In a recent article published by CNBC, famed economist Robert Shiller (yes, that Robert Shiller of the oft-referenced Case-Shiller index) is quoted as saying he thinks stocks are a better investment than real estate over a lifetime.

REALLY???

That’s like kicking a sleeping dog.

So we got up off the couch and decided to do a show on this topic.

Some might say we’re shills for real estate…but we’ll find out who’s a bigger shiller here.

In the broadcast doghouse for this episode of The Real Estate Guys™ radio show:

- Your big dog host, Robert Helms

- His little dog co-host, Russell Gray

So we’re hanging out in our broadcast briefs perusing the news for interesting subject matter…and we see an article by CNBC headlined, “Where to put your cash? A house or a stock?”

So we’re hanging out in our broadcast briefs perusing the news for interesting subject matter…and we see an article by CNBC headlined, “Where to put your cash? A house or a stock?”

Hmmm…that sounds interesting…

The article opens up saying that even though the stock market is at record highs, the government is pushing home ownership to build wealth…and using easy credit to help all those poor, unqualified borrowers.

The author immediately questions the premise by reminding readers of the “catastrophic housing crash of the last decade“…while completely failing to mention the accompanying catastrophic crash of the stock market…but more on that in a moment…

Then the author invokes Nobel Prize-winning economist Robert Shiller who is quoted as saying, “It would be perhaps smarter, if wealth accumulation is your goal, to rent and put money in the stock market, which has historically show much higher returns than the housing market.”

Seriously? Okay, now our hackles are up…

So we keep reading…and discover those comments were made at a Standard & Poor’s conference. Last time we looked, S&P is mostly about stocks and Wall Street.

Of course, we do a little speaking from time to time, so we know when you’re in someone else’s house, it’s smart to say nice things. We don’t begrudge Mr. Shiller for playing to his audience.

Side note: a few days later, CNBC put out a video where Shiller says, “Go back to buying houses.” Wow, that was fast. But we know the stock market moves quickly. 😉

Back to our current article…

So the CNBC author says, “Shiller notes that the comparison between stock returns and home value returns is rough, given that stocks pay cash dividends and housing pays ‘in kind’, in the form of housing services; that is, you get to live in the house.”

That VERY important point is quickly set aside in the next paragraph, which compares ONLY the capital gains of the broad stock market since 1890…yes EIGHTEEN NINETY…and Shiller’s own secret recipe (that’s how you win a Nobel Prize) of the “real” U.S. home price index.

There’s SO much here…we’re starting to pant.

The bottom line says Shiller according to the CNBC article…is that the net real capital gains (presumably after being adjusted for inflation) are “smaller than one might expect” (we get that a lot…)

The bottom line says Shiller according to the CNBC article…is that the net real capital gains (presumably after being adjusted for inflation) are “smaller than one might expect” (we get that a lot…)

Really? How small?

The article quotes Shiller as saying for stocks it’s about 2.03 percent per year. And houses…only a paltry 33 basis points (about 1/3 of 1%).

Confused? If buying stocks and real estate sucks so badly, why would ANYONE do it?

The perhaps obvious answer is that NOT doing it sucks WORSE.

Think about it. The dollar has lost about 98% of it’s value since the Fed was created in 1913. If you simply stacked up paper dollars, you’d be at a negative 98%. So plus 2%…or even plus 1/3% sounds pretty good by comparison.

So now that we know investing…even spending… is better than cash under the mattress, we’re back to comparing stocks and real estate.

The CNBC article points out that “A house can offer greater returns if the owner chooses to rent it out and not to live in it.” Duh. Welcome to our world.

This highlights a bigger point, which is that when you’re reading a mainstream financial media article on real estate, they almost always are talking about the house you live in.

To the CNBC author’s credit, she mentions that “Shiller adds homes should not be seen as an investment vehicle, like a stock, but as a consumption good, like a car.”

