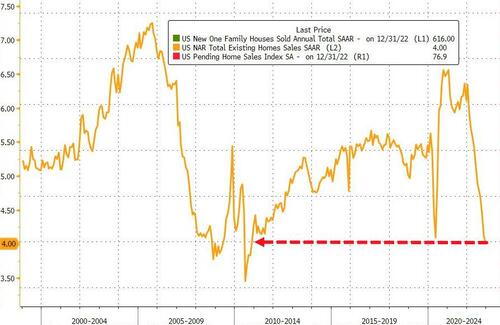

Existing home sales had fallen for a record 11 straight months ahead of this morning’s print for January, which consensus expected to reveal a 2% MoM rebound. However, existin home sales for January actually tumbled 0.7% MoM (well below the 2.0% jump expected) and the record 12th straight monthly decline with December’s 1.5% decline actually revised even worse to -2.2% MoM…

January’s unexpected decline smashed sales to a record 36.9% YoY crash, dragging the total existing home sales SAAR is at its weakest since Oct 2010…

That is worse than at the very lows of the COVID lockdown crisis.

“Home sales are bottoming out,” Lawrence Yun, NAR’s chief economist, said in a statement.

“Inventory remains low, but buyers are beginning to have better negotiating power.”

Properties remained on the market for 33 days on average at the start of the year, up from 19 days a year earlier.

“Homes sitting on the market for more than 60 days can be purchased for around 10% less than the original list price,” Yun said.

That’s helping to put downward pressure on home prices.

The median selling price was up just 1.3% from a year earlier, the smallest annual gain in home prices since January 2012, to $359,000.

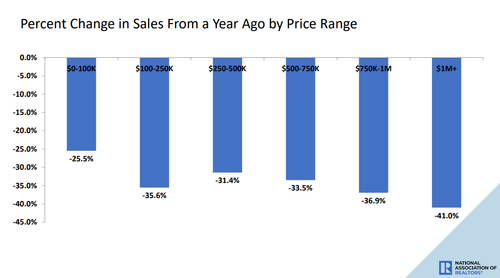

High-end ($1mm-plus) homes saw the biggest drop in sales…

Is this what Powell is looking for?

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!