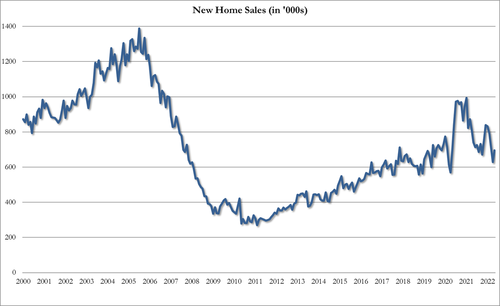

Following the disappointing tumble in existing home sales (to 2 year lows), analysts expect a modest drop in new home sales in May of just 0.2% MoM (after April’s 16.6% MoM plunge). Instead, new home sales spiked 10.7% MoM (from an updwardly revised -12% MoM print in April) – despite soaring mortgage rates…

Source: Bloomberg

Source: Bloomberg

New home sales SAAR bounced from near COVID lockdown lows to 696k from an upwardly revised 629k…

Source: Bloomberg

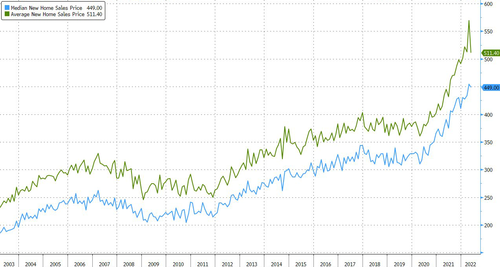

New Home average price tumbles from $569.5K to $511.4K, the lowest since Jan.

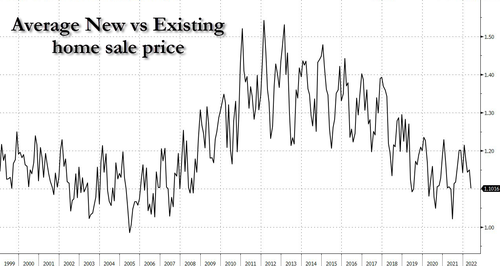

New home prices are falling relative to existing home prices…

Earlier this month, the average rate for a 30-year loan posted its largest one-week increase since the 1980s. It’s risen even further since then.

“Supply remains limited across the country,” Miller said.

“Clearly, production must catch up to the growing household numbers as production of dwellings over the past decade has lagged prior decades by as many as 5 million homes.”

A separate report out last week showed US homebuilder sentiment slid to a two-year low in June, the sixth-straight decline, as rising inflation and higher mortgage rates weighed on demand.

The pickup in sales may also reflect some buyers locking in their mortgage rate in anticipation of even higher borrowing costs.