We agree. But, isn’t the entire premise of the article a comparison of the investing in stocks versus real estate? You might want to lead with that next time…

Still, this is a VERY USEFUL exercise for anyone enticed by this record high stock market...and every real estate investor being chastised by their stock investing friends. And ESPECIALLY useful for any real estate entrepreneur who’s out raising money to syndicate real estate deals.

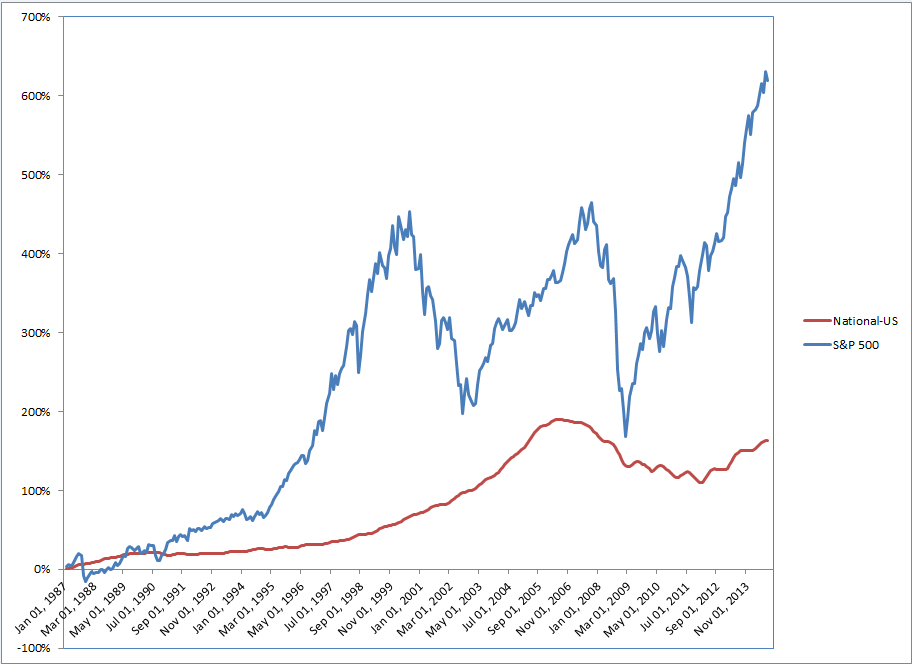

After all, we’re all hearing about how great the stock market is doing. In fact, here’s an amazing chart from the CNBC article:

This shows how the stock market (blue) is crushing housing (red).

Aren’t you impressed?

Do you see the real estate bubble of 2003-2007 and the “catastrophic crash” in 2008? (Pay no attention to those GIGANTIC blue line ups and downs…but since you are…what does the pattern say might be next for stocks???)

The CNBC article concludes with this:

“The happy compromise [between taking the risk of leaving equity in a house whose value might drop and putting the equity to “better” use by investing in the stock market]…would be to keep less equity in your home though a long-term, low-down payment mortgage; or…through an interest only loan, and keep more cash at the ready for investing in the stock market. It’s a riskier choice, given the current volatility in home prices, but it may be the best way to build wealth.”

So NOW we’re on the floor laughing out loud…

Open your eyes. You can now look at the blue line in the chart.

Who’s calling who volatile???

First, before we go ballistic…we must say we LOVE the idea of getting idle equity out of a property to shelter it from that ever-fickle Mr. Market.

And because mortgage interest rates are SO low…you don’t have to be Warren Buffet to out-earn the cost of borrowing…especially when you consider that the interest is tax-deductible.

But stocks? We don’t think so. That chart makes us dizzy…

So we need to do some math. We figure if you’ve read this far, you must be a SERIOUS reader, so you can probably handle it.

We’ll only do enough to help you understand why there’s NO CONTEST when it comes to risk-adjusted returns in real estate versus the stock market.

