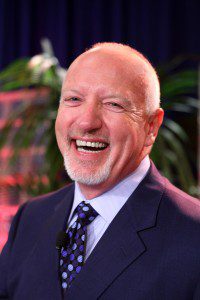

8/26/12: Finding Your Inspiration – Your Next Billion Dollar Idea with Mark Victor Hansen

Success in anything, including real estate investing, requires energy, enthusiasm and creativity – especially when working through challenging times. And it all starts with great ideas. In our travels, we have the great fortune to run into some of the most exciting and interesting people in the world. And because we cleverly carry our mobile […]