(Here’s a 5-minute money read)

You probably know the global economy caught a virus and suffered a massive heart attack. Cash stopped flowing, creating a cascade of problems …

… including individual cell damage, organizations and systems in danger of failing, and almost certainly … brain damage.

So the monetary doctors at the Federal Reserve are infusing enormous volumes of liquidity … perhaps hoping sheer pressure will force cash to flow.

Concurrently, Uncle Sam is injecting free money right into Main Street bank accounts …

… while local governments are selectively allowing certain chosen industries to provide “essential” products and services.

We’re not criticizing or complimenting. It’s simply an observation of what’s happening.

In recent rants, we suggested that insane, absurd, unsustainable levels of systemic debt is the primary vulnerability …

… the kryptonite of the “super” economy the United States was purportedly enjoying … right up until it wasn’t.

It’s a long, convoluted rabbit trail to explain, but the short of it is simple … when cash stops flowing, debts go bad.

That’s bad enough. But of course, it gets worse …

All that debt is underpinning artificially inflated asset prices (yes, that’s where the inflation ended up … they just call it “the wealth effect”).

As debts go bad, asset prices PLUMMET …

… UNLESS, the Wizards behind the curtain conjure many trillions of new dollars out of thin air to prop up … EVERYTHING … and push asset values back up.

Of course, all those dollars aren’t really free.

But no one in the White House, Congress, the Federal Reserve, or the mainstream financial media will say it, because …

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

– Henry Ford

But YOU should know it.

It’s the reason real estate investing has been arguably the most powerful and reliable builder of real wealth for many decades.

Properly structured income-producing properties allow investors to hedge deflation, ride inflation, and enjoy high after-tax yields on equity along the way.

Of course, there’s risk. And real estate investing is more work and takes more education than “invest and forget” or “buy low/sell high” paper asset investing.

But with ALL forms of investing … when external factors change, your investing strategy and tactics need to change too.

Right now, external factors are changing FAST. But it’s too early to tell if we’re facing an unpleasant cold front … a deadly blizzard … or a new ice age.

However it’s safe to say storm clouds have formed … and inclement economic weather is threatening to engulf the entire world.

This is notable because it usually takes a strong lead dog to pull the pack and sled through the snow … though that sometimes comes at a price.

China took on nearly $33 trillion in new debt to help pull the world out of the Great Financial Crisis of 2008. It’s doubtful they’ll do it again.

So contrary to popular myth, this 2020 crisis-in-waiting is probably NOT 2008 all over again.

Of course, the how and why won’t be clear until we’re on the other side.

But YES, the sun will come back out … eventually. Right now, it’s cloudy and cooling with very limited visibility.

So rather than delve into tactical details for right now …

(we’re interviewing many of our boots on ground teams and we’ll be talking on the radio show about what they’re seeing and doing right now)

… we think it much more useful to share what we’re watching and why …

Jobs

The MOST important thing is jobs.

When we interviewed then-candidate Donald Trump and asked about his housing agenda, his one-word answer was, “Jobs”.

But jobs are only the start of the financial food chain.

Tenants’ jobs provide your rent, which provides your mortgage payments. Obviously, homeowners’ jobs are the source of their mortgage payments.

Mortgage payments often get made to servicers, who in turn forward the income to investors often via mortgage-backed securities (MBS).

But when enough payments get missed, those MBS lose value. And if they’re leveraged, that loss in value triggers margin calls.

Margin calls then force leveraged paper investors to post cash or face a forced sale of their pledged assets at a loss.

(This is where all the excessive systemic debt is the biggest problem … in that regard this IS 2008 all over again … only bigger)

If you’ve ever been on the wrong end of a leverage stock investment and received a margin call, you know exactly what that’s like.

Sometimes, highly-margined paper traders need to sell anything and everything at ANY price in order to raise cash … or end up bankrupt like Lehman Brothers in 2008.

These fire sales cause paper asset prices to collapse, triggering more margin calls, and a vicious downward cycle of asset price deflation.

That’s financial system contagion and when you see RED flashing across all the financial market indices.

The “patch” is for the “Plunge Protection Team” and/or the Federal Reserve and their proxies to step in and bid up prices … the Fed’s “asset purchase programs“.

Of course, when this happens, markets see a blip up, and cash-starved traders “sell the rally” … which of course, creates more red.

Right now, the Fed is SO active, paper traders default to buying anything the Fed’s buying just to catch a free ride.

We wish real estate underwriting were so simple.

The REAL solution is productivity (jobs), NOT printing currency.

But neither the government nor the Federal Reserve can “create” jobs. The best they can do is foster an environment where private enterprise creates jobs.

Right now, just the OPPOSITE is happening. They’re shutting everything down.

Until that’s fixed and businesses have time to rebuild … economic malaise and financial system (credit markets, banks, currency) instability are likely.

