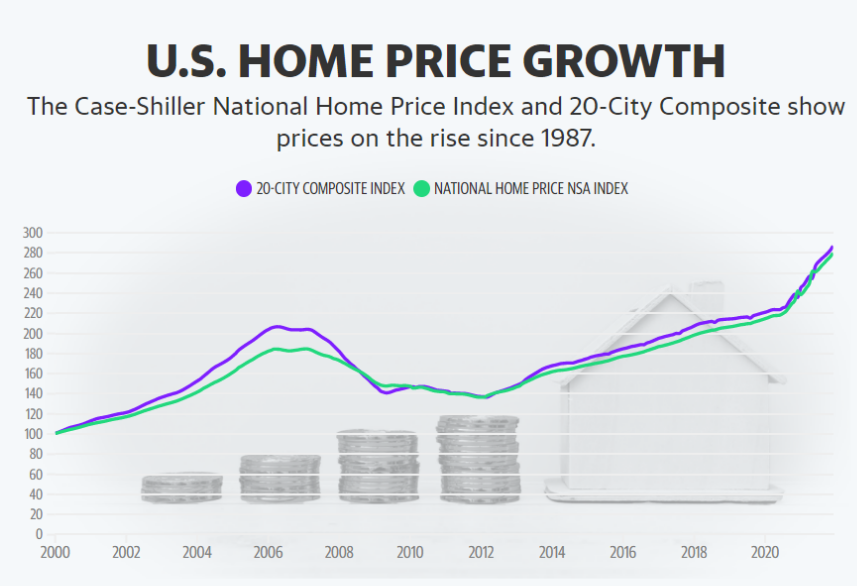

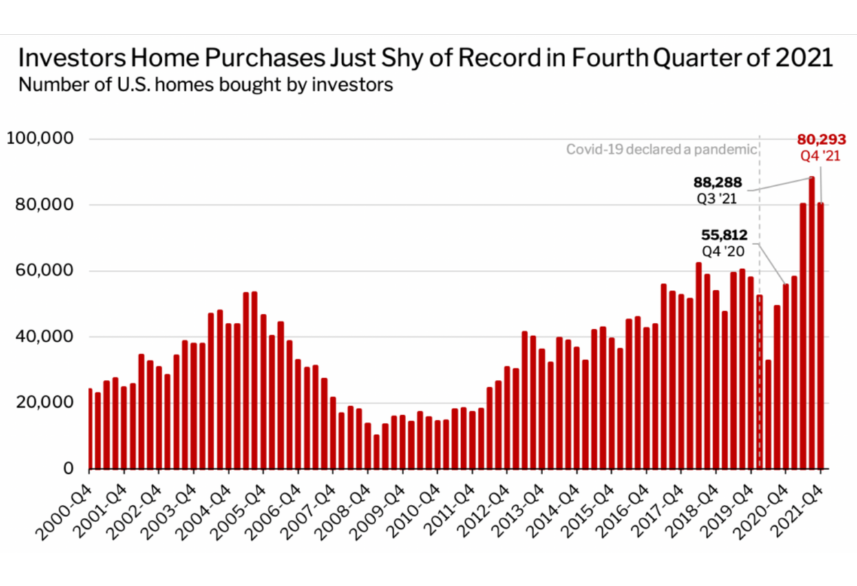

Newsfeed: 4 Million Americans Priced-Out As Home Rents Rise Significantly, Home Loan Qualifications ‘Skyrocket’

As costs of home ownership rise, millions of Americans have been pushed out of the housing market, according to Harvard University’s annual State of the Nation’s Housing Report released Wednesday.