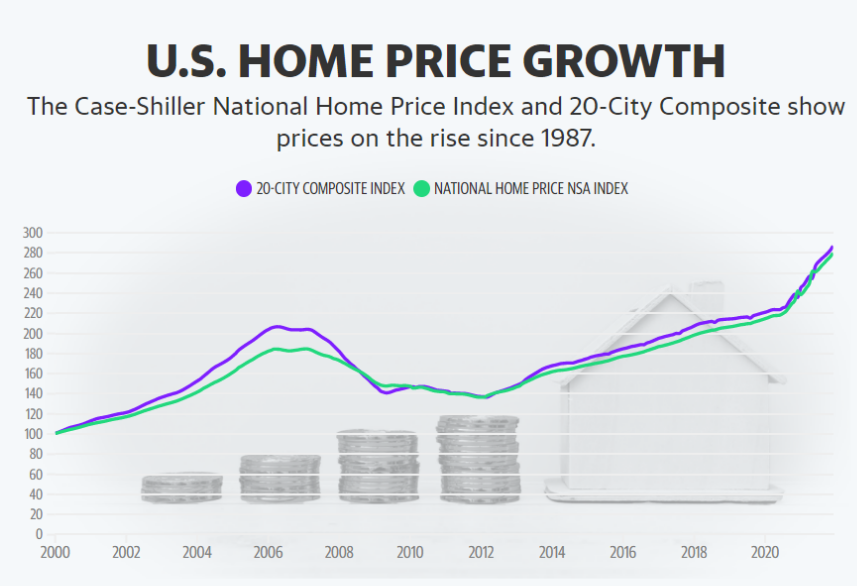

Newsfeed: U.S. home prices could fall as much as 20% next year

Home prices have plunged during the second half of 2022 with demand for residential real estate cooling off in a number of states and cities across the U.S.

Newsfeed: U.S. home prices could fall as much as 20% next year Read More »