… we noted that the housing market had just gotten the most unffordable in history…

… setting the stage for a sharp repricing lower in home prices.

Late last week we got confirmation from Redfin, which reported that the median sale price for U.S. homes came down 0.7% from its record-breaking June peak during the four weeks ending July 10.

And with the housing market undergoing a shock repricing, as bid-ask levels soar in search of marginal prices, home sales fell nearly 16% from a year ago, the largest decline since May 2020. The shift has also started impacting sale prices: They’re still growing by double digits, but the 11% year-over-year increase is the smallest in nearly two years.

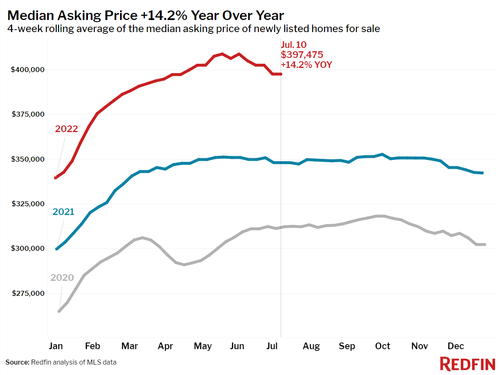

Sellers’ asking prices also came down 3% from their May peak as the share of homes with price drops hit another new high.

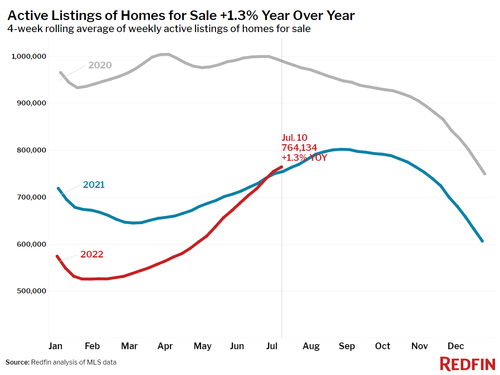

According to a separate RedFin report, the number of homes for sale nationwide in June rose 2% – the first annual increase since July 2019, before the pandemic-fueled homebuying frenzy sapped the market of available homes and sent buyers into bidding wars for nearly every listing. Now, supply has built up as the combination of 5.5%-plus mortgage rates, high home prices and a faltering economy push more buyers to the sidelines, thereby creating a more balanced market.

Meanwhile, as sellers slowly start to realize that the winds have turned and are about to flood home supply posted its first year-over-year increase since August 2019 as pending sales continued to slide. As shown in the next chart, active listings (the number of homes listed for sale at any point during the period) rose 1.3% year over year—the largest increase since August 2019.

“The country’s economic woes have already cooled the housing market, and they’re likely to continue dampening demand,” said Redfin Chief Economist Daryl Fairweather. “The Fed has signaled it may increase interest rates further to combat stubbornly high inflation, which could harm consumer confidence, and lower stock prices mean fewer prospective homebuyers can afford a down payment. I advise sellers to commit: If you decide to sell, do it quickly before demand potentially falls further. And price carefully—this is not the time to test the waters. You’ll do more harm than good if you overprice and have to do a price reduction or take the home off the market.”

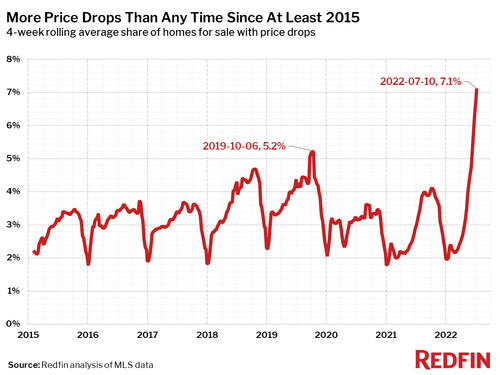

Worse, as liquidity-sensitive homeowners rush to sell ahead of the herd, Redfin has recorded more price drops than any time since at least 2015…

