If you earn, save, borrow, invest, or denominate wealth in dollars, this CNBC headline might concern you:

Why Being Long the Dollar is “Very Very Dangerous Right Now”

Comments from readers showed people were confused …

“Why being long the US dollar is ‘very very dangerous’ right now” … what the hell does that mean?”

“1st prize for ambiguous headline”

This commenter feels trapped …

“All Americans are long on the Dollar. There is no other place to be right now.”

As we often say, mainstream financial news and its readers tend not to understand real estate investing. Conversely, many real estate investors get confused by mainstream commentary.

So let’s break this down for real estate investors …

Being “long” just means you own it. If you’re long a stock, you own it for the long haul. You think its future is bright.

Being “short” means you’ve sold it. With stocks, “short selling” is borrowing a stock you don’t own to sell at today’s price.

You’re betting the stock will go down, so you can buy it back cheaper later to pay back the broker you borrowed it from.

It may seem weird to sell something you don’t own. But it’s not any weirder than spending money you don’t have. People do that all the time.

So “long” the dollar is holding cash or dollar denominated bonds. Being a bond holder is basically the same as being a lender. You lend dollars and accept dollars in repayment.

Borrowing is being short the dollar. You’d rather “sell” (i.e., spend or invest) dollars today at today’s value … and then pay back later with cheaper (inflated) dollars.

So if you think the dollar will get stronger over time, you’d pay off debt and save cash.

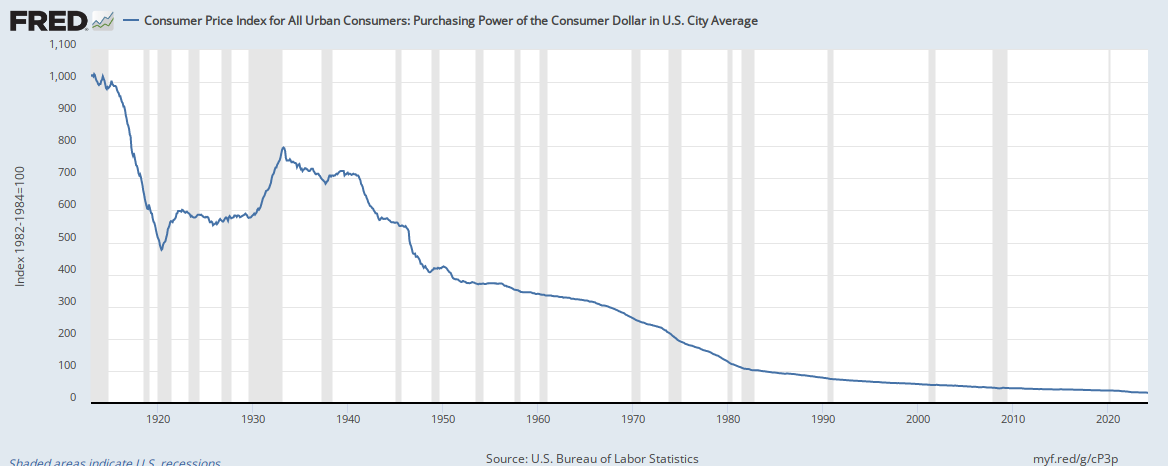

This chart might influence your opinion:

Source: https://fred.stlouisfed.org/series/CUUR0000SA0R

If you think the dollar will continue it’s 104-year slide, you’d “short” the dollar … by borrowing and converting dollars into real assets.

The author of the subject article is clearly bearish on the dollar. He thinks it’s “very, very dangerous” to be long the dollar.

So the commenters who complain the headline is ambiguous or confusing simply don’t understand history … or the concepts of long and short.

And the comment that “all Americans are long the dollar” and “there’s no place else to be right now” isn’t accurate either.

Real estate can be a great way to short the dollar.

Using a purchase or cash-out mortgage, you can leverage the income from a rental property to borrow (short) dollars with a mortgage.

Just pay attention to cash flow and the spread.

If you can borrow money at 5% and buy a property cash flowing at 8%, you’re earning a 3% spread on the borrowed money. Nice.

For liquid savings, you can use other currencies, precious metals, Bitcoin, or other highly liquid dollar alternatives. You don’t need to save dollars just because you earn them.

Real estate is also awesome because you can “straddle” … basically going long and short at the same time.

To straddle using real estate, you’d use a cash out mortgage (debt) to short the dollar.

Let’s say it costs you 6%, which would be deductible in most cases (check with your tax pro). So your net cost might only be 4%.

You can go long the dollar by lending the loan proceeds against a high equity property at 9%.

Now, you’re long and short equal amounts at the same time. You’ve got a positive spread (9% income against 4-6% expense) and positive cash flow.

Plus, the loan you made is backed by a property you’d be happy to own if the borrower defaults. High equity and good cash flow. If there’s not, you shouldn’t have made the loan to start with.

Now, you’re prepared for a strong or falling dollar.

Think about it.

If the dollar falls (inflation), you’re in good shape.

Inflation causes real assets and income, like real estate and rents, to go up in dollar terms. Meanwhile, your debt and debt service remains fixed. You win.

Meanwhile, even though you’re long the dollar with the loan you made, the cost of the funds (your debt) is fixed. So you’re fixed on both sides. You’re even. And with a positive spread, you win.

Plus, inflation causes the property you loaned against and the income it produces to go up in dollar terms. So the loan you made is safer because the collateral got better. You win.

But what if the dollar gets strong?

First, let’s define “strong.”

There’s “strong” compared to other currencies, like what’s been happening over the last few years. That’s very different than “strong” in terms of purchasing power and against real assets.

The former is relative strength. The latter is REAL strength.

Recently, the dollar has gotten strong relative to other currencies. Yet real estate and rents both went up. A relatively strong dollar didn’t hurt real estate.

It would take REAL dollar strength to push down the dollar-denominated price of real estate and wages. That’s REAL deflation.

MAYBE that could happen. But imagine the reaction of the Fed, the politicians, the banks, and the voters, to falling real estate prices and wages.

You don’t have to imagine. We all know… because it’s what happened in 2008. They pulled out ALL the stops to reflate everything. They had to.

That’s because the banks hold trillions in debt, and the federal government owes trillions. Inflation serves them both best. They’re scared to death of deflation.

That’s because banks need property values to hold or increase … otherwise, upside down borrowers walk. Banks fear holding non-performing loans against negative equity properties.

And no one’s more motivated to pay back cheaper dollars than the world’s biggest debtor, Uncle Sam. Debtors LOVE inflation. It makes their debt easier to pay.

So … the long and the short of the dollar is it’s that it’s probably better to be short for the long haul. And nothing lets you do that better than leveraged income producing real estate.

Until next time … good investing!

More From The Real Estate Guys™…

- Sign up for The Real Estate Guys™ Free Newsletter and visit our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android!

- Stay connected with The Real Estate Guys™ on Facebook and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training and resources to help real estate investors succeed.