Money is such an interesting topic. It really is the lifeblood of human society. It’s the repository of human production and the means by which value is exchanged. Money does in fact make the world go ’round.

For real estate investors, and really any other investor, business owner or laborer, productivity, cash flows and net worth are all denominated in some form of money.

For real estate investors, and really any other investor, business owner or laborer, productivity, cash flows and net worth are all denominated in some form of money.

Of course, over history and around the world, money takes different forms. And depending on when and where you’re from, you look at money through a specific paradigm.

For 70 years, the U.S. dollar has been the world’s reserve currency. As such, the dollar has become the universally accepted unit of value through which virtually everyone around the world engages in commerce.

You may be able to do business at the street level with local currency, but when big corporations or governments do business, it almost always goes through U.S. banks and U.S. dollars. And it’s been a powerful source of U.S. hegemony (influence over other countries) for decades.

But many people believe the dollar’s reign as the dominate currency may be coming to an end. Even if it doesn’t, technology, global power shifts, and modern monetary theory are all affecting the dollar’s value and utility.

And because the production and accumulation of money is the main purpose behind most real estate investors daily activities, we thought it would be a good idea to talk about the future of money.

Enriching the conversation about currency, coins and crypto-currency:

- Your on-the-money host, Robert Helms

- His-cryptic co-host, Russell Gray

- Billionaire businessman, political pundit and best selling author, Steve Forbes

- Currency fund manager, Axel Merk

- Precious metals expert and entrepreneur, Anthem Blanchard

When you have billions of dollars, we’re guessing you pay close attention to their value. So when billionaire Steve Forbes puts out a book called Money – How the Destruction of the Dollar Threatens the Global Economy and What We Can Do About It, we’re interested in hearing what he has to say.

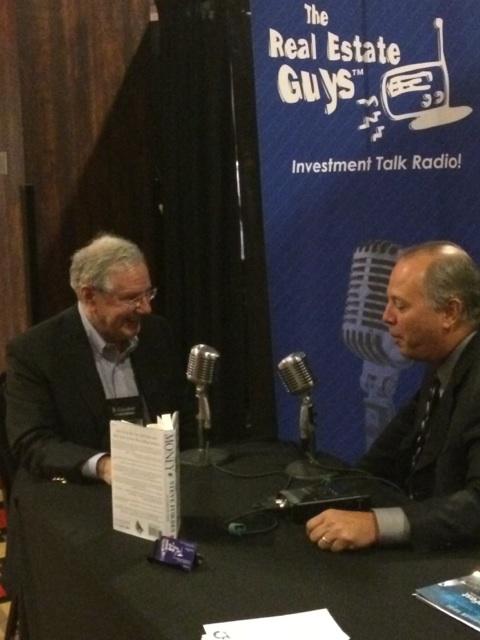

Fortunately, Steve was kind enough to sit down with us to talk about it, so we turned on the microphones so you could listen in.

Fortunately, Steve was kind enough to sit down with us to talk about it, so we turned on the microphones so you could listen in.

The short of it is that an unstable dollar means an unstable economy. The analogy Steve uses is time.

Consider what your calendar planning would look like if each day you woke up, the number of seconds in each minute was being changed. Some days there are 60 seconds in a minute. Other days, there are 75 seconds. Sometimes there are only 45 seconds.

When you start calculating the value of hours, days, weeks and months using these floating value minutes, you can imagine how confusing and chaotic your schedule would be.

You’d probably miss more than a few appointments because you’d invariably end up in the wrong place at the wrong time.

It’s not hard to see that when the dollar’s value is constantly shifting, investors and businesspeople invariably end up with money in the wrong place at the wrong time.

Austrian school economists call this a misallocation of capital or a malinvestment. Later, when adjustments are being made to realign monetary values with real values, this misplaced capital is revealed. And it’s usually a painful “correction”. Can you say 1929, 1987 or 2008?

Sadly, lots of people are wiped out when these events occur. Then politicians get angry and slap more regulations on business and investing. And central banks print more money to paper over the losses and reduce the pain. Everyone feels good for a moment because they feel like something is being done.

But history tells us it doesn’t work. In fact, history says it makes it worse.

Why?

Because the REAL problem was never addressed. The real problem is unsound money. Unsound money is inherently unstable, and leaves investors and businesspeople guessing about values and risk. A case in point is the 2008 real estate crash.

The post mortem on the 2008 crash reveals that the gobs of cheap money created to paper over the dual whammy of the tech bust and 9/11 attacks ended up fueling a bond bubble that blew up.

It’s a big topic, but worthy of short review. After all, what’s the point of riding this next wave of rising real estate prices only to get slapped down hard in a few year because you weren’t paying attention?

