Podcast: Ambition and Grit – Success Secrets of a 50 Year Real Estate Entrepreneur

As the saying goes, success doesn’t come from a lack of challenges, but by the ability to overcome them …

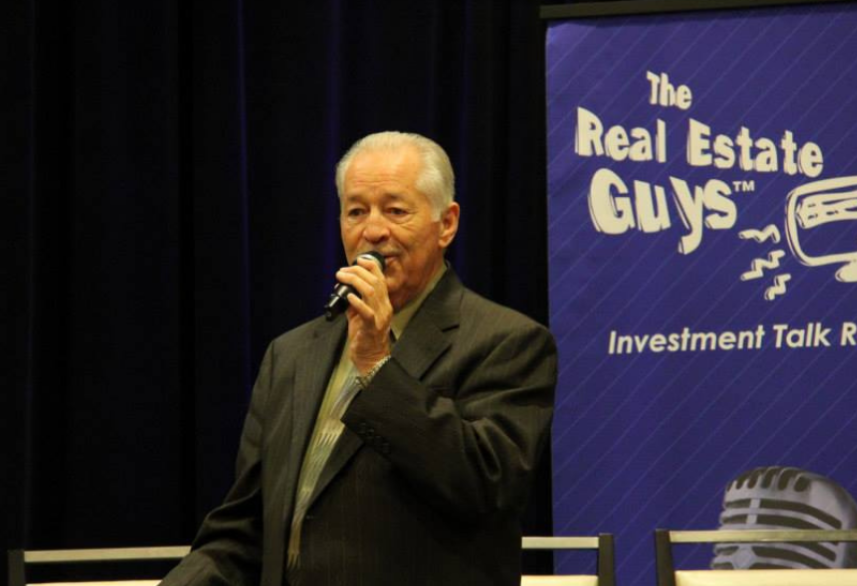

Today we’re talking with Dave Liniger, a bestselling author and trailblazing figure

Podcast: Ambition and Grit – Success Secrets of a 50 Year Real Estate Entrepreneur Read More »