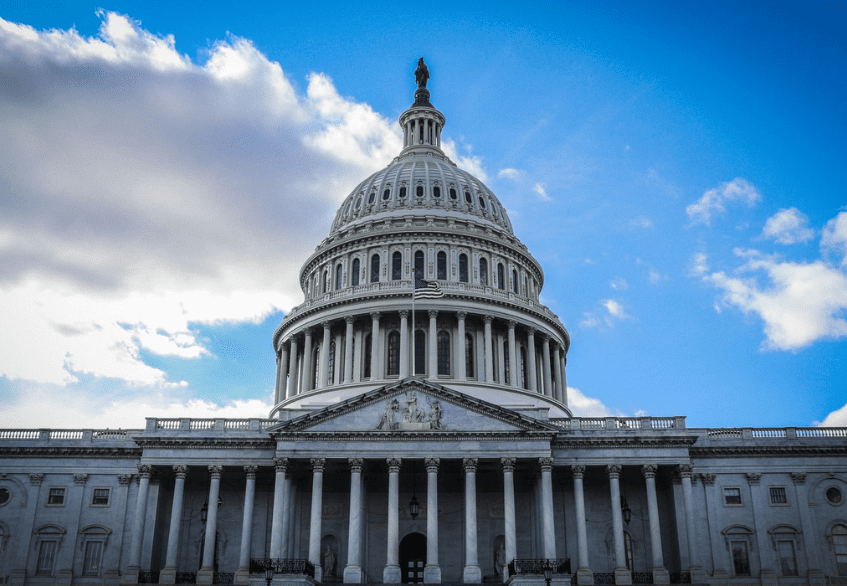

The Biden era begins …

It’s been a long, winding, and somewhat treacherous road. But here we are at the dawn of the next Presidential administration of the United States. It’s time to put away the popcorn and break out the champagne … or valium … depending on your feelings about the most controversial election in modern times. But as we […]

The Biden era begins … Read More »