So all the cheap money pumped into the system in 2001 needed a home and Wall Street began creating investments. They started by packaging up loans (mortgage backed securities) and selling them as assets to investors. It satisfied some demand, but it wasn’t enough.

So Wall Street needed to make more loans and started lending to people who really couldn’t afford to pay back.

But because it was a pump and dump operation, Wall Street buried the sub-prime loans inside big pools, then sliced the pools up and sold them off in pieces so no one could really see what was inside.

But because it was a pump and dump operation, Wall Street buried the sub-prime loans inside big pools, then sliced the pools up and sold them off in pieces so no one could really see what was inside.

It was like pulling the pin on a hand grenade. You know it’s going to be ugly, but you know you can toss it to the next guy before it blows up.

These mortgage backed securities (MBS) sold like hot cakes. Remember, there was all kinds of cheap money in the market and it needed a home. But when there weren’t enough real borrowers, qualified or not, Wall Street needed to create more investments to sell anyway…so they came up with derivatives.

Think of derivatives like clones of the original.

Derivatives look real, but there’s no actual borrower or property. The “investment” is just a contract that says this piece of paper will be worth the same as the original piece of paper (the one with the real borrower and property attached). This concept of creating “assets” out of nothing is a common theme in modern day finance…right down to the greenback in your wallet…

And as long as everyone believes the clone is just as good the original, AND the original borrower pays so the original paper performs, no one knows that it’s all just a big fraud. Really, it’s no different than a common Ponzi scheme. It all seems okay until you run out of suckers.

Of course, we all know what happened. Joe Sub-Prime couldn’t handle the interest rate increase two years into the loan. By then the originator of the bad loans had long since sold them and moved on. And when Joe Sub-Prime defaulted, the original paper and ALL the derivatives indexed to it went bad. In other words, the whole house of cards collapsed. It was a financial train wreck of epic proportions.

It all happened because of unsound money.

You see, unsound money can be conjured out of this air. It’s like having a credit card with no limit. There isn’t anything to stop a constant expansion of money…at any pace.

You see, unsound money can be conjured out of this air. It’s like having a credit card with no limit. There isn’t anything to stop a constant expansion of money…at any pace.

And just like 2002-2007, it’s all great…right until it isn’t.

Sound money on the other hand, CANNOT be conjured out of thin air. It must be backed by something real, which is limited in supply. Which means that the price of it (interest rates) reacts to supply and demand.

And when too much money is being used, it gets more expensive. This regulates how quickly money can be metered into the economy.

Obviously, it’s a big topic.

Steve Forbes is calling for a gold-backed dollar. At least partially. His point is that the dollar needs to be stabilized or the world is not going to continue to use it as the reserve currency.

THAT would be a BIG PROBLEM for U.S. dollar holders. And it’s something we’re paying VERY close attention to.

Which bring us to Axel Merk…

Axel is an expert on currencies. He manages funds which trade in currencies. This means he pays attention to the relative strength of things like dollars, yen, euro, yuan, etc.

Axel is an expert on currencies. He manages funds which trade in currencies. This means he pays attention to the relative strength of things like dollars, yen, euro, yuan, etc.

He also pays attention to gold…something that we’ve been following closely for quite some time.

If and until Steve Forbes gets his way or someone creates a gold-backed currency, all currencies worldwide are essentially fiat.

Fiat currencies have value because the issuing government say they do. These are called legal tender laws.

This means that a piece of paper (or digits on your bank statement) can be used to pay taxes and any public or private debts. As long as you can settle these items with otherwise worthless pieces of paper, the paper has value in society.

Side bar (as though this blog isn’t already along enough)…

Think about this for a moment: When a currency is stable (or has the widely accepted illusion of stability) then all sellers and workers in a given economy will probably accept it. At the very least it can be used to pay their debt and taxes.

When a currency’s value begins to fall, initially seller’s and workers will continue to take it, but they quickly seek to spend it on something real like food, clothing, furniture, equipment…anything tangible that has inherent utility. They only keep enough currency on hand to pay taxes and debt. Go look at the historical record of any of the many currency collapses from the Weimar Republic to Zimbabwe and Argentina. It’s a movie with a very predictable script.

But if legal tender laws require that this now abundant, albeit practically worthless, currency must be accepted for payment of taxes and debt, wouldn’t it be wise in the face of a falling currency to defer taxes as long as possible and borrow as much as possible to buy tangible items today?

Then later, when the currency is abundant, you can offer the taxman and creditor your piles of paper and they are compelled by law to accept them…even though they aren’t worth much at all in terms of purchasing power.

In effect, debt today (like long term fixed rate mortgages on real estate) is a very powerful way to effectively short a falling dollar. It’s certainly something to think about if the dollar continues its steady decline.

