By Garfield Reynolds, Bloomberg Markets Live commentator and reporter via ZeroHedge

The gathering consensus that inflation has peaked is spurring a FOMO moment for bonds, with investors eager to buy and chatter that 10-year Treasury yields could drop all the way back to 2%. That sort of Treasuries rally is unlikely unless China’s slowdown worsens.

While the Fed is willing to risk a recession to quell inflation, China’s economic outlook is going from bad to worse. Most troubling of all, Beijing is turning abruptly back to exactly the sort of stimulus measures they warned of as being counter-productive. It’s a nightmare scenario for global GDP and a boon to bond holders.

This helps explain why deep-pocketed investors from US fund managers to Japanese life insurers and Australian pension giants are lining up to buy bonds despite yields that are way below inflation levels.

Indeed, the average yield of Bloomberg’s global government bond index topped out not much above 2%. While much of that period saw unprecedented central bank stimulus, there’s plenty of evidence that the savings glut remains a powerful restraint on yields.

The China factor feels like it’s been overlooked for too long, with the country’s epic transformation making it hard to imagine that the days of 6%-plus GDP are never coming back. But the reality is that China’s 12-quarter moving average for annual GDP growth is back under 5%.

With this in mind, the bond markets in Australia and New Zealand are worth keeping an eye on. If they outperform versus Treasuries, that would signal China is weighing even more severely on the world economic outlook.

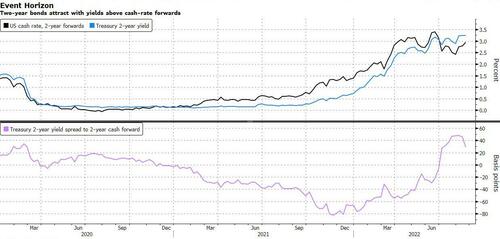

China’s woes are bubbling up while the market has turned decisively sour on the US economy. On top of the dramatic inversion of the classic 2s10s curve, two-year Treasuries are also yielding well above two-year OIS forwards.

This latter measure recently topped a 50-basis-point premium, which was the most since 2019 when the Fed was cutting rates. It adds the short end of the curve to the buy-and-hold menu for bond investors and underscores expectations for recessions in the US and around the world. While bear-steepening is the trend with Jackson Hole approaching, that sets up the potential for strong reversals should growth fears come to the fore after the confab.

With the Fed and most of its developed-market peers clear on their intention to control inflation, China may be the swing factor for bonds.

If the storm brewing in China eases once Xi Jinping secures a third term as leader, a lot of the uncertainty hanging over the global economy will fade away. If the clouds linger, or get even darker, then US 10-year yields could reach 2% very rapidly.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!