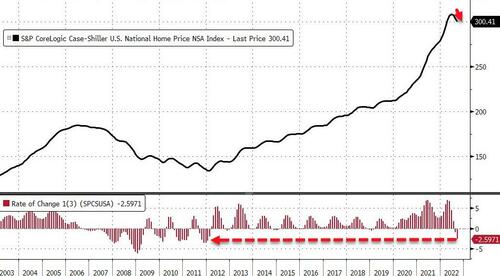

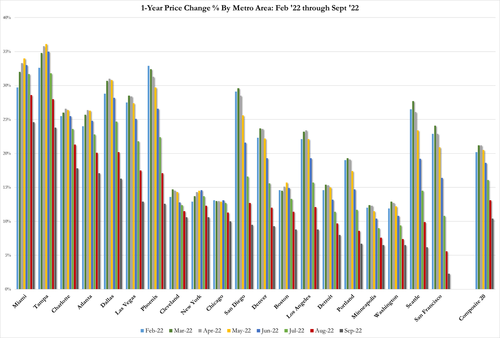

After tumbling for the first time since 2012 in July, Case-Shiller’s 20-City Composite Home Price index was expected to drop for the third straight month in September (the latest data available) as mortgage rates soared, crushing affordability; and it did, with the 20-City Composite down 1.24% MoM (as the YoY rise slowed from 13.06% to 10.43%)…

“As has been the case for the past several months, our September 2022 report reflects short-term declines and medium-term deceleration in housing prices across the U.S.,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

This three-month decline is the largest since Jan 2012…

LA, San Francisco, and New York were the biggest drags on the national home price index while Cleveland, Tampa, and Charlotte saw the smallest declines. San Francisco prices are up just 2.3% YoY – nearing its first annual price decline since 2011…

Finally, given the unprecedented explosion in mortgage rates, just where will home prices end?

We would like to think Powell’s plan does not involve that kind of collapse… or maybe it is – since prices will have to fall considerably more to become affordable for the average American to follow his ‘dream’.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!