So as you can see, and as we previously discussed and Steve Forbes contends, that unsound money, no matter who issues it, it problematic for investors and businesspeople. It makes every financial transaction, especially those of long duration (like real estate or starting a business) a much more complicated process.

Axel and his firm spend time watching the rate at which each currency is declining as compared to another, and then they trade currencies in an attempt to be in the right side of move.

In his best-selling book, Currency Wars, James Rickards talks about a race to the bottom. This is where all currency issues are expanding currency supplies (causing their values to drop) in an attempt to make other currencies stronger by comparison.

In his best-selling book, Currency Wars, James Rickards talks about a race to the bottom. This is where all currency issues are expanding currency supplies (causing their values to drop) in an attempt to make other currencies stronger by comparison.

This means the stronger currency can buy more exports from the lower currency. And since everyone wants to increase their exports, they cheapen their money. Yes, it’s twisted, but that’s the way of the world right now.

Think of it this way. If two currencies are falling, but one is falling fasten than the other, then the one that is falling slower, is “stronger”.

For example, if a dollar falls 10% and the Euro falls 20%, the dollar actually increased relative to the Euro.

$1.00 less 10% is 90 cents.

€1.00 less 20% is 80 cents.

90 cents is worth 10 cents more than 80 cents. And 10 cents is 12.5 percent of 80 cents. So the 90 cent “dollar” (which started out as 100 cents) is worth 12.5% more than the Euro. That is, the dollar rose against the Euro.

But is the dollar really stronger?

Confused? That’s Steve Forbes’ point and why guys like Axel Merk manage currency portfolios for their clients.

So what does ANY of this have to do with real estate?

Well, it’s no secret that the Fed has been trashing the dollar for quite a while and especially the last 5 years.

This has made other currencies relatively stronger, so foreigners have been buying up dollar denominated assets…like real estate. In fact, in some markets foreign buyers are coming in for cash and buying up to 30% or more of all available properties.

If you’re in one of those markets, then these people are bidding up prices, gobbling up inventory and, in the case of single family homes, pricing out U.S. home buyers. That’s one of the reason why home prices rise even though the U.S. job market and wages remain weak.

So yes, all this matters to you.

Of course, even though he believes in capitalism and free markets, Steve Forbes is advocating for a political solution. He wants the policy to be that the dollar is backed by gold…at least partially. His argument is that a sound dollar will unleash business and investment by bringing stability to the entire process.

Sounds good. But what do we do until then?

Enter Anthem Blanchard. Like Steve Forbes, Anthem is a returning guest to The Real Estate Guys™ radio show. He runs Anthem Vault which is a technology driven physical gold (and other precious metals) dealer and storage facility. And Anthem just came out with something which we find VERY interesting.

Perhaps you’ve heard of Bitcoin, which is arguably the biggest and best known of the crypto-currencies…

Bitcoin is interesting on a couple of levels.

Bitcoin is interesting on a couple of levels.

First, the very fact that the market has embraced Bitcoin is a sign of falling confidence in the dollar.

After all, with today’s technology, electronic payments have been ubiquitous for years. So Bitcoin didn’t catch on because it was easier than writing a check or handing over pieces of paper.

The market is apparently eager to find some alternative to the dollar.

Second, Bitcoin, like every other crypto-currency up until now, isn’t backed by anything. The coins are “mined” when computers produce this long strands of code on the back-end of an arduous computing process.

The idea is that even though they aren’t backed by anything tangible, Bitcoins can’t simply be fabricated with a few computer entries like dollars can (as former Fed Chair Ben Bernanke so famously boasted on national television).

So Bitcoins are allegedly limited in supply. Therefore as demand grows, the price rices.

We’re not here to slam Bitcoins, though we certainly aren’t fans of any kind of currency that isn’t backed by something real.

Our point is that the market place clearly wants an alternative to the dollar that is convenient to use and removed from the political pressures to crash its value.

Steve Forbes says a gold-backed dollar is the answer.

Others say crypto-currency like Bitcoin is the answer.

But what if you could combine the two? How about a gold backed crypto-currency?

Now THAT is an interesting concept.

And that’s exactly what Anthem Vault has created. Maybe it’s just us, but we think it’s going to be a big deal.

All this to say (and thanks for reading this far), that the future of money is changing and it’s something every real estate investor should be paying attention to.

So listen in as Steve Forbes, Axel Merk and Anthem Blanchard share their perspectives on the future of money, metals and crypto-currency.

Listen now:

- Don’t miss an episode of The Real Estate Guys™ radio show! Subscribe to the free podcast!

- Stay connected with The Real Estate Guys™ on Facebook!

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training and resources that help real estate investors succeed.