Podcast: An Overlooked and Underserved Real Estate Investment Niche

As we often say, real estate is NOT an asset class.

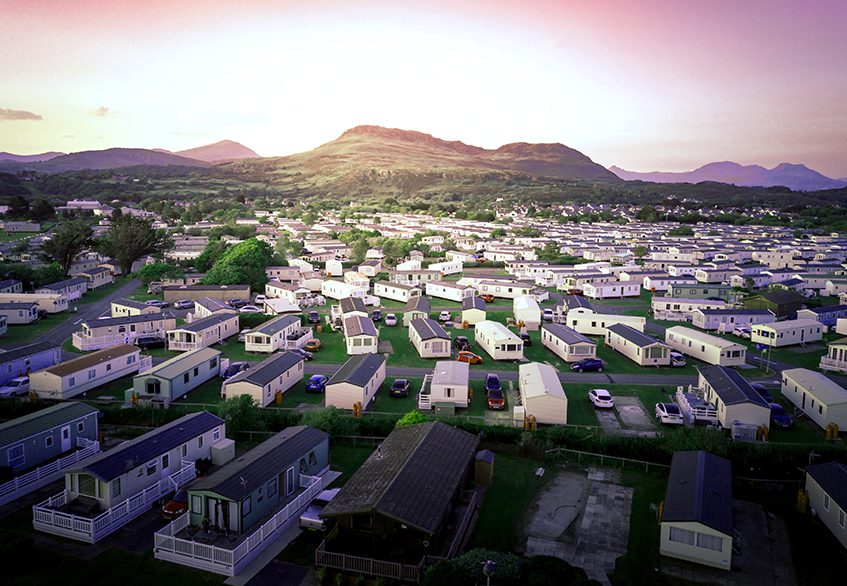

There are MANY different niches you can invest in to earn big profits … Single family, resort property, multifamily …

Podcast: An Overlooked and Underserved Real Estate Investment Niche Read More »