Newsfeed: Buffett Blasts Bankers For Turning Stock Market Into “A Gambling Parlor”

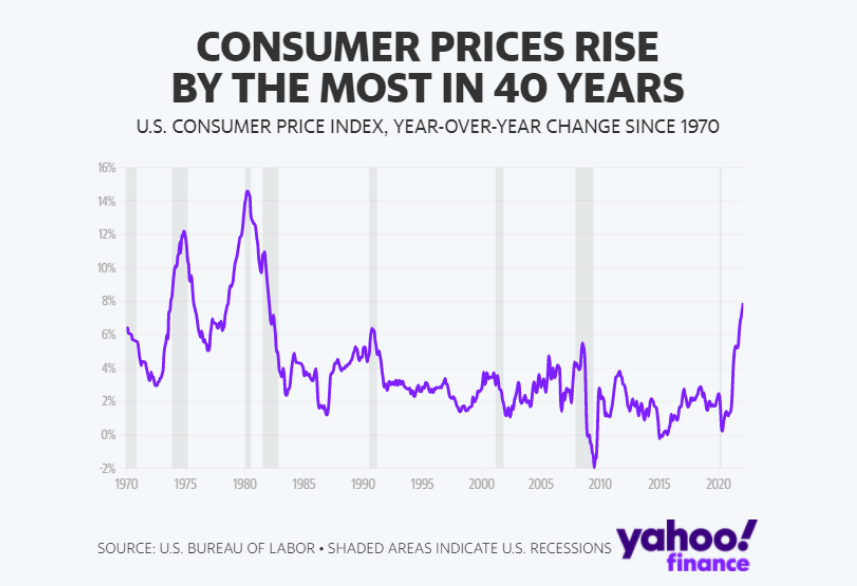

After a tumultuous week of violent lurches higher (but mostly lower), the S&P 500 has ended April with its worst start to a year since the start of World War 2…

Newsfeed: Buffett Blasts Bankers For Turning Stock Market Into “A Gambling Parlor” Read More »