Authored by Simon White, Bloomberg macro strategist,

A composite measure of DM banks’ lending standards shows they are the tightest since 2009. Tighter credit conditions will be an impediment to central banks’ preference to keep rates “higher for longer.”

The ECB’s bank lending survey was released this morning, with banks further tightening their credit standards.

This has pushed an aggregate measure of bank-loan credit standards to levels not seen since the Lehman crisis.

This has been driven primarily by US and European banks; loan standards for Japan and UK banks are close to unchanged over the last year.

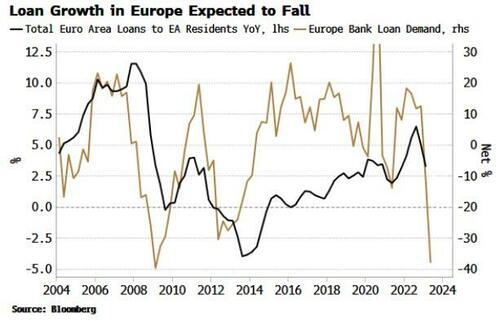

For Europe, the data released today showed a further rise in tighter credit standards for loans. Typically when banks make it harder to take loans out, this leads to lower demand for them. In turn, lower demand for loans is consistent with less supply.

This should keep pressure on money growth in Europe, but it is important to focus on the correct type of money. M3 was also released today, and showed a slowdown, but M3 is counter-cyclical. M1 is a more reliable leading indicator of economic activity and risk-asset performance.

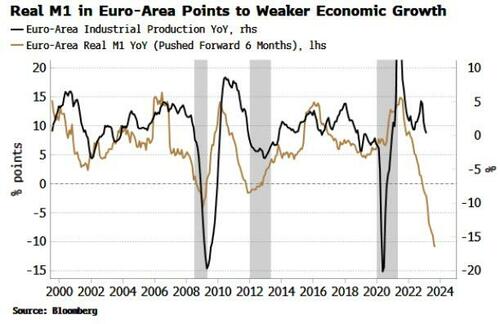

Real M1 has fallen sharply over the past months, and the expected decline in bank loans will keep the pressure on real M1 even as inflation moderates. This points to weaker growth in Europe through the rest of the year.

Some have posited that M1’s significance is diminished as a rising-rate environment means more borrowers are terming out overnight deposits. But this is nothing new. M1 is a better measure because it is driven by demand deposits, i.e. money that is available to spend. It is therefore a pro-cyclical measure of future activity. If people are terming out deposits this is not a sign of confidence in the economy.

Credit tightening and weakening economic growth in Europe and the US will soon bring the pipe dream of “higher-for-longer” into contact with reality, with one part of the yield curve already making this plain.

More From The Real Estate Guys…

- Sign up for The Real Estate Guys™ New Content Notifcations

- Check out all the great free info in our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe on iTunes or Android or YouTube!

- Stay connected with The Real Estate Guys™ on Facebook, and our Feedback page.

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training, and resources to help real estate investors succeed.

Subscribe

Broadcasting since 1997 with over 600 episodes on iTunes!

Love the show? Tell the world! When you promote the show, you help us attract more great guests for your listening pleasure!