Back in September, when looking at various leading rental market indicators, we reported that “Manhattan Apartment Rents Finally “Plateau” After Red-Hot Summer” a trend reversal that was also observed at the national level as we observed in “Nationwide Rents Drop For First Time In Two Years.” With rents peaking in August, two months later the retnal drop accelerated as we discussed in “Just Tumbled The Most On Record As Economy Craters“, incidentally something we wrote just hours after the latest FOMC, when Fed chair Jerome Powell clearly hadn’t yet gotten the rent memo as the following two quotes from his November FOMC presser reveal:

Fast forward to today when not just Powell but everyone at the Fed should be fully aware that rents have been sliding for almost half a year now, because as Powell’s favorite WSJ mouthpiece himself wrote today, “apartment rents fell in every major metropolitan area in the U.S. over the past six months through January, a trend that is poised to continue as the biggest delivery of new apartments in nearly four decades is slated for this year” while tenants are now maxed out on how much income they can devote to rent.

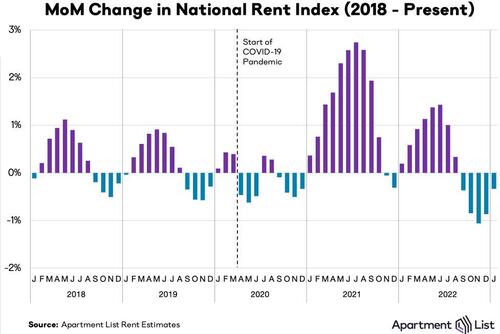

Citing our favorite real-time rental market indicator, listing website Apartment List whose data we used in Sept 2021 when we wrote “What Rental Hyperinflation Looks Like: “Soaring Prices. Competition. Desperation” to explain why rents are far higher than the CPI reports and why the prevailing groupthink consensus of “transitory inflation” was dead wrong, WSJ reported Nick Timiraos writes that renters with new leases in January paid a median rent that was 3.5% lower than they would have paid last August…

… “the first time in five years that rent fell every month over a six-month period, according to the same estimates.”

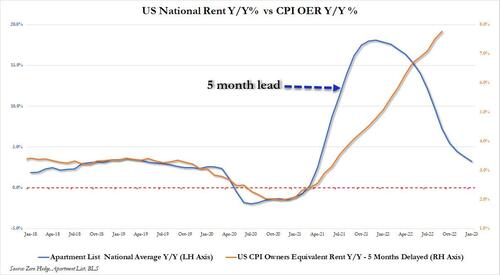

Realizing what our readers – if not the Fed – knew long ago, namely that to get an accurate picture of rents and inflection points in the apartment rental market one needs to look not at the CPI’s Owner Equivalent Rent data which is delayed by approximately 12 months, Timiraos says that four other market measures by housing-data companies also show that new-lease rents either fell or remained flat in January compared with the previous month, extending a streak of monthly rent declines that began at the end of the summer.

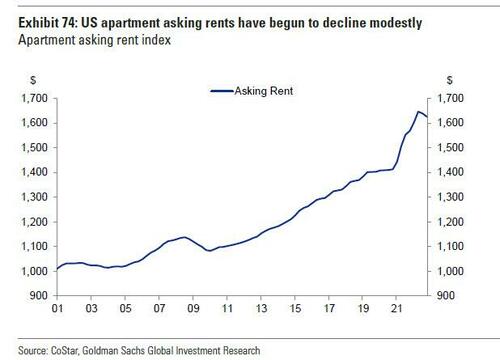

This can be seen in this Goldman chart which uses primary data from CoStar which also shows that rents peaked in August and have been declining since, even if they clearly have a long way to go to catch down to their pre-covid levels.

The softening rental market follows an unprecedented run for the apartment and home-rental industry put into motion by the pandemic. Pent-up demand for housing exploded in the months after the introduction of Covid-19 vaccines in late 2020 and a surge in people searching for apartments lifted rents 25% over two years.

But now that covid stimmies have long run out, the recent rental declines are a sign that many tenants have maxed out on how much of their income they can devote to rent, while the specter of layoffs has created new concerns for some. Other would-be renters who are living with family or friends, remain sidelined by prices that are still far too high for their budgets.

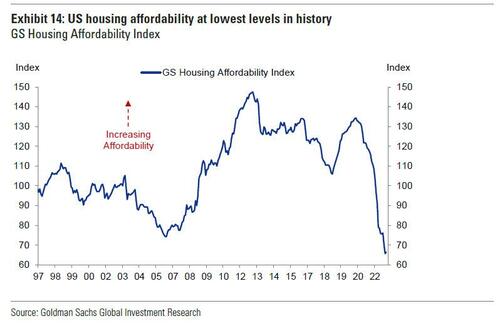

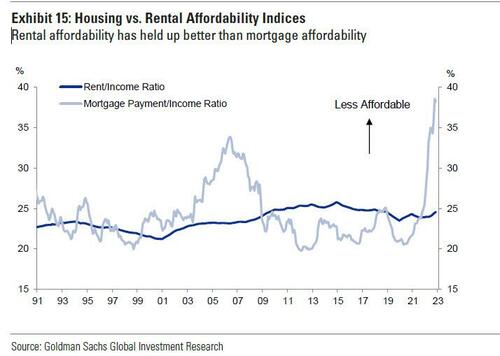

And while some seasonal stalling in rents is normal, Timiraos cautions that according to projections from CoStar, the market faces a significant headwind in the form of a supply “crush”, namely the biggest delivery of new supply since 1986: nearly half a million new apartments are coming on line this year as developers seek to cash in on the high rents that tenants have been paying. Indeed, as discussed over the weekend, countless renters facing the most unaffordable housing market in generations…

… are unable to to buy a home because of higher mortgage rates and steep prices, so rentals have been in high demand.