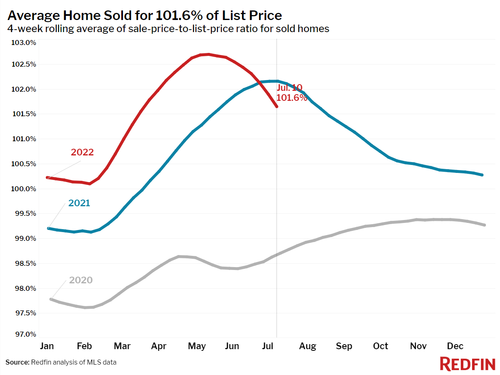

… and the average home will soon sell for less than its listing price: in July, the average sale-to-list price ratio, which measures how close homes are selling to their asking prices, declined to 101.6%. In other words, the average home sold for 1.6% above its asking price. This was down from 102.2% a year earlier.

As Redfin concludes, “these changes in the housing market can be attributed to buyers reaching their limit on costs—not just of homes and mortgages, but also food, transportation and energy.”

”Inflation and high mortgage rates are taking a bite out of homebuyer budgets,“ said Redfin chief economist Daryl Fairweather. “Few people are able to afford homes costing 50% more than just two years ago in some areas, so homes are beginning to pile up on the market. As a result, prices are starting to come down from their all-time highs. We expect this environment of reduced competition and declining home prices to continue for at least the next several months.”

Here are some more details from the latest Redfin report:

- The median home sale price was up 12% year over year to $393,449. This was down 0.7% from the peak during the four-week period ending June 19. A year ago the median price rose 0.9% during the same period. The year-over-year growth rate was down from the March peak of 16%.

- The median asking price of newly listed homes increased 14% year over year to $397,475, but was down 2.8% from the all-time high set during the four-week period ending May 22. Last year during the same period median prices were down just 0.9%.

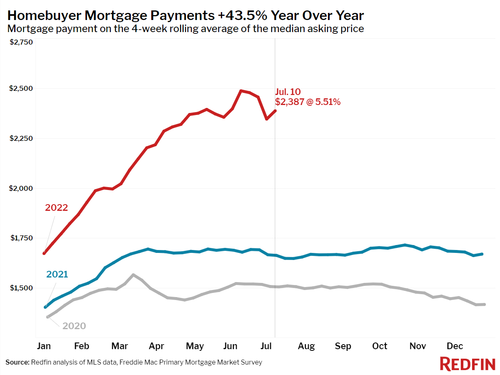

- The monthly mortgage payment on the median asking price home hit $2,387 at the current 5.51% mortgage rate, up 44% from $1,663 a year earlier, when mortgage rates were 2.88%. That’s down slightly from the peak of $2,487 reached during the four weeks ending June 12.

- Pending home sales were down 14% year over year, the largest decline since May 2020.

- New listings of homes for sale were down 1.7% from a year earlier.

- Active listings (the number of homes listed for sale at any point during the period) rose 1.3% year over year—the largest increase since August 2019.

- 43% of homes that went under contract had an accepted offer within the first two weeks on the market, down from 47% a year earlier.

- 29% of homes that went under contract had an accepted offer within one week of hitting the market, down from 33% a year earlier.

- Homes that sold were on the market for a median of 18 days, flat from a year earlier and up slightly from the record low of 15 days set in May and early June.

- 51% of homes sold above list price, down from 54% a year earlier.

- On average, 7.1% of homes for sale each week had a price drop, a record high as far back as the data goes, through the beginning of 2015.

There’s more: while rents are still rising by double digits year over year, the latest Apartment List data shows that the rate of increase is now the lowest since Aug 2021, a reversal which the Owner Equivalent Rent metric which is a lagging indicator, won’t notice for at least another 6-9 months.

The bottom line is that the market is now is a mixed bag for buyers. They’re seeing higher monthly housing payments than earlier this year due to comparatively high mortgage rates but facing less competition for homes, which often allows them to make less risky offers that include protections like inspection and appraisal contingencies.

Meanwhile, sellers are starting to move for the exits with the more enterprising among them willing to take aggressive price cuts to offload inventory.

Finally, and as usual, the Fed is about 9 months behind the curve, and even though prices have now peaked and will decline sequentially for the foreseeable future, Powell & Co will be hiking rates for many months to come, confirming that the Fed will be tightening aggressively into the next housing crisis.