Sorry to burst your bubble … oh wait, something else already did that.

The Dollar

As we’ve been pointing out for some time, the Federal Reserve is using their printing press to “borrow” trillions of new dollars from the purchasing power of ALL dollar holders worldwide.

Read that again. And if you don’t CLEARLY understand it, then make a note to study this topic until you do.

It’s probably the most important financial concept most people don’t understand, but should …

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

– John Maynard Keynes (look him up)

A fantastic resource for understanding the foundation of all this is The Creature from Jekyll Island by G. Edward Griffin.

Creature is a much more useful horror experience while sheltering in place than binge watching The Walking Dead.

And while you’re digging deep into the design of the dollar system, be sure to study its ascendancy to world’s reserve currency status in 1944.

Then go even deeper and consider what YOUR world will look like if the dollar loses that reserve currency status. Most Americans are NOT ready.

However, as we chronicled way back in 2013, Russia and China have been on a mission since 2010 to knock King Dollar off the throne.

As pointed out in the opening session of the Future of Money and Wealth program, Russia and China are in a MUCH better position to pull it off today.

Are they? Will they? Maybe. Maybe not.

But it’s no secret they want to … and have been working on it for a long time. They’ve reiterated it in word and deed on many occasions over the last 10 years.

Which brings us to …

Gold

Gold is the oldest and most universal form of money.

“Gold is money. Everything else is credit.”

J.P. Morgan

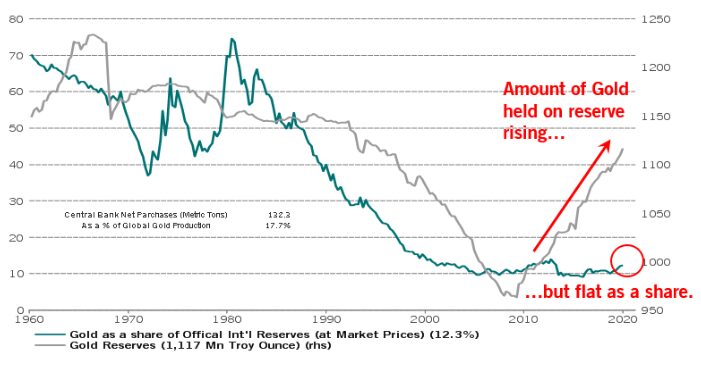

And apparently, the rest of the world is adding to their gold savings ….

Again, this has been going on since 2009, when China publicly warned the U.S. about protecting the value of dollar.

But Uncle Sam’s debt swelled nonetheless.

And the Fed’s balance sheet exploded from $800 billion to $4.5 trillion in 2012 … and is now $6.6 trillion and still GROWING. That’s all freshly printed dollars.

No wonder the world went to work on breaking their dependency on the dollar.

You may know gold is at all-time highs against every major paper currency in the world … except the dollar.

Stated inversely, paper currencies have collapsed to their all-time lowest values against gold … and the dollar is getting there … probably soon.

The ultimate currency insiders … central banks … accelerated their gold acquisition over the last two years. Hmmmm ….

What’s in YOUR safe?

Bringing it Home to Main Street

It’s no secret all us outsiders are on the front end of what looks to be a severe economic contraction.

Individuals, businesses, industries, asset classes, and even countries …are going to feel it. Real estate is not immune.

But even as you prepare for the worst, there are bright spots …

U.S. Manufacturing and Agriculture

In the short term, it’s ugly.

But long term, it seems policymakers and John Q. Public realize it’s important to have more manufacturing back in the United States.

Shortages of masks and medicine sent a message. We’re guessing many industries will consider or be coerced into moving.

So we’ll watch for opportunities in currently overlooked geographies where a migration of manufacturing might create a resurgence in real estate.

Energy

Again, energy is depressed right now because of a temporary collapse in demand.

But that also means choice assets are on sale. Meanwhile, less efficient production is going off-line … perhaps permanently.

So unless you think economic activity has ceased forever, then at some point the demand for energy should rebound … even more so if more manufacturing makes its way back to the USA.

Cheap Debt

Stimulus almost always means free money.

While borrowing to spend is stupid, borrowing low and long to invest high and short can be very smart … and profitable.

And right now, credit markets haven’t collapsed … yet.

So, it’s probably still a great time to quickly load up on cheap dollars, some precious metals, and high-yield debt secured by real estate you wouldn’t mind owning.

Distressed Assets

Of course, tough times means wrong-footed investors will need to let go of nice properties in good markets because they’re only structured for sunshine.

They’re selling because they have a problem, and when you buy … even at a discount … you help solve their problem.

And while it’s nice to buy at the very bottom, what really matters is where everything is at 10-20 years from now.

So, don’t be shy to buy if a deal makes sense … even if there’s a chance more air will come out. After all, you don’t know what will happen tomorrow.

Until next time … good investing!