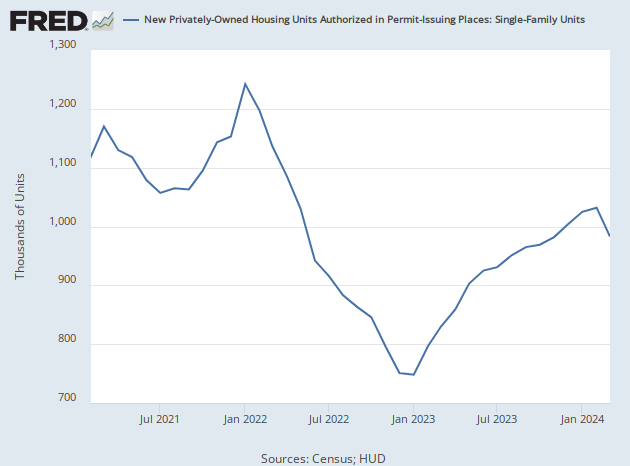

The permits side of the February report also indicated a rebound. New private housing unit authorizations were up a sharp 13.8 percent in February after being near flat in the prior two months. Single-family permits rose for the first time in a year, jumping 7.6 percent to 777,000.

Single-family permits are a reliable economic indicator. They are not typically subject to big revisions. They are accurately measured. And most importantly, they tend to be a reliable indicator of construction spending, employment, and the direction of the housing market.

One month’s increase does not equal a trend, but it does suggest that perhaps housing has found a bottom. If permits continue to rise, that would suggest both that financial conditions have effectively loosened and that the housing market was staging a recovery.

The Yield Curve Is Still Inverted Only Less So

Last week, the yield curve reached a record level of inversion after adjusting for interest rate levels. The difference between two-year and 10-year Treasuries fell to negative 110 basis points following Powell’s hawkish testimony on Capitol Hill. Although it is tempting to say it was Powell’s words that were responsible, the inversion was already plunging following hotter than expected employment and job openings reports.

The yield curve has inverted prior to every modern recession. While that makes the yield curve a leading indicator, the lead time between inversion and recession is highly variable. According to Joe Lavorgna at SMBC, the shortest time from inversion to recession is eight months and the longest time is 22 months, with a mean of 13 months.

Since the curve inverted in July of last year, that means we would expect on average the recession to start in August.

This week, however, the yield curve retraced a big part of the inversion. At minus 42 basis points, the curve is now less inverted than any time since last October. That’s largely because the yield on the two-year Treasury has plunged at a record pace on the expectation that the Fed will pivot away from hiking interest rates due to financial disorder in the wake of the failure of Silicon Valley Bank.

The latest odds from the CME Group’s FedWatch tool have the chance of an outright pause at next week’s Fed meeting at just under 20 percent, a big decline from 45 percent a day earlier. That seems about right to us. The Fed probably should not halt rate hikes altogether because that risks reigniting inflation when it is already running high. But if Friday brings more bank failures, the outlook could change dramatically.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!