Rents, of course, are not alone, and they have retreated alongside sharper recent declines in home-sale prices, which fell 3.6% between June and November, according to the Case-Shiller. Soaring mortgage rates and softening buyer demand have been weighing on home prices, despite a period this year when lower rates sparked an uptick in buyer interest. Ironically, the more unaffordable home purchases have become, the greater the demand for rentals… at least until a tipping point of sorts was hit several months ago.

The good news is that with a long delay, the coming tidal wave of new apartment supply – especially in places where housing inventory remains unusually low to the benefit of home sellers – will give renters more choices, making it not only more difficult for landlords to raise rents at rates seen early in 2022, when rent growth was at a near-20% annual clip, but forcing many to cut rents outright.

Indeed, the supply of new rentals is already having an impact: according to software company RealPage, the share of apartment tenants who renewed leases declined in January to 52%, the lowest level for that month since 2018; the data suggests some tenants are finding better deals at other buildings.

“Renters facing lease renewals suddenly have a lot more options,” RealPage economist Jay Parsons said in a report. Landlords are likely to start dropping their renewal rents to prevent tenants from leaving, he added.

Ironically, asking rents are sliding just as the much-delayed shelter cost component of the CPI basket soared by oar 7.9% in January compared with the same month a year earlier. Of course, as we long ago noted, the impact of rent declines tends to lead what is expressed in the CPI by as much as 12 months. Furthermore, as we discussed recently, many renters are in the middle of leases signed before recent price drops. That is one reason why the rising cost of rent reflected in the CPI shows annual price growth that is still higher than market measures, which track new leases.

And while rent has been declining sequentially for five months now, rent growth still remains positive on an annual basis according to most data sources; even so the pace of growth is rapidly slowing and if it continues to decelerate beyond winter, it would help pull down services inflation figures, of which housing costs are the biggest component. New-lease rent growth ranged from about 2% to 6% in January compared with one year prior, according to most market reports, down significantly from the pace of growth in early 2022. As more leases expire, analysts expect CPI figures to better reflect the lower costs of new leases.

Where are the rental drops the biggest?

Citing the latest Apartment List data, Timiraos notes that in the months since August, new-lease rents have fallen most sharply in some of the nation’s biggest metro areas. Seattle rents have tumbled 8%, while rents in Boston and Las Vegas have fallen 6%, according to Apartment List.

The Seattle metro area’s median rent was $1,706 in January, while in the Boston metro area it was $1,879. Other measurements of rent with different sample criteria show much higher rent prices, but similar long-term trends in price movement.

Notably, none of the 52-largest metro areas tracked by Apartment List experienced positive rent growth over the period. Indianapolis and Miami were the best performing cities, with rental declines of just 1%. It was all downhill from there.

Rents for single-family homes, which had also increased sharply before last summer, now are stalling, too. The average national asking rent for a house rose just one buck in January, compared with December, to reach $2,070, according to data provider Yardi Matrix.

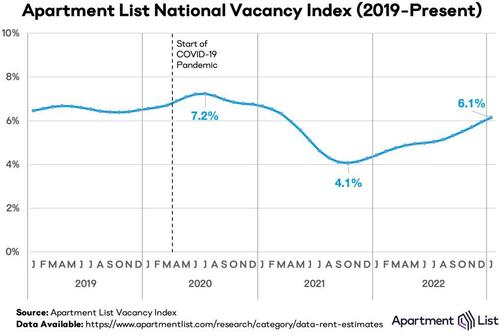

Assuring further rental declines, apartment vacancies have been rising since last fall, due to weaker demand from potential renters. Fewer people are flocking to Zoomtowns—communities that experienced a surge in population from an influx of remote workers—such as Boise, Idaho, or Phoenix compared with earlier in the pandemic, a recent report from listing website Zumper notes.

Of course, there is a lot of room to fall: even after a 3.5% decline in new-lease rents since last summer, rents in many cities remain 20% or 30% higher than they were when the pandemic began. Rents in the Tucson, Ariz., Tampa, Fla., and Miami metro areas are all 35% higher than in March 2020, according to an Apartment List report.

“Renters are still having a tougher time than they were even a year-and-a-half ago,” said Chris Salviati, economist at Apartment List. However, if the Fed keeps rising rates and ignoring the general economic malaise – which the Biden admin is doing everything to cover up – rents should be in freefall in just a few months, but don’t expect the Fed to respond: as usual it takes the US central bank about 6 to 9 months to realize it is always behind the curve.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!