Ready? Take a cleansing breath…and…here we go…

First, let’s just say that Shiller is right and the real average annual value increase (capital gain) on housing is 33 basis points per year. We could argue, but he’s a Noble Prize winner. We’re a couple of schmoes with microphones.

What his comments and the CNBC article don’t take into consideration is financing…or better stated…leverage.

So if you were to put 20% down, you’d control five 20% parts of an asset (the property) which is 100% of it. That is, your “capital stack” is 20% cash from you (down payment) and 80% cash from the bank (the loan).

But YOU get 100% of the 33 basis points appreciation. At 5:1 leverage (you have only 20% cash in), YOUR appreciation rate on your cash is 5 x .33 or 1.65%. Nothing to run naked through the streets bragging about, but 5 times better than 33 basis points and a WHOLE lot closer to the 2.03% that Shiller says is the stock market’s history.

Now let’s stop right there.

Go back and look at the roller coaster blue line in the chart. Do you notice that the last low was lower than the prior low? Do you see that the high before this one, was higher than the high before that one? Any guesses on where the next low might be?

Now look at the red line. Looks like a smoother ride.

Would you be willing to give up 38 basis points (that’s the difference between 2.03% and 1.65%) to avoid having your stomach come out your ears?

But we’re not done…

Remember that 80% loan? Well, this is a RENTAL property.

That means you have tenants who are paying enough every month to cover ALL the expenses, including the mortgage (and professional property management…because who wants to manage a property?), and a little bit more. If that’s not the case, then you shouldn’t own the property.

Assuming your loan rate is 5% fully amortized for 30 years, the very first loan payment includes a pay down of principal (that increases your net worth on your balance sheet because it reduces your liability…we call it amortized equity) is $96.12 and it goes UP each month from there.

So month 1 is the LOWEST profit rate of the entire 30 years. Make sense?

Math time!

$96.12 x 12 = $1153.44 minimum annual equity build up from amortization

$1153 on a $20,000 cash invested (remember, you only put 20% down) is a growth rate of 5.76% annualized. Add that to your 1.65% of new equity (previous calculation) and you’re up to 7.41%.

See? It’s starting to look better. And it smokes the actual return of the stock market (according to Shiller) and still doesn’t take into account tax breaks or positive cash flow from rents.

So just for fun…can you think of anything you’d rather be doing right now???…let’s add in some net operating income.

Suppose this rental property only provided a modest positive cash flow of about $70 a month net spendable after ALL expenses…including maintenance, turnover, vacancy and set-asides…plus property taxes, insurance, property management, etc.

Is that reasonable?

We think so…and here’s the math (don’t worry, it’s simple!)…

We think so…and here’s the math (don’t worry, it’s simple!)…

If this $100,000 property is renting for $1000 a month (our 1% rule…and there’s lots of those out there right now) and you budget 50% for all non-mortgage expenses and set-asides, you have $500 a month left for debt-service.

An $80,000 loan at 5% fully-amortized over 30 years gives you a payment of $430.

$1000 rental income less $500 for expenses = $500… less $430 for mortgage = $70.

See?

But $70 x 12 = $840

And $840 return on $20,000 down payment is a 4.7% cash on cash.

So when you put it all in your financial blender and hit puree…your 4.7% cash on cash together with your 5.76% amortized equity and your 1.65% from Shiller’s 33 basis points at 5:1 leverage, you have a total return of 8.11 %. That sounds a LOT better than 2.03%.

Wow. Now we need a nap.

But take a listen as we take on the challenge of stocks versus real estate. We debate. You decide. Then we can all go have a pint.

Listen Now:

- Visit our Special Reports library.

- Don’t miss an episode of The Real Estate Guys™ radio show. Subscribe to the free podcast!

- Stay connected with The Real Estate Guys™ on Facebook!

The Real Estate Guys™ radio show and podcast provides real estate investing news, education, training and resources that help real estate investors succeed.