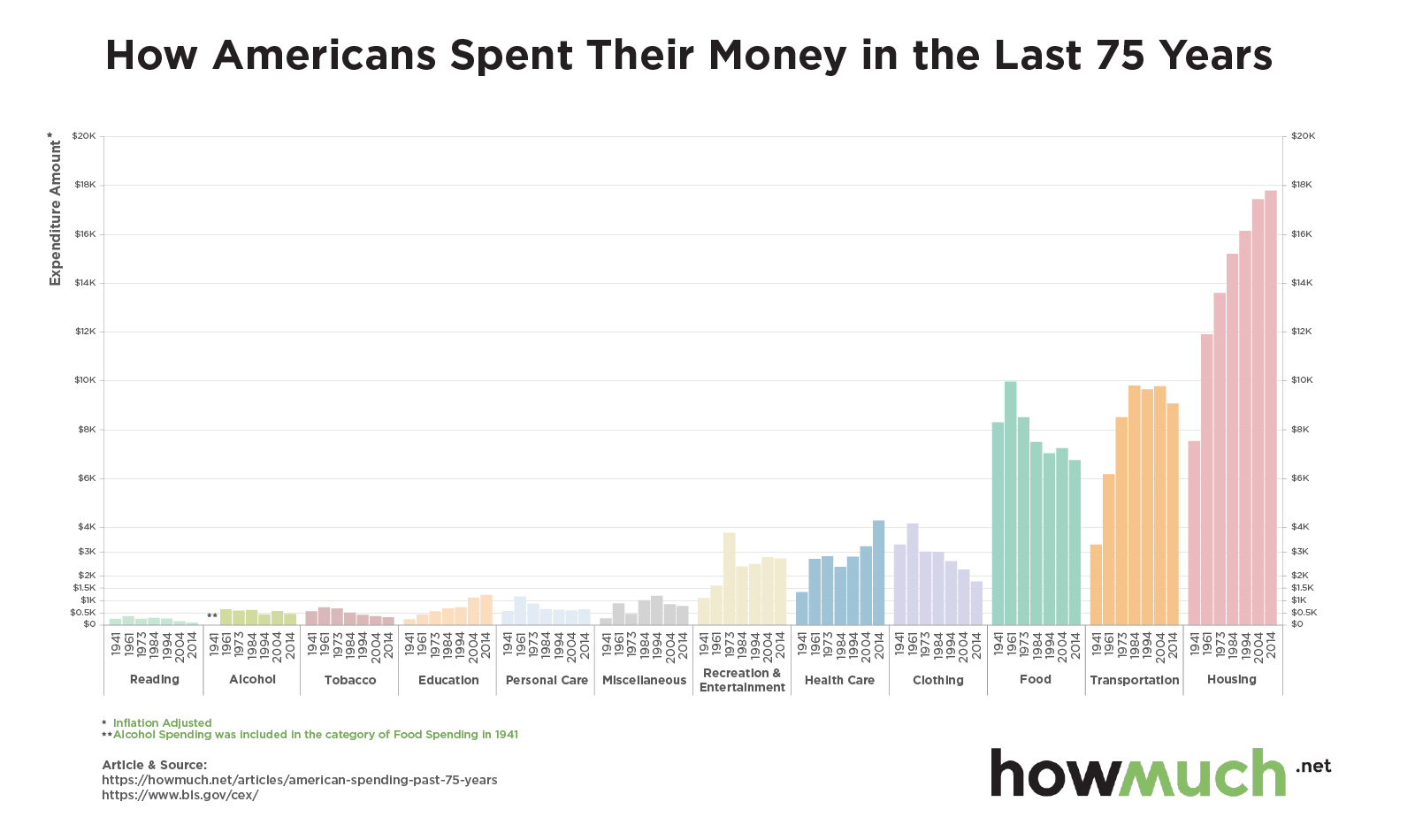

Here’s a chart residential real estate investors should find interesting…

Source: Unprecedented Spending Trends in America, in One Chart, an article from HowMuch.net, a cost information website.

If you can’t quite make it out on your screen, go ahead and click on it. Don’t worry, it won’t bite. But you’ll want to see the labels.

So why did this chart tickle our fancy? And why should real estate investors care?

Great questions! Glad you asked.

The first and most obvious are the ginormous pink lines on the far right. That’s housing. As in, “little pink houses for you and me.”

Not only are the numbers big, but there’s a long-term trend. Up.

BUT … you can see the last 10 years have slowed.

Hmmm … does that mean housing is becoming more affordable? Or could it mean it’s becoming LESS affordable because people have to spend a bigger chunk of their budget elsewhere?

The source article noted, “ … spending on food and clothing has fallen when adjusting for inflation while spending on education and healthcare has risen quickly.”

That’s interesting.

How much control do consumers have on the costs of education and healthcare? For food and clothing? And toss in transportation, which is also down.

And then notice recreation and entertainment. A little dip recently, but pretty stable.

What does all this mean?

Think about this: A person’s values can be fairly accurately inferred through an analysis of their calendar and checkbook. Where you spend your time and money says a lot about you.

And when you understand someone’s values, you can position yourself to provide goods and services they are likely to buy.

So this chart is like looking at the American consumer’s checkbook.

It seems Americans value housing, healthcare, education and entertainment more than food, clothing and transportation.

Of course, none of these are really optional for basic survival needs, except possibly education and entertainment.

But most of these spending categories can be dialed up or down based on preferences … and some are more controllable than other others. After all, when you’re sick, you’re sick. You need healthcare.

But if we use this snapshot into the collective American consumers’ spending to think about the types of real estate most likely to be in demand, here are some thoughts …

Affordable housing markets and properties

Seems like the willingness or ability to spend on housing is slowing, though the need will never go away. When squeezed, people usually move to a more affordable area or property.

Lots of renters

This has been going on for a while … and if interest rates continue to tick up faster than real wages … saving down payment money and affording a mortgage payment will become even harder for debt-laden consumers. So they rent.

Healthcare related real estate

Another niche we’ve been talking about continues to look appealing. Maybe you’re not ready to build a hospital or medical office building, but you can invest in communities with a strong healthcare economy.

You could also turn a McMansion into a residential care home. This is also a way to derive rents from affluent people and their long-term care insurance policies.

Entertainment-related real estate

In good times and bad, people pay to escape their reality for a little while.

We’re not talking movie theaters and restaurants. People can watch movies at home. And we’ve already seen a downward trend in food spending.

You don’t have to build a theme park, but you can invest near one. Vacation rentals and resort properties are another option for generating entertainment related income from real estate.

The trend is your friend

This old stock trading adage can be applied to real estate as well … except that real estate moves slowly. So slowly in fact, it’s easy to fall asleep at the wheel.

But if you pay attention, you can see long term trends in demographics, economics, supply and demand, and public policy … which create an ebb and flow of long-term investment opportunities.

So keep your day job and enjoy your daily life … but from time to time, take a look at long term trends.

Think about where the opportunities are and what moves you can make to put yourself in the path of profit.

And if you’re REALLY motivated, attend conferences and trainings where you can hear from expert analysts and experienced investors, and immerse yourself in thought-provoking conversations.

After all, based on the law of large numbers, just one good idea acted upon in real estate can be worth tens of thousands … perhaps even hundreds of thousands of dollars.

Of course, the good idea you don’t discover can’t help you. So keep learning!

Until next time … good investing!

More From The Real Estate Guys™…

- Sign up for The Real Estate Guys™ Free Newsletter and visit our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android!

- Stay connected with The Real Estate Guys™ on Facebook and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training and resources to help real estate investors succeed.