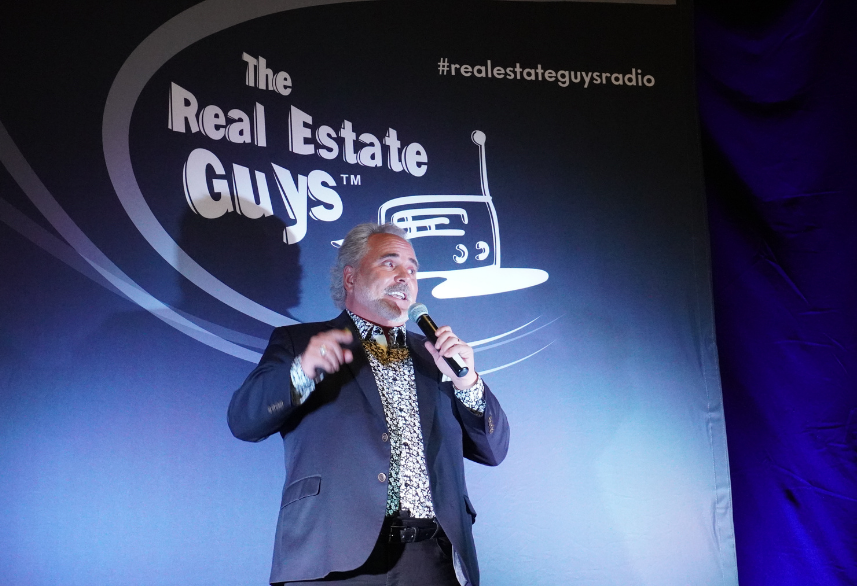

The Real Estate Guys™ honor the life and legacy of Gene Guarino

It is with great sadness and heavy hearts that we share the news of our dear friend Gene Guarino’s passing. While the many achievements of his lifetime extend far beyond his work, Gene made an undeniable impact on the real estate investing community during his 30+ years in the industry.

The Real Estate Guys™ honor the life and legacy of Gene Guarino Read More »