House prices are sliding, and sales are plunging as the Federal Reserve hits the pause button on quantitative easing this year with the most aggressive interest rate hikes in four decades to cool the red-hot housing market spurred by low interest rates and tight inventories during the pandemic.

A rising rate environment has sent the average thirty-year fixed mortgage rate to highs not seen since the Dot Com collapse era over two decades ago. This abrupt surge in rates caused an affordability crisis in housing as prices remained at lofty levels this year, forcing real-estate brokerage Redfin Corp. to slash workers in June.

Now the online real-estate brokerage has announced the second round of layoffs, as well as an exit from its home-flipping business called “iBuying.”

Redfin CEO Glenn Kelman sent a letter to employees, also published on the company’s website, about the layoffs. He indicated 13% of staff, or about 862 people, will be fired.

We’re laying off 862 brilliant, loyal people and also closing RedfinNow.

We’ll still need home-services employees for our concierge service to fix up brokerage customers’ listings, but since that group spent most of its time renovating RedfinNow homes, it will get much smaller.

Kelman explained the layoffs are equivalent to about 13% of the workforce. Since April 27, about 27% of the total workforce has been reduced — this coincides with a rising interest rate environment and souring macroeconomic backdrop for the economy forced on by the Fed’s monetary tightening.

The top-level executive made a bold prediction about the 2023 housing market:

A layoff is awful but we can’t avoid it. We plan to keep increasing our share of the market, but that market in 2023 is likely to be 30% smaller than it was in 2021. The June layoff was a response to our expectation that we’d sell fewer houses in 2022; this layoff assumes the downturn will last at least through 2023.

Besides reducing headcount, Redfin is also exiting iBuying, a large-scale home-flipping operation, because it’s been a massive money pit for the company. Kelman said:

RedfinNow Is Too Much Money and Risk: And the second problem is that iBuying is a staggering amount of money and risk for a now-uncertain benefit. We’ve tied up hundreds of millions of dollars in houses that you yourself wouldn’t want to own right now. Even before its overhead expenses, the RedfinNow properties segment will likely lose $22 – $26 million dollars in 2022. However small our iBuying loss may be compared to others, that loss is still larger than we could afford to bear again.

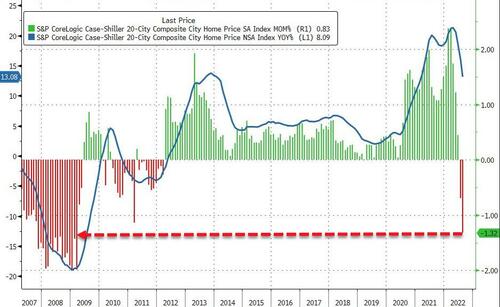

Redfin’s troubles also come as the lagged Case-Shiller Index showed US housing prices dropped 1.3% from their June 2022 peak in August. This is the biggest monthly decline since the Lehman collapse.

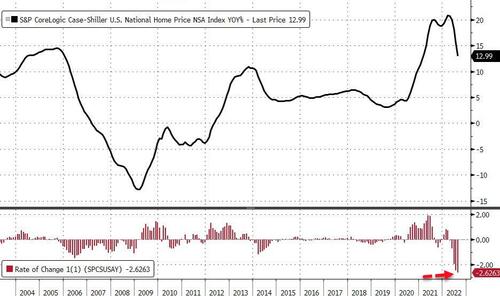

The national home price index growth has slowed for five straight months (below 13% YoY for the first time since Feb 2021). The absolute drop in the growth rate of 2.62 percentage points is the largest ever…

Researchers at Goldman Sachs forecast home prices could slide 5-10% from peak to trough — with their official forecast model predicting a 7.6% decline.

Given the unprecedented explosion in mortgage rates and near-record-high prices, contributing to the worst affordability crisis ever for future homeowners, Redfin’s decision to substantially reduce headcount this year and exit the home flipping industry comes as 2023 could be a year of turmoil for the housing market.

Add Redfin to the list of mounting layoffs across tech.

Layoffs This Month (% of Workers):

1. Twitter: 50%

2. Cameo: 25%

3. Robinhood: 23%

4. Intel: 20%

5. Snapchat: 20%

6. Coinbase: 18%

7. Opendoor: 18%

8. Stripe: 14%

9. Lyft: 13%

10. Shopify: 10%

11. Meta: “Thousands”

12. Apple: Hiring Freeze

13. Amazon: Hiring Freeze

— The Kobeissi Letter (@KobeissiLetter) November 8, 2022

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!