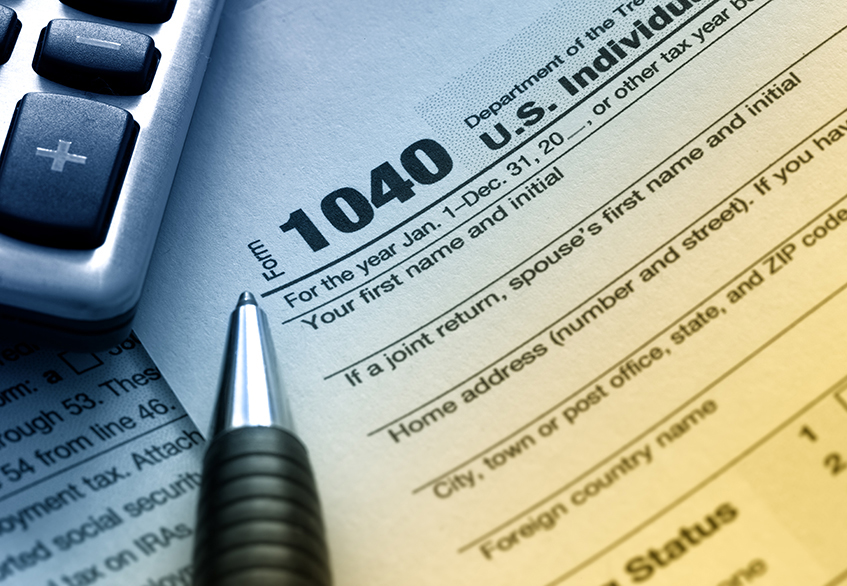

Newsfeed: Opinion: Household wealth dropped by $13.5 trillion from January to September, second-worst destruction on record

American households lost about $6.8 trillion in wealth over the first three quarters of 2022 as the stock market SPX, +1.43% DJIA, +1.58% COMP, +1.26% shed more than 25% of its value, the Federal Reserve reported Friday in the government’s quarterly financial accounts.