Newsfeed: 70% of Boise Home Sellers Dropped Their Asking Price in July

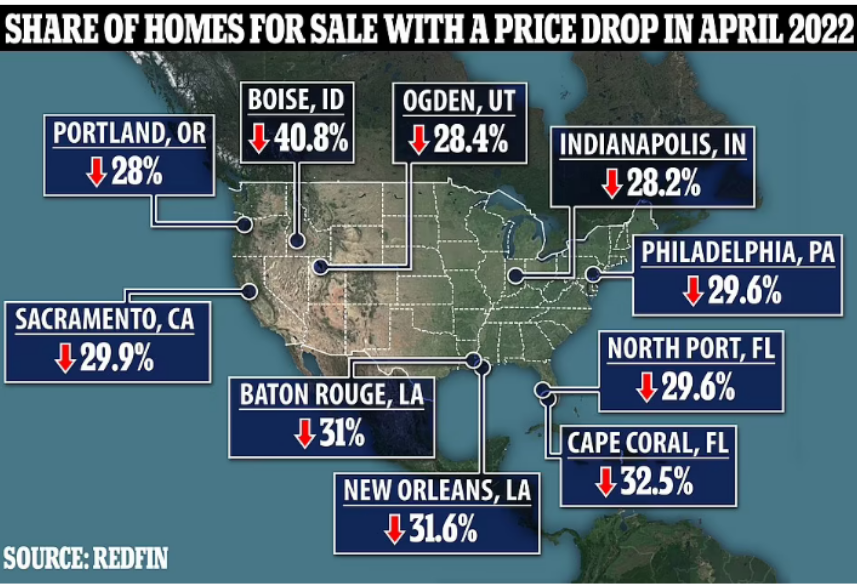

A high share of home sellers dropped their asking price in July, particularly in pandemic boomtowns, as they struggled to match their expectations with the reality of the cooling housing market.

Newsfeed: 70% of Boise Home Sellers Dropped Their Asking Price in July Read More »