Property management firm RealPage published new data that shows demand for US apartments began “evaporating” as early as last summer as the highest inflation in a generation crushed consumer confidence.

“We’ve never before seen a period like this – weak demand for all types of housing despite robust job growth and sizable wage gains,” RealPage Chief Economist Jay Parsons told commercial real estate news website “GlobeSt.”

“It wasn’t just apartment demand that shot up in 2021 and plunged in 2022. The same pattern played out to varying degrees in other rentals and in for-sale homes,” Parsons said.

Parsons noted, “while some pundits have suggested demand is slowing due to affordability challenges, there’s not yet any evidence that’s true within the professionally managed, market-rate apartment market.” He said turnover, while normalizing, is still very low, and about 96% of renters were paying on time as of November.

In addition, “there’s no indication renters are doubling up to any significant degree,” he said, adding, “that may occur later, but as the publicly traded apartment REITs all reported in their last earnings call, it’s not a major factor yet.”

Parsons pointed out, “there’s no ‘flight to affordability’ – meaning that renters aren’t moving down from more expensive units or markets into more affordable units or markets” and said sliding demand is at all price points and every market.

RealPage’s top economist believes plunging demand is the cause of macroeconomic headwinds denting consumer confidence:

“Low consumer confidence means many American households feel nervous and uncertain, and that has a freezing effect on household formation and housing demand.

“Human nature is that when we feel uncertain, we’re much more likely to stay put – and that’s what happened in 2022.”

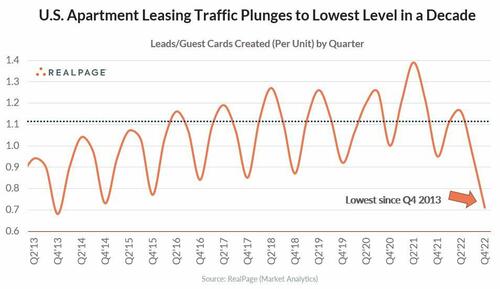

Separately, Parsons tweeted an image that shows rental demand “evaporated” in the second half of last year.

“Both Q3 and Q4 recorded the weakest numbers since 2013. The Dec 2022 numbers were especially low. While December is always slow, Dec 2022 was the slowest month in at least 12 years,” he said.

Parsons continued in a series of tweets about how the collapse in rental demand is “truly unprecedented.”

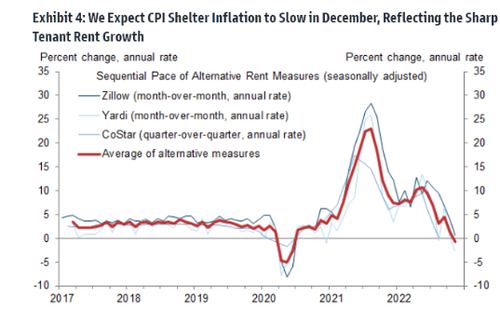

Recall back in October, we explained to readers when it comes to measuring inflation, the Fed Reserve is looking at inaccurate and out-of-date data, the result of Shelter Inflation and Owner Equivalent Rent – the most significant weight of the CPI basket – being about 9-12 months behind the curve when it comes what’s really happening in the housing market.

Indeed, as we recently said in “Why The CPI Is Making The Same Huge Mistake Now It Did One Year Ago,” the time to panic about soaring rent was more than a year ago — as we noted in September 2021 – but not the Fed which was busy spreading fake news that inflation was transitory. And now what’s happening is that BLS is finally caught up to the reality 6-9 months ago when rents and home prices were indeed soaring… meanwhile, rental markets are cooling across the country as the US risks sliding into a Fed-induced recession.

RealPage’s data and the mounting evidence we’ve provided over the last few quarters shows the Fed chooses to ignore high-frequency data for laggard data in how it views the shelter inflation situation. Of course, the Fed will realize when it’s too late that it overtightened.

And perhaps Fed Chair Powell should take a look at Goldman Sachs’ CPI preview for this week, where chief economist Jan Hatzius is certainly paying attention to high-frequency rent data that has all but gone negative on an annualized basis, an indication CPI shelter inflation could begin to recede as early as December.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!