Apartment markets in the Mountains/Desert region have seen notable inventory growth rates in recent years as developers try to keep up with sizable in-migration into this part of the country.

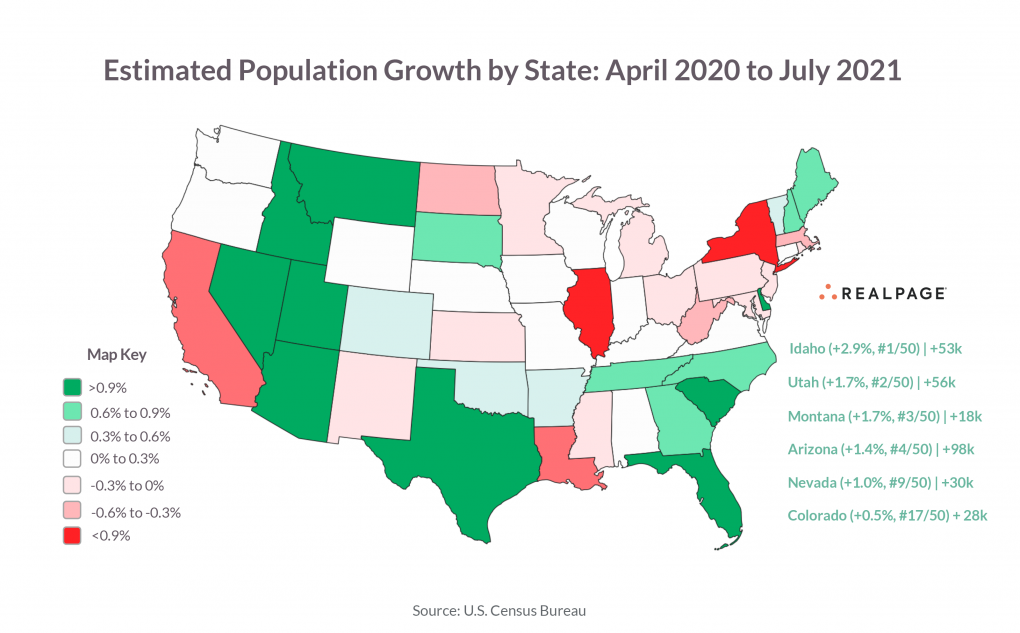

The Mountains/Desert region markets were key renter destinations for several years prior to the COVID-19 pandemic, but the economic downturn spurred even more significant interest. Many states in this region were national leaders for population growth between April 2020 and July 2021, according to the U.S. Census Bureau.

Idaho saw the most significant growth, with its population increasing 2.9% with the addition of 53,000 new residents in this 15-month time frame. Utah added 56,000 new residents growing its population 1.7%. Montana also saw a 1.7% increase, with the addition of about 18,000 new residents.

Colorado saw population growth of less than 0.9%. The resident base here grew 0.5% with the influx of about 28,000 new residents. Meanwhile, New Mexico was the only Mountains/Desert region state to see a decline in its resident base during the designated time frame.

While a lot of the in-migration into the Mountains/Desert region came from the more expensive coastal states, California was the most notable contributor.

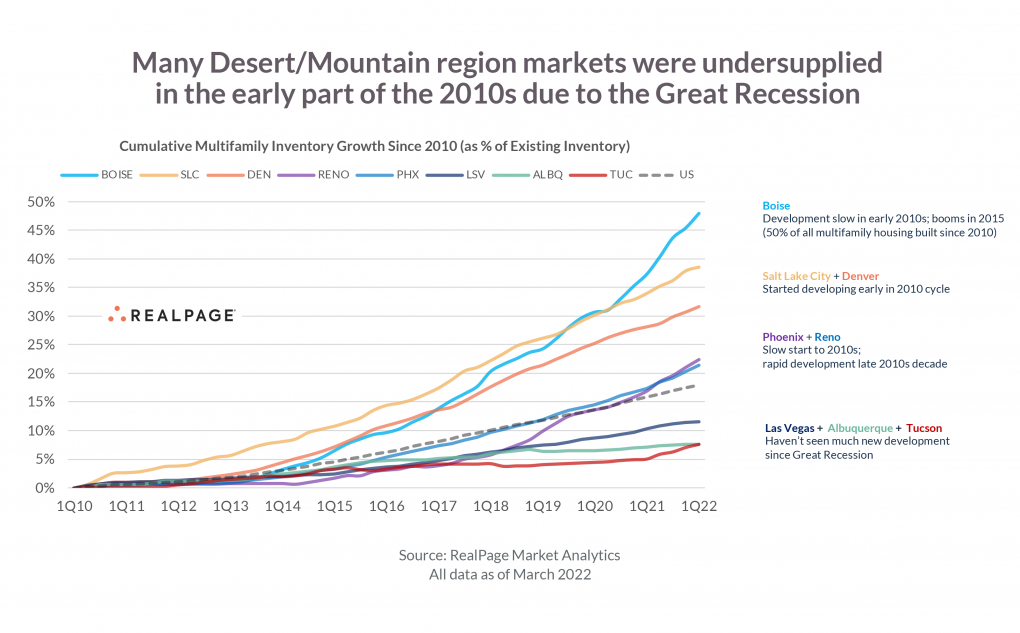

This population growth resulted in some jaw dropping apartment performances. One of the big drivers for the incredible occupancy rates across the Mountains/Desert region markets recently is that these areas were chronically undersupplied in the early part of the 2010s due to the Great Recession.

However, developers are working on that. While inventory growth is significant across many of these markets, it did take a while for them to catch up to U.S. norms.

Aside from Salt Lake City, which saw apartment inventory growth take off immediately in 2010, most Mountains/Desert markets took a while to match the pace of U.S. deliveries during the current building cycle, according to data from RealPage Market Analytics.

Denver took three years to get up to the pace of U.S. inventory growth. Boise didn’t start to see construction rates take off until about 2015, but since then has seen significant progress. In fact, almost half of all existing Boise apartment stock has been delivered since 2010. And about 40% of this market’s inventory has delivered since the start of 2015.

Inventory growth in both Phoenix and Reno remained below the U.S. trend until 2019. Meanwhile Las Vegas, Albuquerque and Tucson have yet to catch up to the U.S. level of construction activity.

For more information on the apartment markets in the Mountains/Desert region, including forecasts, watch the webcast Market Intelligence: Q2 Mountains/Desert Region Update.

More From The Real Estate Guys…

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!